BAE Systems plc

BAE Systems, British Defense and Aerospace Company

Presentation of the Company

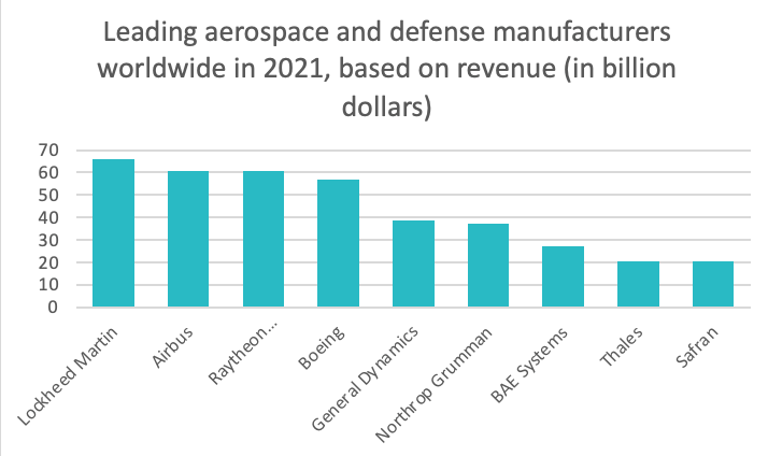

BAE Systems (LON: BA) is a British defense and aerospace company. The company is the main supplier to the UK Ministry of Defence but also has interests in North America through its subsidiary BAE Systems Inc. In the defense sector, it is in 2020 the seventh largest company in the world and the largest in Europe. Wikipedia

BAE Systems (LON: BA) provides a wide range of defense-related goods and services, including aircraft, ships, land vehicles, electronics and information security.

BAE Systems' main competitors are : Safran, Thales, and Boeing.

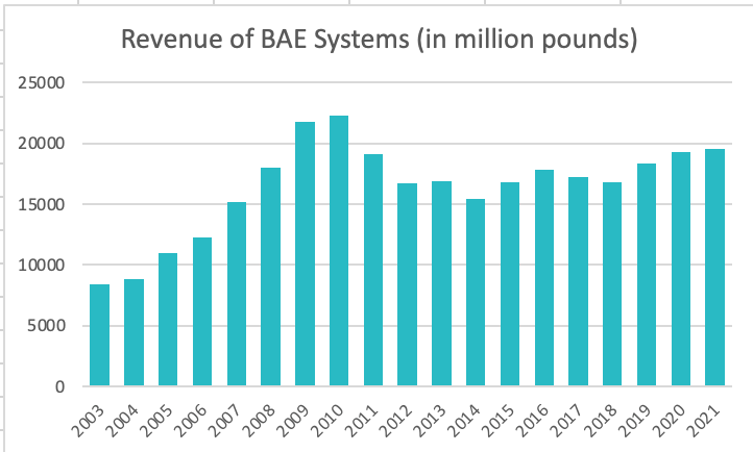

Source : statista.com

Source : statista.com

History of BAE Systems

BAE Systems (LON: BA) was founded on November 30, 1999 as a result of the merger of British Aerospace (BAe) and Marconi Electronic Systems (MES). BAE Systems is thus the heir to famous British aerospace and defense companies.

In 2001, BAE restructured its activities in Europe and decided to focus more on its development in the United States. This strategy was confirmed by an audit in 2004. The company becomes the second largest player in the world after two acquisitions in 2004 and 2005.

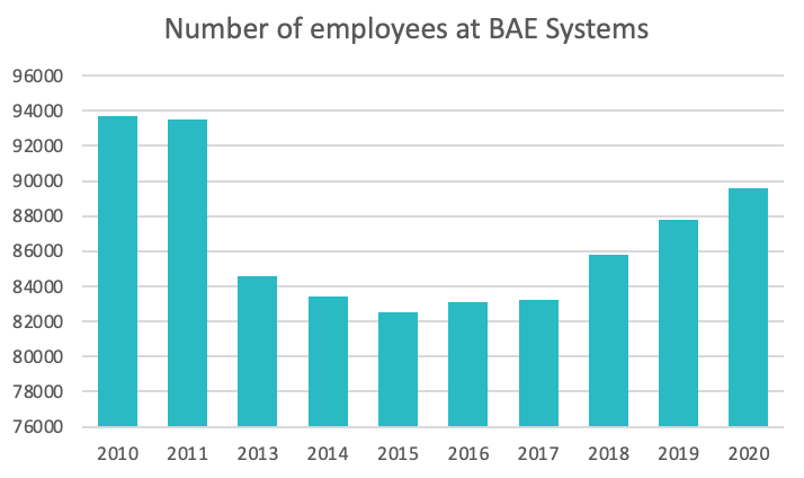

In September and October 2017, the new management of BAE Systems (LON: BA) carries out a restructuring; the company closes its office in Denmark and otherwise cuts 2,000 jobs mainly in Great Britain. Announcement-of-organisational-changes

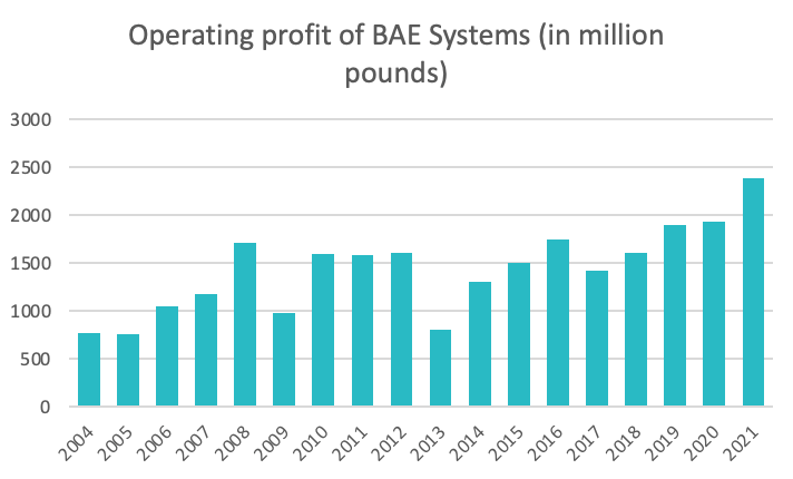

Source : macrotrends.com

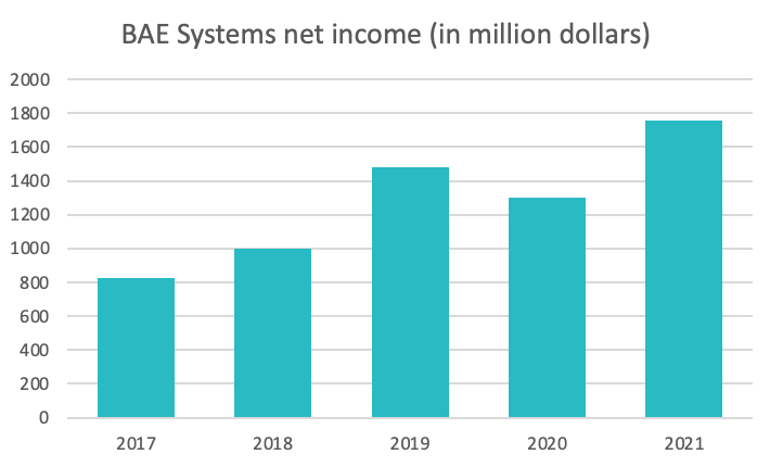

Source : statista.com

The Market

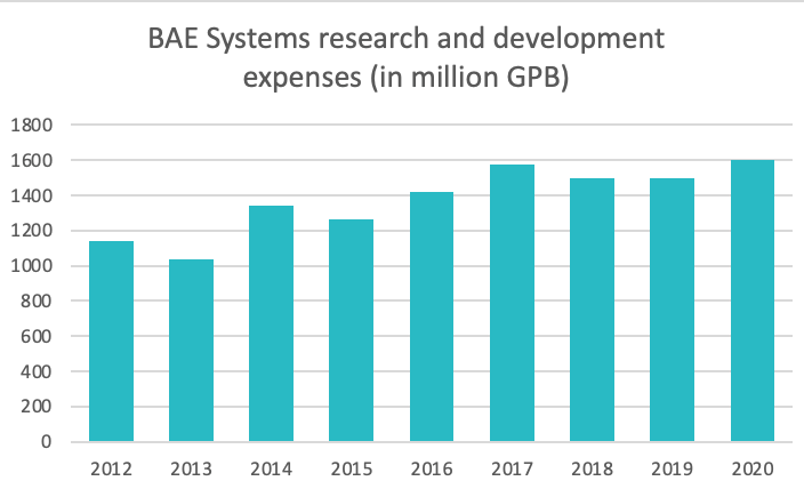

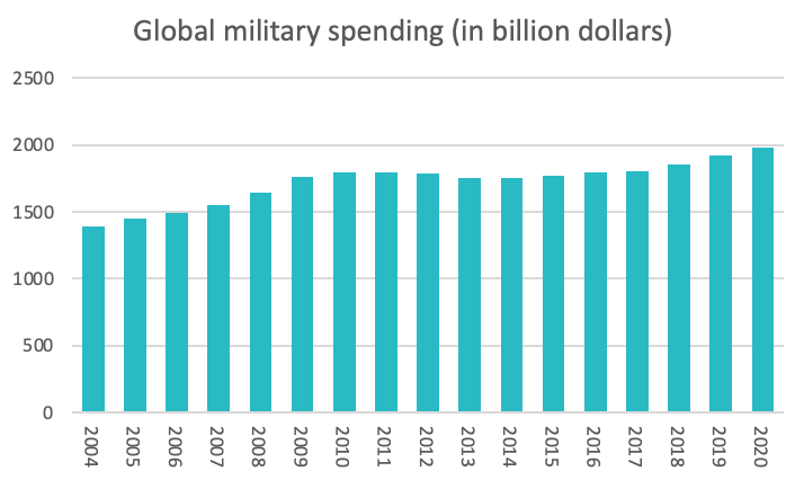

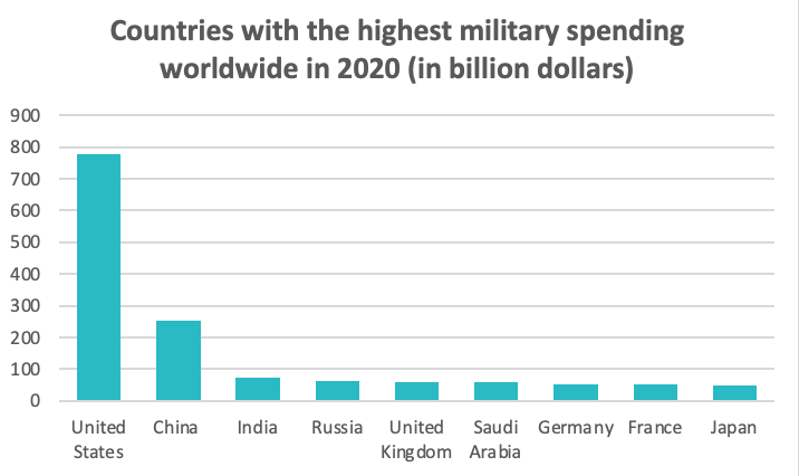

BAE Systems (LON: BA) is a defense and aerospace company. This is a sector in which demand is international, although very unevenly distributed between countries. The ability to defend oneself is a natural desire expressed since the beginning of civilizations. It is of course a sector very prone to innovations, which companies must imperatively take into account in order to remain competitive. As a result, we observe a demand that is renewed with each new innovation.

It is also a sector very much impacted by the global and national geopolitical context. Indeed, the customers of this sector are not individuals but states, governed by various laws and budgets, which makes it a much more complex market to predict. The current context between Russia and Ukraine, which strongly benefits this market, is one proof.

Source : statista.com

Source : statista.com

Key Figures and Financial Ratios

Market capitalization : $31.48 billion1[2022]

Revenue : $25.503 billion2[2021]

Net income : $2.5 billion 3[2021]

Dividends paid : Every 6 months for 28 years 4

Earnings per share : $0.72 5[2021]

Price to earnings ratio : ≃13.88 6[2022]

Debt to capital ratio : 0.687[2022]

Source : statista.com

Source : marketwatch.com

Graniteshares Offering Products

BAE Systems

Sources

- Bae Systems Market Cap

- Baesystems article

- Bae Systems Net Income

- Dividend information

- Baesystems Five Year Summary

- BAE Systems PLC

- Debt_equity_ratio

DISCLAIMER

Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author, and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks, and liquidity risks.