3LBA

3x Leverage BAE Systems (BAES) ETP

3LBA Product Description

GraniteShares 3x Long BAE Systems Daily ETP is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x Long BAE Systems plc Index that seeks to provide 3 times the daily performance of BAE Systems plc shares.

For example, if BAE Systems plc rises by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments. However, if BAE Systems plc falls by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments.

What is BAE Systems plc (BAES) ?

BAE Systems plc is a multinational defense, aerospace, and security company that provides advanced technology solutions globally. The company operates through several segments: Electronic Systems, Platforms & Services, Air, Maritime, and Cyber & Intelligence. The Electronic Systems segment focuses on electronic warfare, navigation systems, and digital engine controls. The Platforms & Services segment manufactures and upgrades combat vehicles and provides naval ship repair services. The Air segment develops future combat air systems, while the Maritime segment handles submarine and ship build programs. The Cyber & Intelligence segment offers cybersecurity services for national security. BAE Systems is headquartered in the United Kingdom and employs a skilled workforce across more than 40 countries. It plays a significant role in major defense projects, including the production of military aircraft and submarines. The company's U.S. subsidiary, BAE Systems Inc., is a major supplier to the U.S. Department of Defense and operates under a Special Security Agreement to handle sensitive defense programs. BAE Systems has a long history of innovation and continues to invest in technology to support its customers' evolving needs.

Key Facts

3x Leverage BAE Systems (BAES) ETP OVERVIEW

LISTING AND CODES for 3x Leverage BAE Systems (BAES) ETP

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| London Stock Exchange | GBX | 3LBA | XS2722160020 | BNDSD68 |

INDEX & PERFORMANCE of 3x Leverage BAE Systems (BAES) ETP

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

COLLATERAL Details of 3x Leverage BAE Systems (BAES) ETP

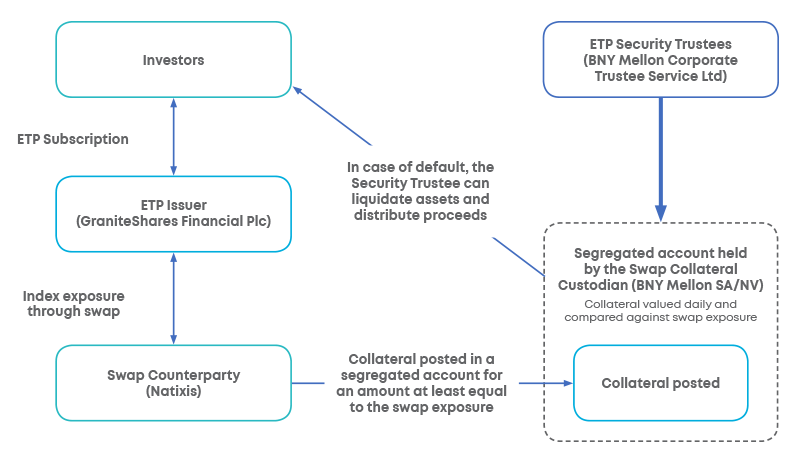

Understanding Collateral

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.