ZOOM

Zoom, One of the Biggest Telecommunication Service

Presentation of the Company

Zoom Video Communications (NASDAQ: ZM) is an American teleconferencing services company based in California. It provides a remote conferencing service that combines video conferencing, online meetings, chat and mobile collaboration using proprietary applications. The company offers a freemium service. The basic features can be used for free, but it is possible to pay to access a more professional service. In 2020, following numerous zooming incidents, Zoom was heavily criticized for aspects of its security and lack of privacy for its users.

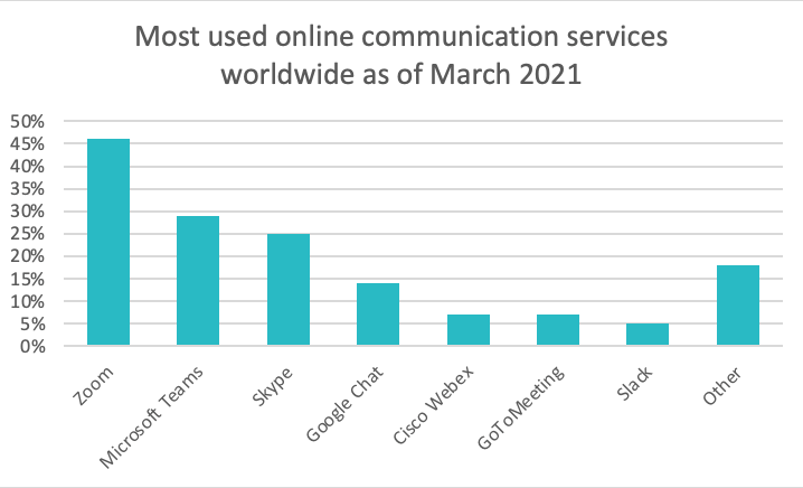

Zoom’s biggest competitors are Discord, Microsoft Teams, Cisco Webex, Google Meet, and Skype.

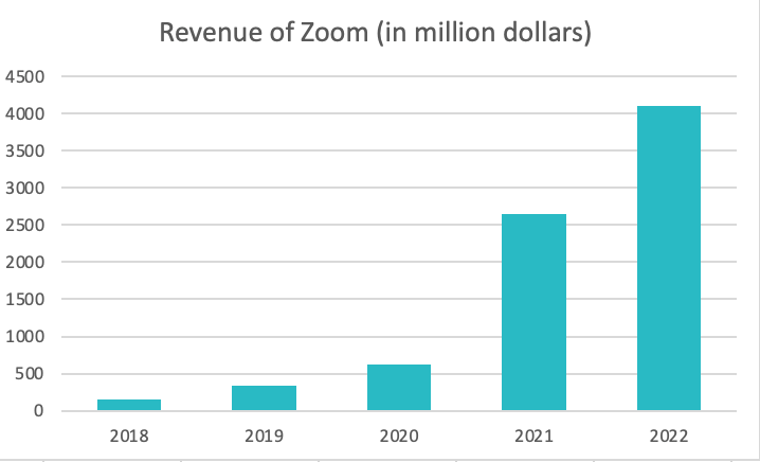

Source : macrotrends.com

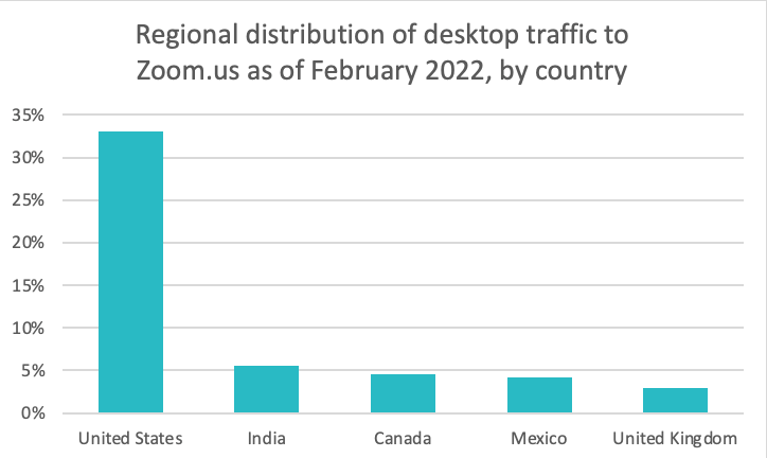

Source : statista.com

History of Zoom

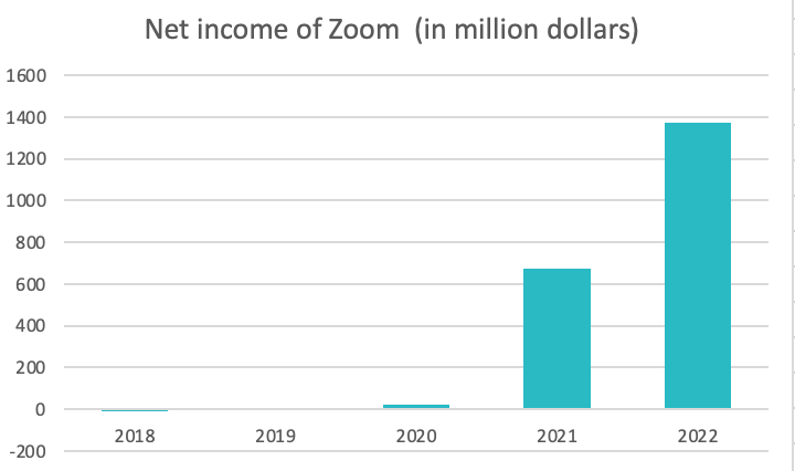

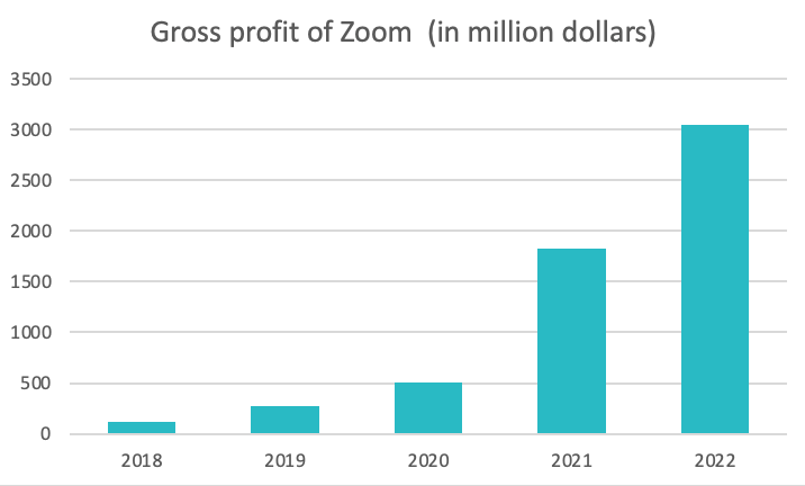

Eric Yuan, a former Cisco engineer and executive, founded Zoom (NASDAQ: ZM) in 2011, and launched its software in 2013. Zoom's revenue growth, fundraisings, and perceived ease-of-use and reliability of its software, resulted in a $1 billion valuation in 2017, making it a "unicorn" company. The company first became profitable in 2019 and completed an initial public offering that year. The company joined the NASDAQ-100 stock index on April 30, 2020.

During the COVID-19 pandemic, usage of Zoom increased drastically due to an increase in remote work, distance education, which was used by thousands of schools, and online social relations, propelling the platform to its current level.

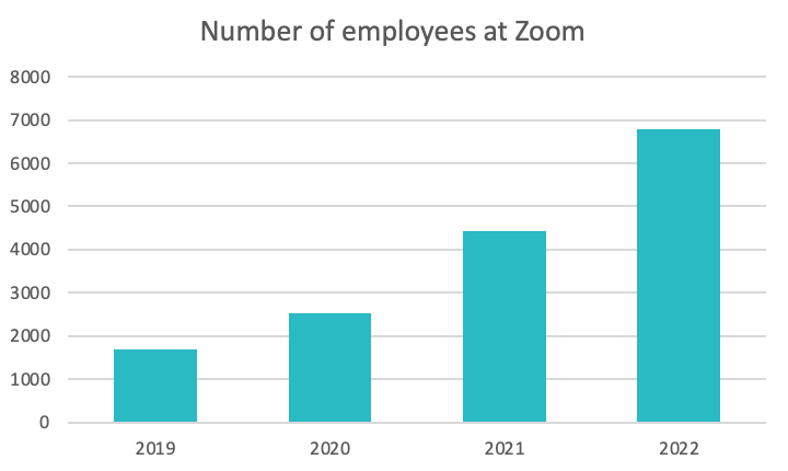

Source : macrotrends.com

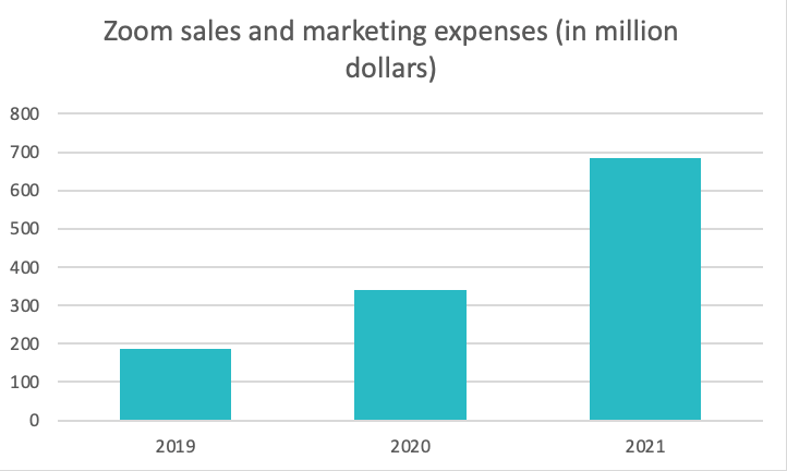

Source : statista.com

The Market

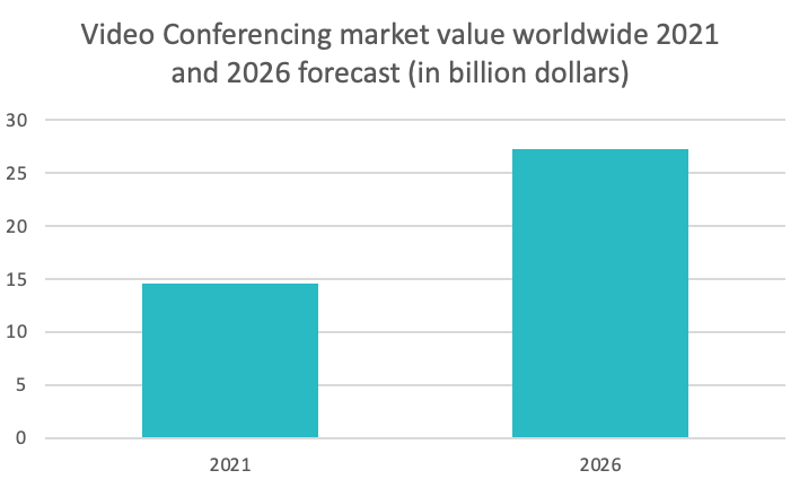

Zoom (NASDAQ: ZM) is a teleconferencing services company. It is a sector that really developed quite late for the general public (towards the 2000s), with all the new technologies facilitating its development. The users are both individuals and professionals, and are mostly young and used to this kind of tool.

This is a sector where covid 19 has had a huge impact in the right direction. The world's population, because of isolation and quarantine, has changed its way of working and communicating. Video communication services have seen an explosion in demand, making them a tool for everyday life.

Source : statista.com

Source : statista.com

Key Figures and Financial Ratios

Market capitalization as of June 2022: $34.36 billion 1

Revenue: $4.1 billion 2(2022)

Net income: $1.375 billion 3(2022)

Dividends paid: No dividends

Earnings per share: $4.54(2022)

Price to earnings ratio: ≃26.70x 5(2022)

Debt-to-equity ratio: 0.40 6(2022)

Source : macrotrends.com

Source : macrotrends.com

Sources

- Zoom Video Communications Market Cap | ZM Macrotrends

- Zoom Video Communications Revenue | ZM Macrotrends

- Zoom Video Communications Net Income | ZM Macrotrends

- Zoom Video Communications EPS - Earnings per Share | ZM Macrotrends

- Zoom Video Communications PE Ratio Gurufocus

- Zoom Video Communications Debt-to-Equity Gurufocus

DISCLAIMER

Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents. GraniteShares Limited (“GraniteShares”) (FRN: 798443) is an appointed representative of Kroll Securities Ltd. (FRN: 466588) which is authorised and regulated by the Financial Conduct Authority.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author, and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks, and liquidity risks.