How to Invest in NIO

21 Apr, 2021 | GraniteShares

Available for trading on London Stock Exchange, Euronext Paris, Borsa Italiana.

GraniteShares 3x Short NIO Daily ETP is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x Short NIO Index that seeks to provide -3 times the daily performance of NIO Inc shares.

For example, if NIO Inc rises by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments. However, if NIO Inc falls by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments.

GraniteShares -3x NIO is available in EUR,GBX,USD

Nio Inc(NASDAQ: NIO) found by William Li, Hsien Tong Cheng, Lihong Qin, develops, produces, and sells automobiles, powertrains, and batteries that are smart electric vehicles. The company is headquartered in Shanghai, that also develops battery-swapping stations for its vehicles, as an alternative to conventional charging stations. The Company products include ES8, ES6, EC6 and ET7. The company for July quarter of 2023 delivered 20,462 vehicles, representing an increase of 103.6% YoY.Read more about NIO

21 Apr, 2021 | GraniteShares

25 May, 2022 | GraniteShares

29 Jun, 2023 | GraniteShares

16 Dec, 2020 | GraniteShares

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| London Stock Exchange | USD | 3SNI | XS2626290311 | BNDTCN1 | |

| London Stock Exchange | EUR | 3SIE | XS2626290311 | BNDTCP3 | |

| London Stock Exchange | GBX | 3SIP | XS2626290311 | BNDTCQ4 | |

| Euronext Paris | EUR | 3SNI | XS2626290311 | BNDTCJ7 | |

| Borsa Italiana | EUR | 3SNI | XS2626290311 | BNDTCL9 |

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

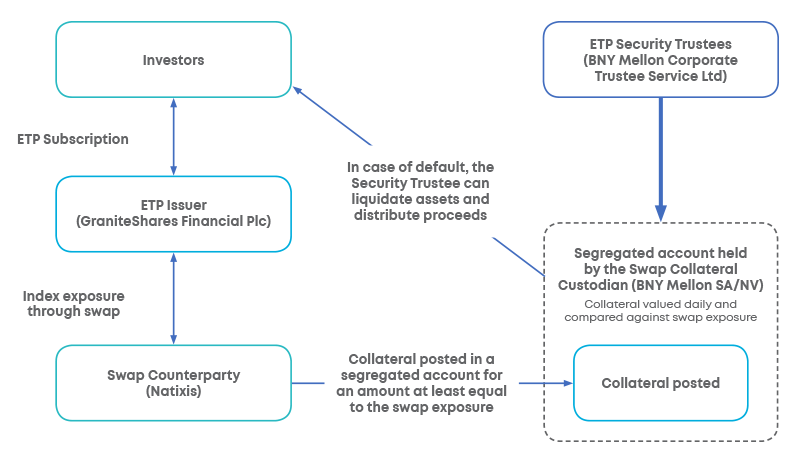

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.