Barclays' Q1 2024 Earnings

Posted:

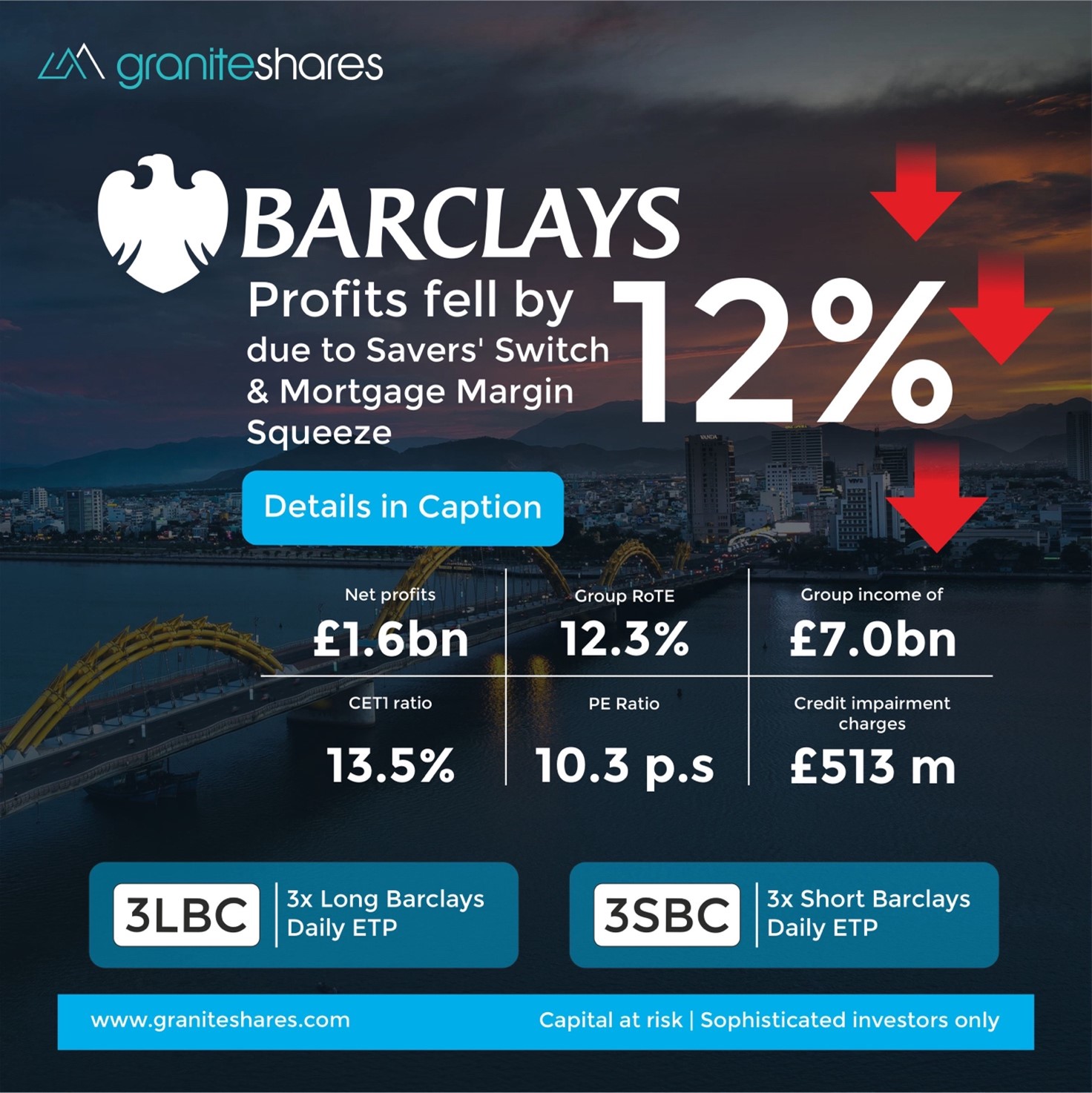

The Bank's profits fell by 12% due to Savers' Switch and Mortgage Margin Squeeze

Barclays' for first quarter reported Group revenue for the first quarter amounted to £6.95 billion, reflecting a 4% decrease compared to the corresponding period last year.

Moreover, Barclays UK, comprising the bank’s personal banking, domestic consumer card business, and UK business banking, experienced a 7% decline. This drop was attributed to shifts in deposit behavior by customers and pressure on mortgage margins, as stated by the bank. Anna Cross, the bank's chief financial officer, said there is a slowdown in savers switching to higher-yielding accounts.

Credit impairment charges amounted to £513 million, slightly lower than the £524 million recorded in the first quarter of 2023 and the Loan loss rate (LLR) stood at 51bps.

Furthermore, the Common equity tier one (CET1) capital ratio, a measure of the bank’s financial strength was 13.5%, down from 13.8% in the previous quarter.

Also, Full-year return on tangible equity (RoTE) was 12.3%, and a tangible net asset value (TNAV) per share of 335p.

Total operating expenses for the end of the quarter were up 2% YoY at £4.2 billion.

Barclays' profits declined by 13% in the first quarter, marking the bank's initial results following CEO CS Venkatakrishnan's ambitious three-year plan aimed at revitalizing its share price.

"We are committed to diligently executing the plan outlined at our Investor Update on 20th February," he stated.

The overhaul entails a £900 million expense related to structural cost-cutting measures, anticipated to yield gross cost savings of approximately £500 million in 2024, with an expected payback period of under two years.

As part of the restructuring, the business was reorganized into five operating divisions, with the corporate and investment bank divided to create: Barclays UK, Barclays UK Corporate Bank, Barclays Private Bank and Wealth Management, Barclays Investment Bank, and Barclays US Consumer Bank.

Furthermore, the bank pledged to return £10 billion to shareholders through dividends and share buybacks between 2024 and 2026.

Barclays' shares surged by 4% on 25th April following the announcement of first-quarter net income attributable to shareholders, which amounted to £1.55 billion.

DISCLAIMER

Please note that GraniteShares' short and leveraged Exchange Traded Products are suitable only for sophisticated investors.

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks and liquidity risks. Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.

GraniteShares

GraniteShares