How to Leverage Tesla Stock

Posted:

Tesla (NASDAQ: TSLA), is headquartered in Texas, United States. It is an automotive giant that designs, develops, manufactures, leases, and sells electric vehicles, battery energy storage from home to grid-scale, solar panels and solar roof tiles, and related products and services. It is headquartered in Austin, Texas. This company offers three autonomous driving packages which include Autopilot, Enhanced Autopilot, and Full self-driving capability for their automotive models.

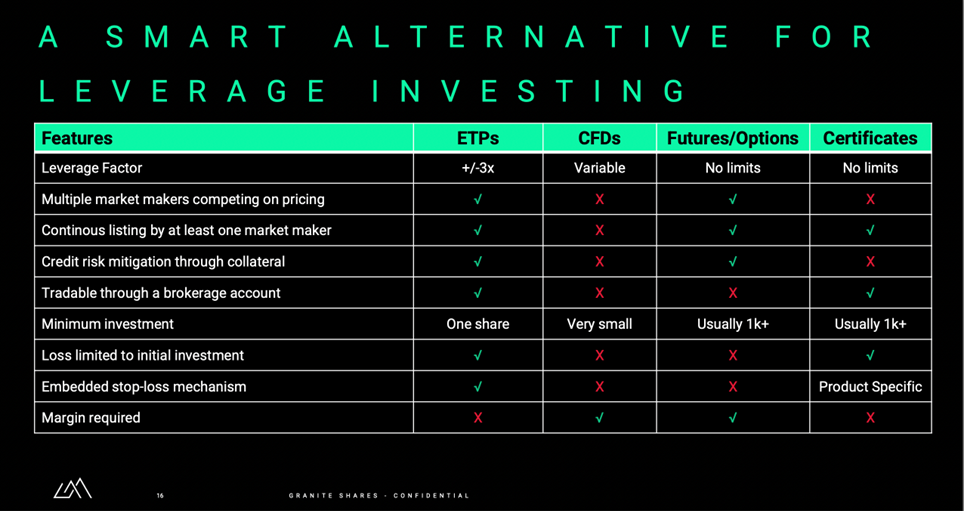

What are the various leverage options? How to invest in Leverage Investment? There are all the common questions that investors have. Let’s address these questions through this article to better understand the company and different instruments to capitalize on the returns from Tesla shares.

Investors can use various options whether leveraged or short trading to benefit from volatility. Let’s understand what leverage instruments are and various investment strategies that would help in leveraging Tesla shares.

Let's Understand ways to invest and Leverage Tesla

What is Leverage?

Leverage is the use of borrowed money (debt) to undertake an investment in a company. Leverage can be used to amplify the returns and losses from the investment. It can be used to help finance buying a house as well as help in stock market speculation. Businesses widely use leverage to fund their growth, financial professionals use leverage to increase their investing strategies, and families apply leverage in mortgage debt to purchase homes.

For example, if Tesla's stock price today goes up by 1% in a day and the investor has invested in let’s say Tesla 3x Leverage Daily ETP it will surge by 3%. However, if the same underlying Tesla stock price instead of going up by 1% goes down by 1% then the Tesla 3x Leverage Daily ETP will go down by 3%. Leveraged returns allow investors to use less of their capital to achieve similar investments and magnify returns using the same amount of capital and increasing their stakes.

How does Leverage work in Investments?

Taking leverage in the most basic sense is a type that involves borrowing money or otherwise increasing the number of shares involved in trade beyond the number of shares you could afford when paying in cash.

Leverage could be a tool for investors to amplify their returns, but it comes with some big risks. Retail investors should understand the degree of risk of investing in leverage instruments. They should consult their financial advisers before investing in leverage. Professional clients may have access to higher levels of leverage than retail clients, due to their greater financial expertise and ability to manage risk. However, this also means that they may be exposed to greater risks if their investments do not perform as expected. They just have a higher risk appetite as compared to retail clients. Professional clients are often deemed capable of making their own investment decisions and assessing the risks involved, without requiring the same level of local laws and regulations protection as a retail client.

Investing by using leverage is also called buying on margin and it is an investment technique that should be used with caution. investors should understand the risk that comes along with investing in leveraged instruments. While leverage does not change the percentage rate of return, it can increase the total dollar value of the return.

What are the several types of Leverage Instruments Strategies?

Trading on Margin

Investing or trading on margin is the use of borrowed money to purchase securities. Buying on margin generally takes place through a margin account which is the main investment account for leverage investing. Margin Trading uses borrowed money to purchase or sell short securities.

A Margin Account is a type of brokerage account where the brokers lend you cash (Margin Loan) by using the account as collateral to purchase, sell or short the securities. By using margin accounts investors can make a larger investment with less or their own money on the line. The securities and the cast in the investor’s account act as collateral for the margin provided and they are charged interest on the margin loan. Buying securities on the margin can amplify your returns and magnify the possible losses.

If the value of investors’ shares falls, their broker may make a margin call and require them to deposit more money or securities into their account to meet its minimum equity requirement.

For example, if an investor bought Tesla Stock today for $100, they would have to pay up the entire money to buy equity. By using a Margin account, they won’t have to pay the entire $100 to buy Tesla stock and they could get more shares through margin investment rather than equity.

Cons of Trading on Margin account:

The problem with margin trading for swing trading and intraday is the cost i.e., the brokerage cost, taxes, and leverage are lower as compared to other leverage instruments.

Options Trading

Options Trading allows investors to buy and sell stocks, ETFs, etc. at a specific price within a specific date. Options trading also gives buyers the flexibility to not buy the security at the specified price or date. They are contracts that provide the holder with the right to buy or sell an underlying asset, at a fixed price (also called the “strike price”), on or before a predetermined date.

Options trading helps you profit from changes in share prices without putting down the full price of the share. Investors get control over the shares without buying them outright. They are a little more complex than stock trading and could make relatively larger profits if the price of the security goes up. It can also restrict your losses if the price of the security goes down, which is known as hedging. The right to buy a security is known as a ‘Call Option,’ and the right to sell is called a ‘Put Option.’

Cons of Options Trading:

The problem with options trading is the lack of embedded stop loss mechanism available in Leveraged ETPs. Also, the cost to trade and invest is high as compared to ETPs.

Futures Trading

A futures contract is a legal agreement to buy or sell a security or a commodity at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. It is an agreement between two parties, a buyer, and a seller, wherein the former agrees to purchase from the latter a fixed number of securities at a specific time in the future for a pre-determined price.

Futures contracts are available for various assets including stocks, indices, commodities, currency pairs, and other securities. A futures contract allows an investor to speculate on the direction of an asset, security, commodity, or financial instrument, either long or short, using leverage.

Cons of Futures Trading:

The problem with investing or trading through futures is the risk involved apart from the inherent leverage risk. Also, the embedded stop-loss mechanism that could help in curbing price fluctuation and losses is not available in the future.

Exchange Traded Products (ETPs)

ETPs are a type of leverage instrument that is listed on the exchange. They consist of a basket of securities that are designed to track the underlying security, an index, or other financial instruments. They can be benchmarked to indexes, sectors, industries, or themes. ETPs can be leveraged or un-leveraged and offer leveraged exposure to popular stocks (single stock ETPs) like Tesla ETPs, indexes (Like FATANG, FAANG, or GAFAM), or other asset classes such as commodities.

Leveraged and inverse ETPs instruments are designed to produce a fund performance that is a multiple of the underlying index or security. There are positives also called long leveraged ETPs named 2x and 3x leveraged (i.e., two, and three times the price). Inverse ETPs are products or funds that offer positive returns when the underlying market or security falls.

They are denoted as -2x, -3x or terms like 'short' or 'inverse' in the name of funds. For example, -3x Short Tesla ETP (-3x Tesla ETP, -3x Tesla Short Daily ETPs, 3x Short Tesla ETFs), also referred to as 3x TSLA Short by Graniteshares.

A 2x Tesla fund would increase twice as much as the underlying index (excluding fees and other adjustments). This is the leveraged factor that helps with more investment, but the help of leverage offers amplified returns.

Leveraged ETPs usually have a multiplier in their product or funds name or have words such as 3x, “ultra” or “daily” in front of the fund or product's name. These ETPs deliver multiples of an index daily return. The number 3x acts as a multiplier, meaning if Tesla's share price today goes up by 1%, the ETP of Tesla will move by approximately 3%.

Investors should also keep in mind the implication of both the upside and downside of multipliers. During the upside of the market, these multipliers are beneficial but when the tides are against it i.e., ETPs multipliers move the same when the market moves against the prediction. For example, +3x Long Tesla Daily ETP by Graniteshares is also written as 3LTS.

Conclusion:

Therefore, it is important for investors to understand the risks associated with the use of multipliers and to take into account factors such as the financial markets, the underlying assets and the specific features of the ETPs before investing. Investors should also consider their financial circumstances and make sure they are comfortable with the risk before investing.

Leveraging allows businesses and individuals to make investments that otherwise might be out of reach or the funds they already have more efficiently. Tesla has continued to demonstrate strong fundamentals and it has growth and profitability to sustain continued valuation.

Apart from this, there are external factors and competition in the electric vehicle space, research and development bottlenecks, and economic factors that could be seen as fraught with red flags. Investors can use leverage for trading and investing in Tesla stock. Also, they can capitalize on returns with long, short, and any leverage options that seem fit.

Leverage Tesla ETPs by GraniteShares

| Product name | Ticker | ||

|---|---|---|---|

| USD | EUR | GBX | |

| 3STS | 3STE | 3STP | |

| 3LTS | 3LTE | 3LTP | |

| 3SFT | 3S3E | 3S3P | |

| 3FTG | 3FTE | 3FTP | |

| FTNG | FTNE | FTNP | |

| SFTG | SFTE | SFTP | |

DISCLAIMER

Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.

This is a disclaimer stating that all trading and investing come with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or its contents. Graniteshares Limited is an appointed representative of Messels Limited which is authorised and regulated by the Financial Conduct Authority.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is it to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author, and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein are intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks, and liquidity risks.