Diageo plc

Diageo, the World Leader in Alcoholic Beverages

Presentation of the Company

Diageo (LON: DGE) is an English company specializing in alcoholic beverages. It is the world's largest company in the spirits market, present in over 180 countries. The group was formed in 1997 from the merger of two companies: Grand Metropolitan and Guinnes Plc. The activity is essentially organized around 4 product families: spirits, beers, ready-to-drink beverages, and wines. Among the brands under which their products are marketed are Guinness, Smirnoff, Captain Morgan, and Baileys. Diageo participates in the prevention of alcohol abuse among its consumers. (Source: Diageo our Business)

Diageo's competitors include Pernod Ricard, Bacardi, Brown-Forman, and Constellation Brands.

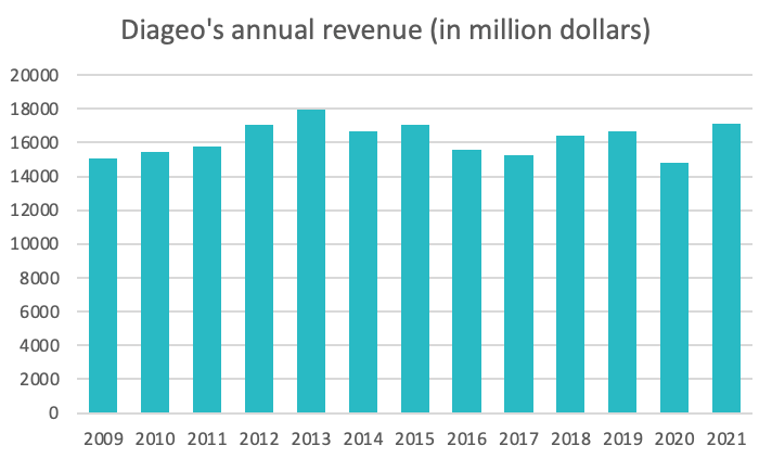

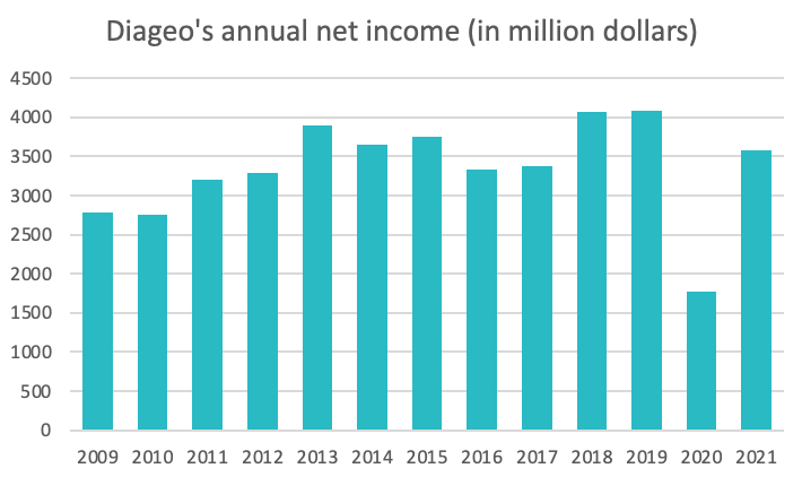

Source : macrotrends.com

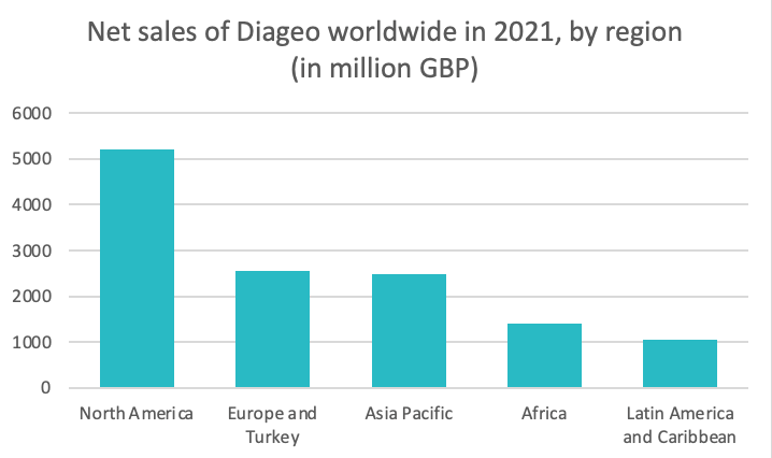

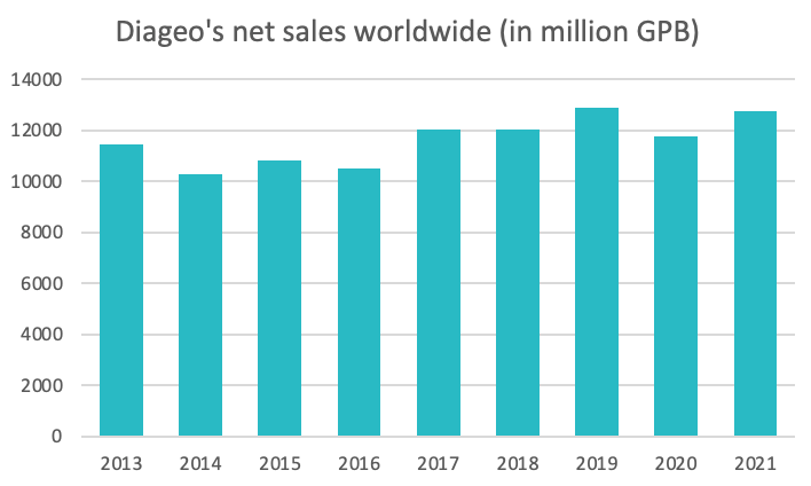

Source : statista.com

History of Diageo

Diageo (LON: DGE) is a relatively young company. It was born from the merger of Grand Metropolitan and Guinness Plc, two multinational companies specialized in alcoholic beverages. From this merger, Diageo inherited some businesses not operating in the alcoholic beverage market, and decided to divest most of these subsidiaries.

Between 2011 and 2017, the group made several acquisitions, for example Casamigos or United Spirits. These operations will even have earned a call to order from the British competition authority.

Today Diageo (LON: DGE) is a company whose brands are known worldwide, operating in more than 180 countries, with a market capitalization of over 100 billion dollars.

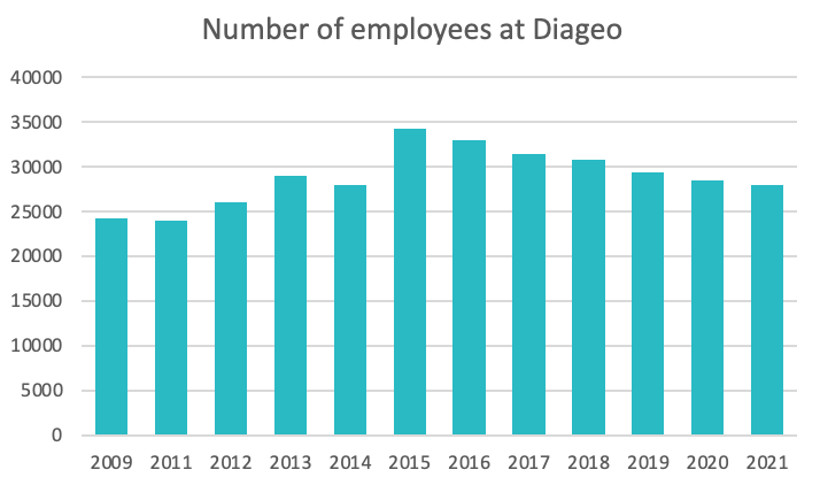

Source : macrotrends.com

Source : statista.com

The Market

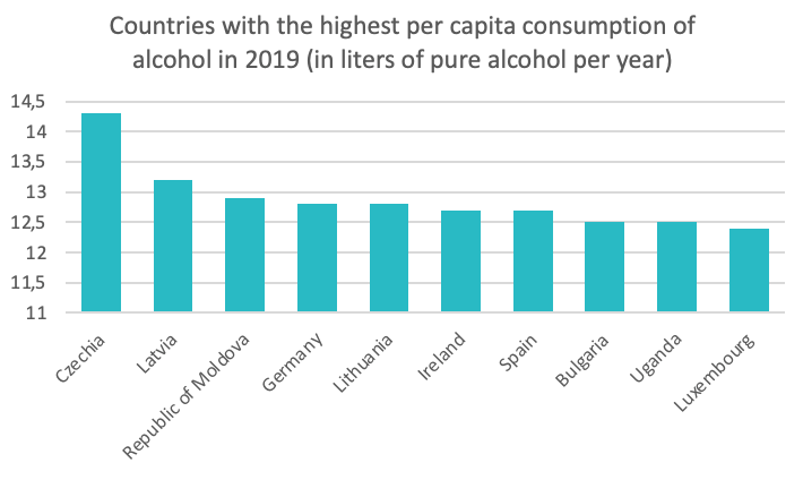

Diageo (LON: DGE) is a company that sells alcoholic beverages. The alcoholic beverage market includes wine, spirits, and beer, which is the largest selling alcohol in the world and accounts for nearly 40% of the market value. This market is worth more than 1,400 billion dollars, and among the different beverages, the largest category is alcoholic beverages. The demand in this sector is present worldwide, with some exceptions.

It is a market that, according to analysts, is expected to register a CAGR of 3.4% during the forecast period 2022-2027, after a recessionary period due to the closure of shops and bars during the global health crisis.

Source : statista.com

Source : statista.com

Key Figures and Financial Ratios

Market capitalization: £ 78.368 billion 1(2022)

Revenue: £ 12,733 million 2(2021)

Operating Profit: £ 3,731 million 3(2021)

Dividends paid: Every 6 months for over 20 years.

Earnings per share: £ 113.8p 4(2021)

Price to earnings ratio: 23.93x 5(2022)

Debt to capital ratio: 1.81 6(2022)

Source : macrotrends.com

Source : statista.com

Graniteshares Offering Products

DIAGEO

Sources

- Diageo plc (DGE.L) Finance Yahoo

- A global leader in beverage alcohol Diageo Investors

- A global leader in beverage alcoholDiageo Investors

- A global leader in beverage alcoholDiageo Investors

- Diageo PE Ratio Ycharts

- Diageo Debt to Equity Ratio | DEO 6. Macrotrends

DISCLAIMER

Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author, and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks, and liquidity risks.