AstraZeneca PLC

AstraZeneca, a Pharmaceutical Company for over 20 years

Presentation of the Company

AstraZeneca (LON: AZN) is a Swedish-British pharmaceutical company formed through the merger of the Swedish company Astra and the British company Zeneca in 1999. The company is active in research, development, manufacturing, sales of pharmaceuticals and the provision of healthcare services.

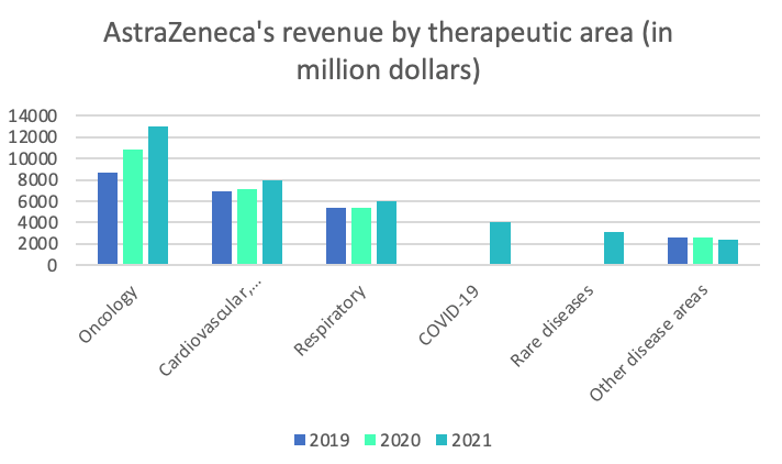

AstraZeneca is active in eight major therapeutic areas: diabetes, anesthesiology, cardiology, infectious diseases, gastroenterology, oncology, neurology, pulmonology and immunology. It is notably known for having developed a vaccine against the Coronavirus used in many countries.

AstraZeneca's (LON: AZN) strategy is to focus on certain areas in order to achieve stable growth. Its main competitors are Pfizer, Moderna, and Johnson & Johnson.

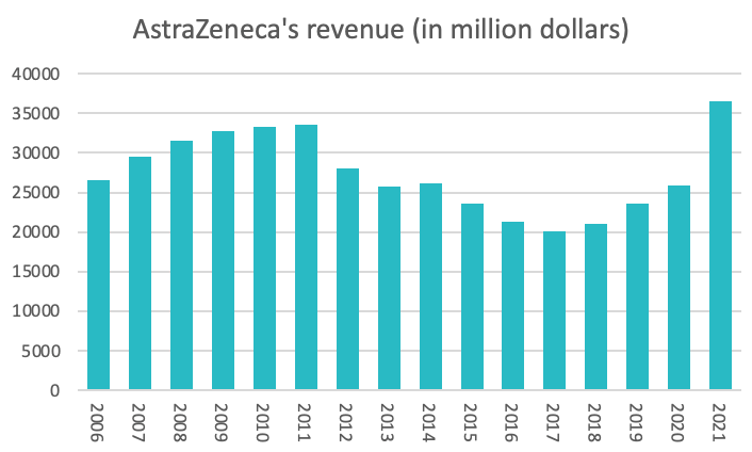

Source : statista.com

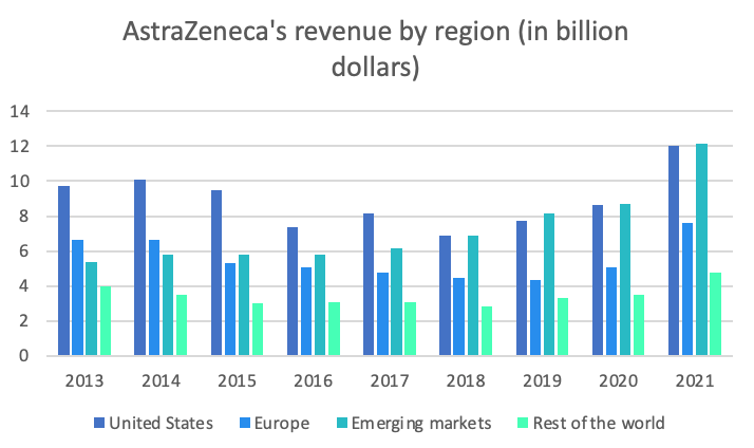

Source : statista.com

History of AstraZeneca

In 1999, AstraZeneca (LON: AZN) was born from the acquisition of Zeneca by Astra. This was possible for Astra thanks to the success of omeprazole.

AstraZeneca, throughout its history, has acquired many companies. MedImmune, an American biotech company, for $15.6 billion in 2007, Spirogen, a cancer biotech company, for $440 million in 2013, Definiens, a company specializing in cancer detection, for $150 million in 2014, ZS Pharma, an American pharmaceutical company, for $2.7 billion in 2015, or 55% of Acerta Pharma, a company specializing in oncology, for $4 billion the same year.

During the global pandemic, AstraZeneca's (LON: AZN) name resonated globally following the release of their Coronavirus vaccine.

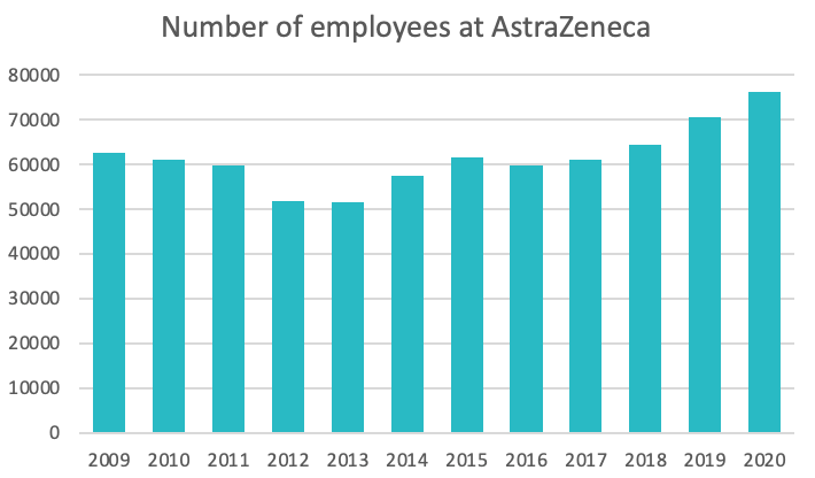

Source : macrotrends.com

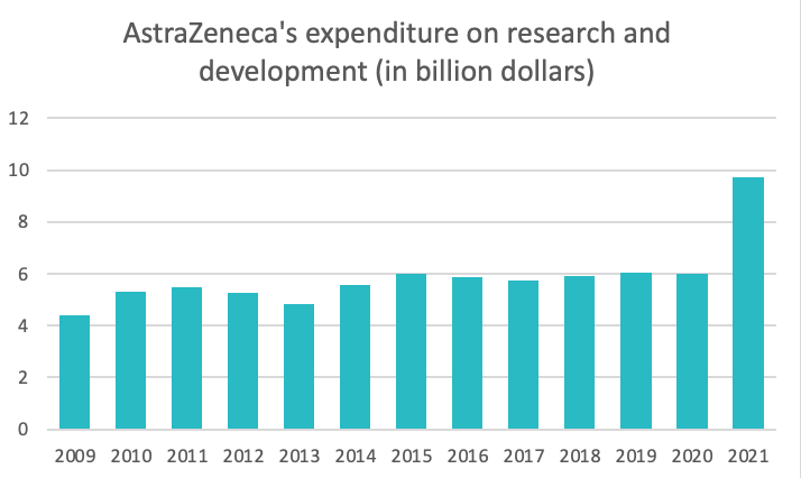

Source : statista.com

The Market

The health market is certainly one of the oldest markets in existence, due to the fact that good health is essential to everyone. Nowadays, it is a sector that creates a lot of jobs and requires a lot of knowledge and rigor.

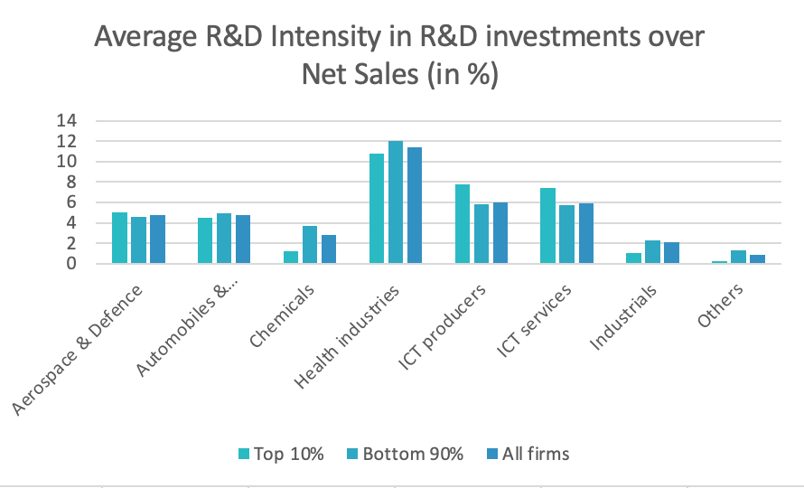

In order to ensure the stability and profitability of its companies, a market must have room for growth. As can be seen in the first graph, the healthcare industries lead the way in terms of R&D investments compared to net sales, which shows that the sector is constantly evolving.

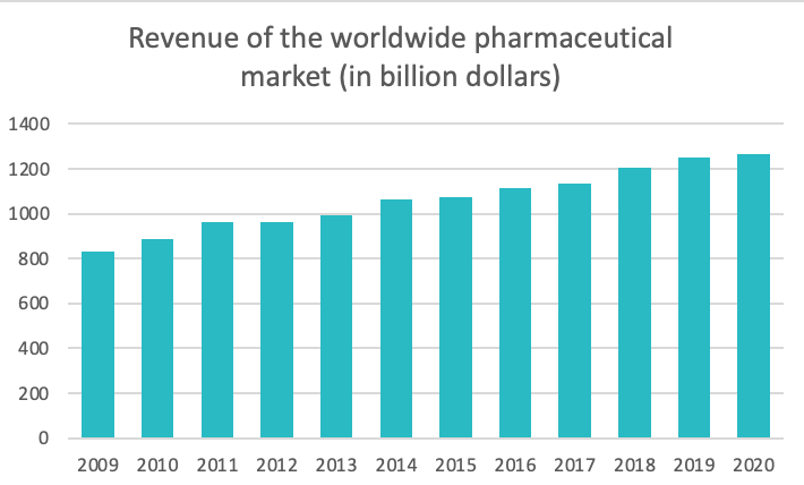

These facts are even more topical with the global health crisis, where the undeniable importance of this sector was further demonstrated.

Also, life expectancy is increasing in all developed countries, as is the amount spent per capita. Access to medical care is also becoming more democratic in emerging countries.

Source : statista.com

Source : statista.com

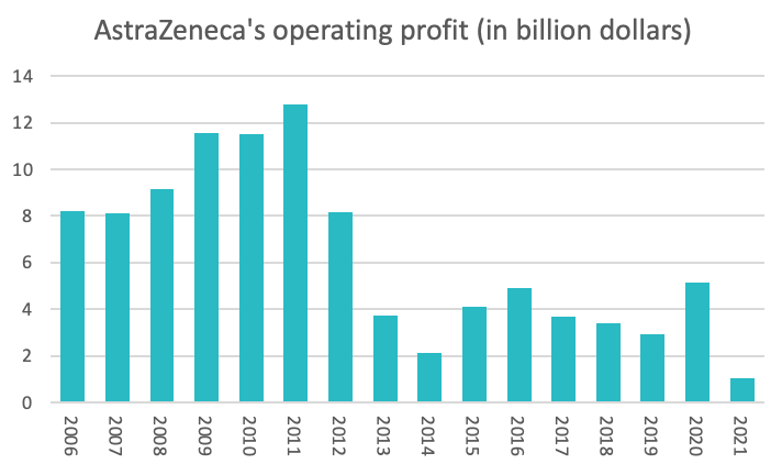

Key Figures and Financial Ratios

Market capitalization as of June 2022: £151.49 billion 1

Revenue : £ 37.417 billion 2(2021)

Net income : $0.112 billion 3(2021)

Dividends paid: Constant, every 6 months for over 20 years

Earnings per share: $0.04 4(2021)

Price to earnings ratio: ≃21.32x 5(2022)

Debt to capital ratio: 0.76 6(2022)

Source : statista.com

Source : statista.com

Graniteshares Offering Products

ASTRAZENECA

Sources

- AstraZeneca PLC Market trends

- Annual Report AstraZeneca Annual Report

- Annual Report AstraZeneca Annual Report

- Annual Report 4. AstraZeneca Annual Report

- AstraZeneca PE Ratio | AZN macrotrends

DISCLAIMER

Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author, and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks, and liquidity risks.