Amazon

Everything you need to know about Amazon

Amazon the World's Largest Company

Amazon is an online retailer and manufacturer of books, an electronic book reader called Kindle headquartered in Seattle, United States. The Web service provider of the company became one of the iconic examples of electronic commerce. It is known worldwide as a leader in this market, and incidentally the largest company in the world. Even though most of the products sold are sold by Amazon, there are also a lot of third-party sellers on the site. They have turned the table on online shopping experience for customers but online selling of goods and services. Beyond online sales, the company is also present in music streaming (Amazon Music), video on demand (Amazon Prime TV), or cloud computing (Amazon Web Service - AWS). Other projects, less developed for the moment, are under development. Amazon's strategy is to ensure customer satisfaction primarily. The company invests heavily to become a place where you can buy everything you need, in the best conditions.

In addition to the fact that Amazon delivers worldwide, the company has a specific website for many countries located in Europe, North and South America, Asia, and Oceania.

Amazon offers an array of downloadable and streaming content through Amazon Prime Videos. It is a subscription-based model that offers content streaming as well as other offers like free and fast delivery of products if people are prime customers. Furthermore, the company also provides Prime day on every July 15 to celebrate the company’s birthday. On Prime day on account of Amazon’s birthday the company offers deep discounts, amazon deals, and offers on various brands.

Amazon customer services and swift deliveries help customers with ease of product deliveries as well as enhance their shopping experience. Also, this helps in acquiring millions of customers to purchase from their website (amazon.com).

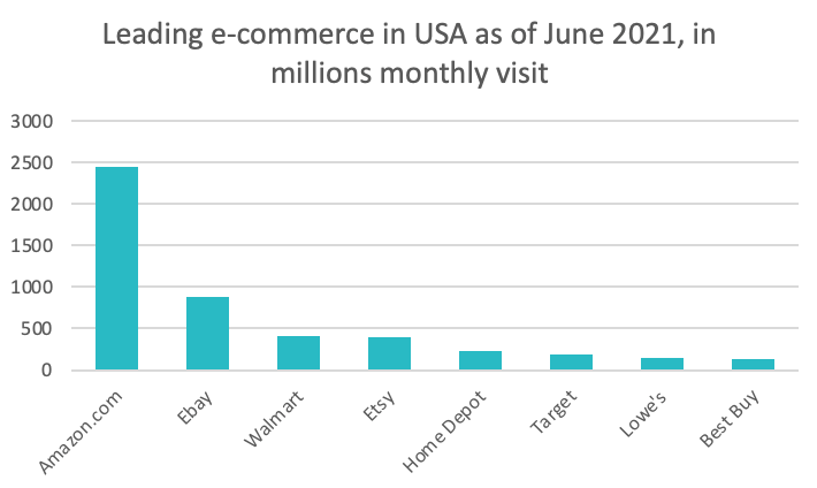

Amazon's main competitors in online sales are eBay, Etsy, and Alibaba.

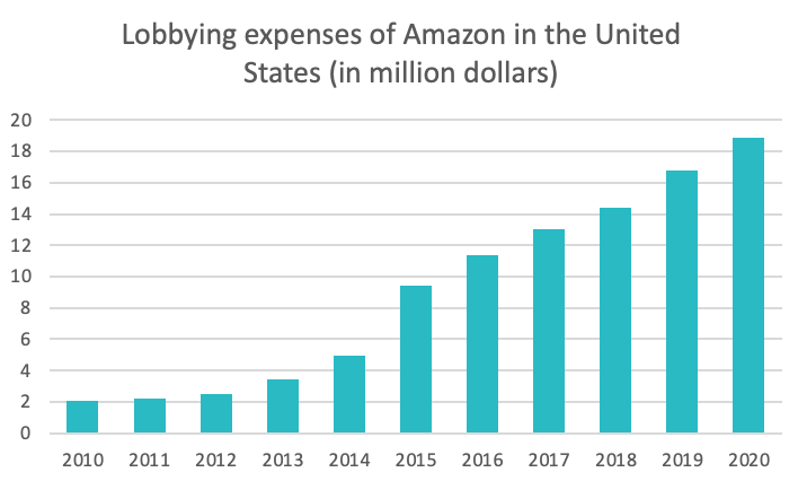

Source : statista.com

Source : statista.com

Amazon Company History and Background

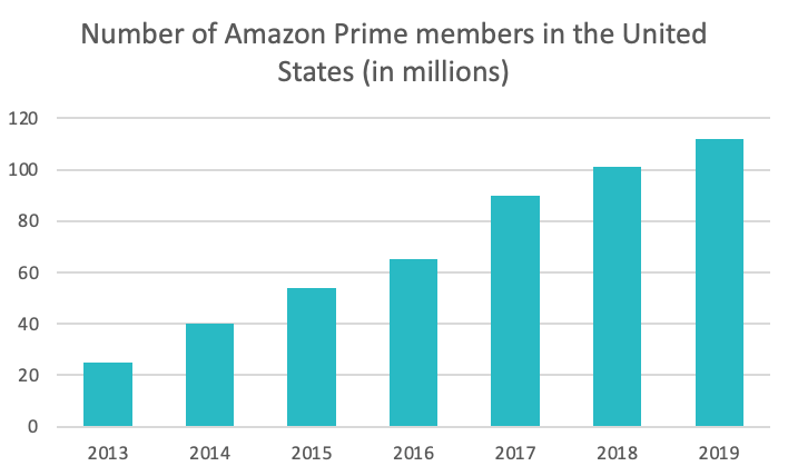

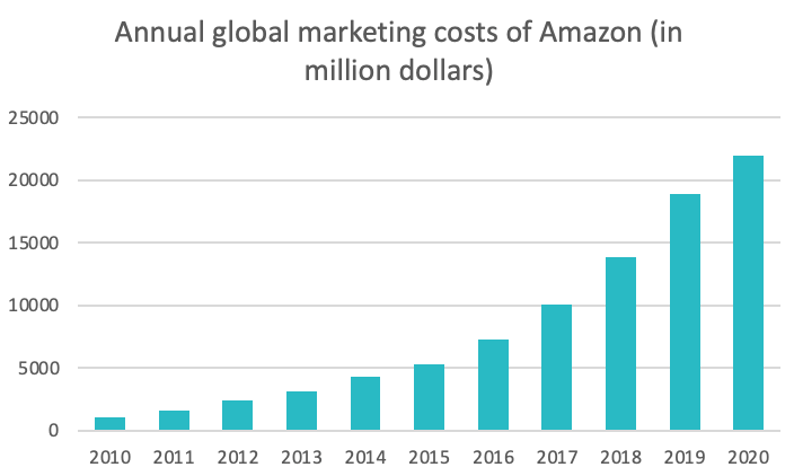

Amazon was created by Jeffrey Bezos in 1994 initially to sell books on the internet. A month later, the company was sending books to 40 countries. Later, Amazon decided to diversify its offer and started with the sale of music and DVDs. Subsequently, it attacked the market for electronics, toys, and kitchen equipment. The multiplication of storage areas will make it possible to expand the range of products increasingly and to better attract the attention of the public. After a decade, Amazon had positioned itself as the essential leader in online sales worldwide. According to the strategy of its founder, Jeff Bezos, a majority of profits were constantly reinvested in the company. In 2005, in order to reward loyal customers and offer an ever faster and more qualitative service, Amazon launched Prime, which gained more than a hundred million users. (Source:Forbes)

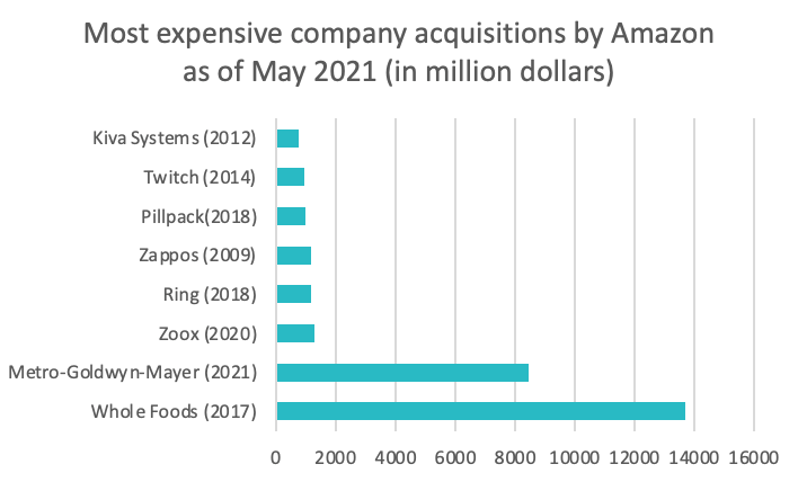

Source : macrotrends.com

Source : statista.com

Who is Jeffrey Bezos, founder of Amazon?

Jeffrey Bezos was born in 1964 and raised by adoptive parents. Passionate about physics and computers, he studied at Princeton University. In 1986, he graduated with a Bachelor of Arts and Science. He then worked on Wall Street, until he became a vice president at D.E. Shawn.

In 1994, he launched the Cadabra project, which he soon renamed to the name of the company we all know, Amazon. His project was to make it the largest bookstore on Earth, but he also aspired to develop his project. Three years later, he decided to diversify and sell other items. In 1999, Time crowned him the man of the year and king of the Internet.

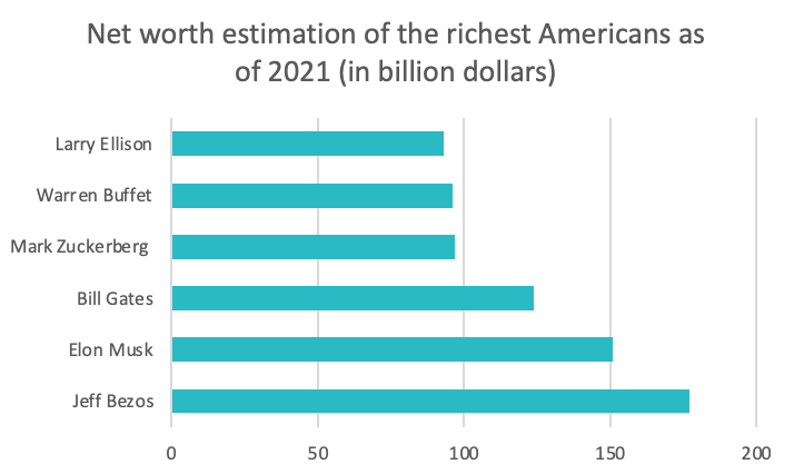

This was followed by an extensive career as CEO at Amazon, which earned him the title of the richest man in the world in 2017, with a fortune of more than $ 100 billion.(Source:Forbes)

On July 5, 2021, Jeff Bezos finally decided to step down as CEO at Amazon, but nevertheless continued as a chairperson of the board.

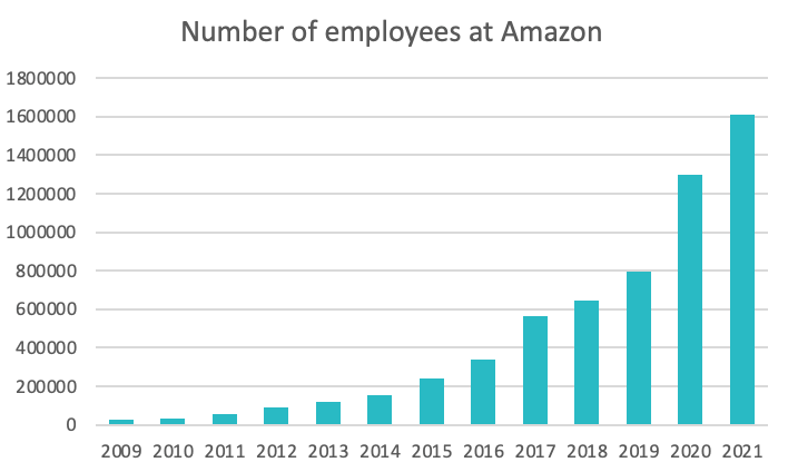

Source : statista.com

Source : statista.com

The market

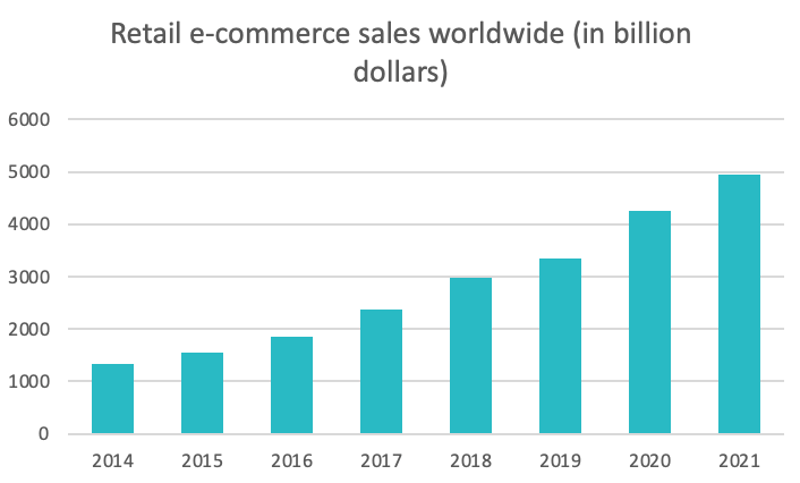

Amazon operates in the e-commerce market. It is a "relatively" young market, given the fact that it was necessary to wait for the democratization of the internet so that online sales were possible. But today, no one would imagine a world without e-commerce. The global health crisis has accentuated online sales growth over the last 6 years growth. As the shops were closed for some time, and people were afraid to go out, this mode of purchase was quickly adopted around the world. This boost has allowed companies to grow even more, and thus offer new services, more efficient, and more convenient than physical commerce.

With the evolution of the way of living and buying, it is certain that online selling is, and will remain, a strong and sustainable market.

Source : statista.com

Source : statista.com

Key figures and financial ratios

Market capitalization: $1.374 Trillion 1(August 1, 2022)

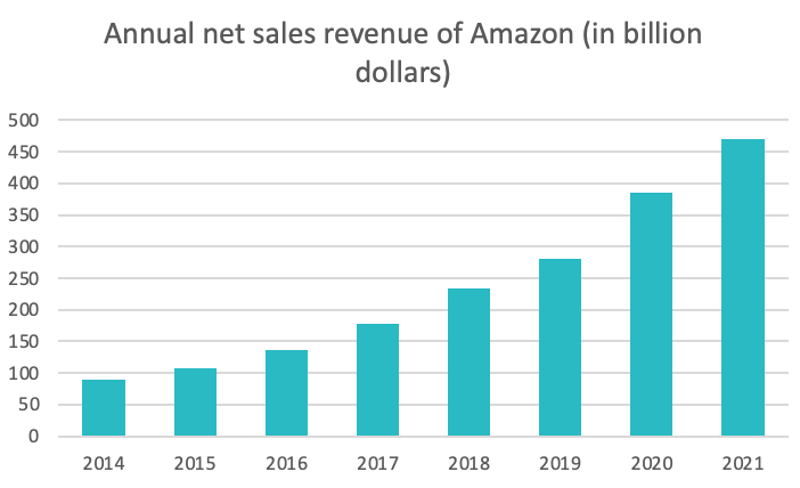

Revenue: $469.822 billion 2(2021)

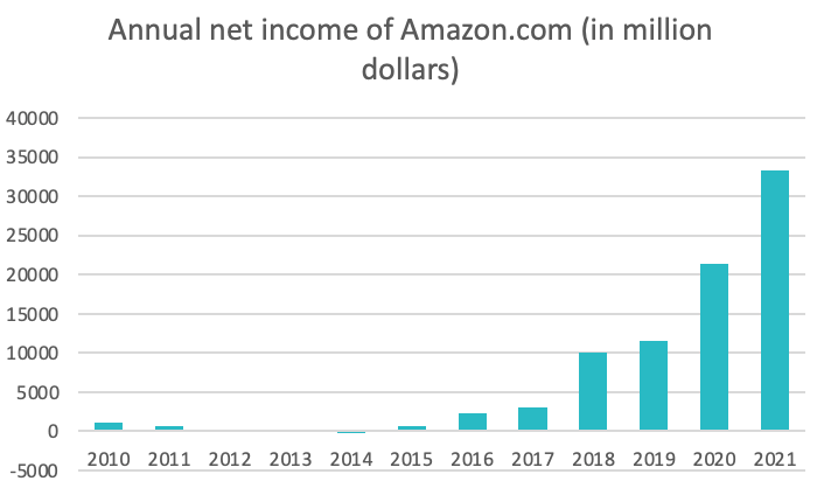

Net income: $33.364 billion 3(2021)

Dividends paid: No dividends

Earnings per share: $64.81(2021)

Price-to-earnings ratio(TTM): 40.90x 4(May 12, 2022)

Debt-to-capital ratio: 0.35x5(2022)

Source : statista.com

Source : statista.com

Graniteshares Offering Products

Amazon

FAANG

GraniteShares FAANG ETPs provide exposure to the equal weight to following companies: Facebook, Amazon, Apple, Netflix and Alphabet

GAFAM

GraniteShares GAFAM ETPs provide exposure to the equal weight to following companies: Alphabet, Amazon, Facebook, Apple and Microsoft

FATANG

GraniteShares FATANG ETPs provide exposure to the equal weight to following companies: Facebook, Amazon, Tesla, Apple, Netflix and Alphabet

Sources

- Market Cap source: Companies Market Cap

- Revenue: Amazon Investor Relations

- NI: Amazon Investor Relations

- EPS: Investor Relations

- PE Ratio: Macrotrends

- Debt to capital: Macrotrends

DISCLAIMER

Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author, and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks, and liquidity risks.