Meta Platforms Inc

Facebook, biggest social network in the world

Presentation of the company

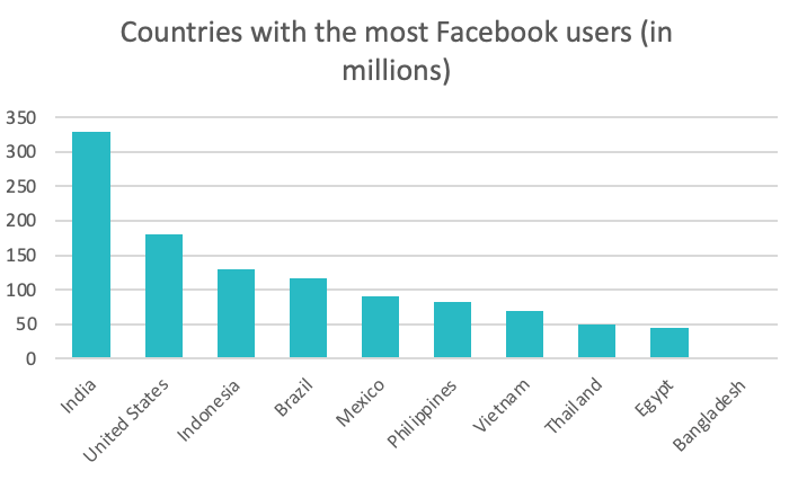

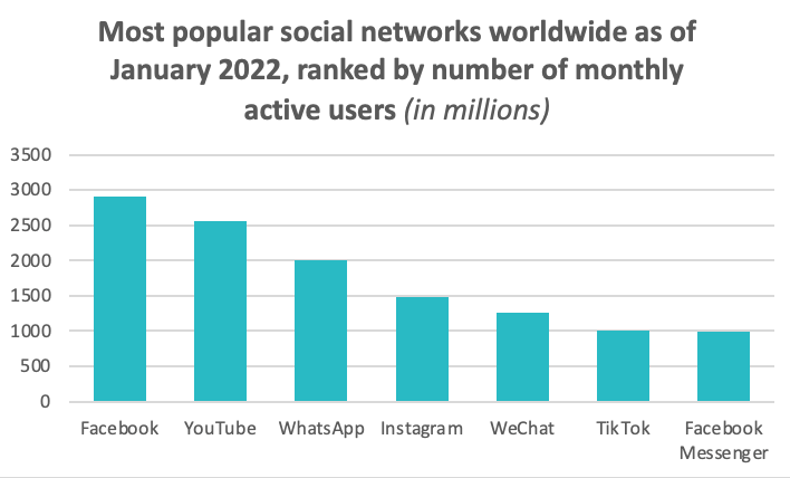

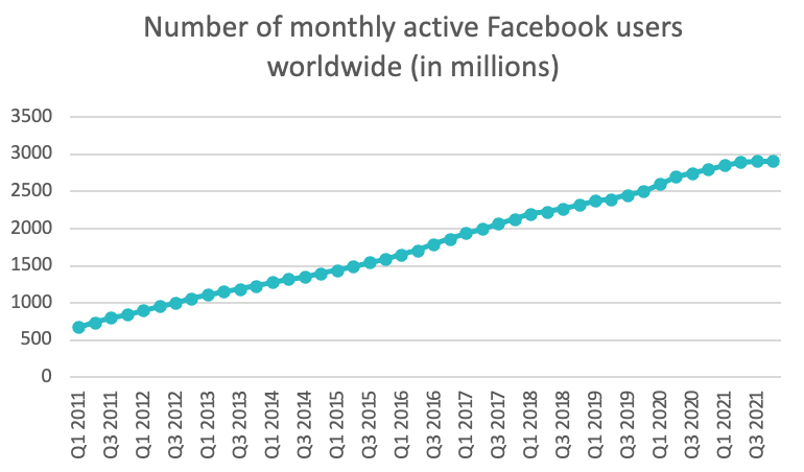

Facebook, owned by Meta, is the world's largest online social network. It allows its users to post images, photos, videos, files and documents, exchange messages, join and create groups and use a variety of applications on various devices. It is the third most visited website in the world behind Google and YouTube, and has almost 3 billion active users.

The company has also had its share of controversies such as influencing users' social lives, spreading false information or hate speech, or using personal data.

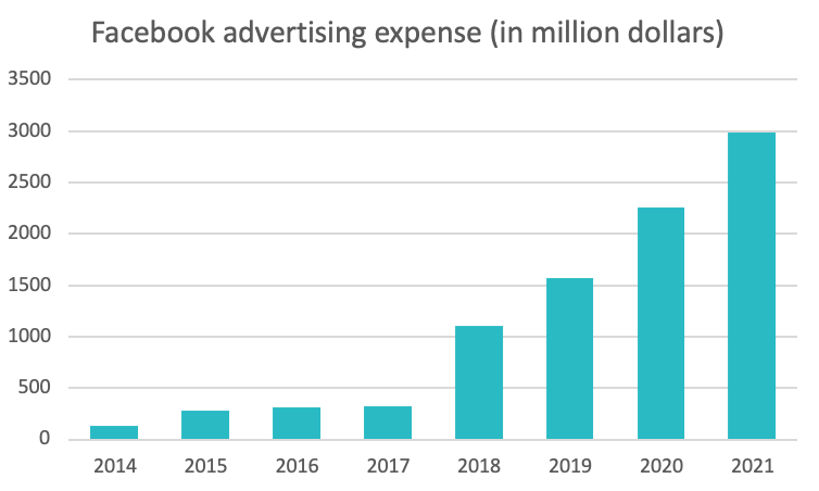

Facebook's strategy is to grow its audience and remain the world's largest social network through new features that make the user experience better and to acquire similar companies to expand its opportunities.

Facebook's main competitors are Snapchat, Twitter, or LinkedIn.

Source : statista.com

Source : statista.com

History of Facebook

The Facebook was created in 2004 by Marc Zuckerberg and a few Harvard classmates, with the first goal of gathering the university's students on a social network. From the first month, the network was a huge success at Harvard and opened to other universities. In 2005, the company bought the facebook.com domain and removed the "The" from its name. That same year, the social network opened to high schools and employees of some companies. In September 2006, anyone with a valid email address could create an account.

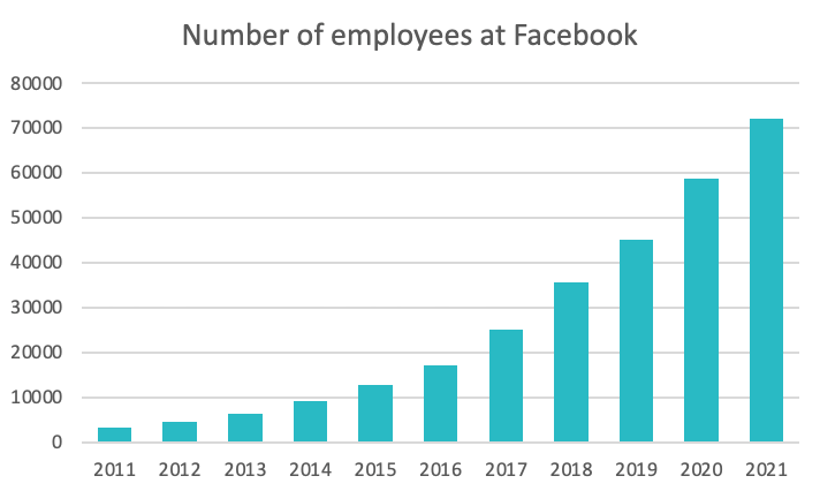

In 2012, Facebook went public, the largest IPO in the history of technology stocks, both in terms of funds raised and market capitalization. Since 2013, brands and personalities are recognized by a certification on the network. Many improvements and features followed, making Facebook the social network as we know it today.

Source : macrotrends.com

Source : statista.com

The market

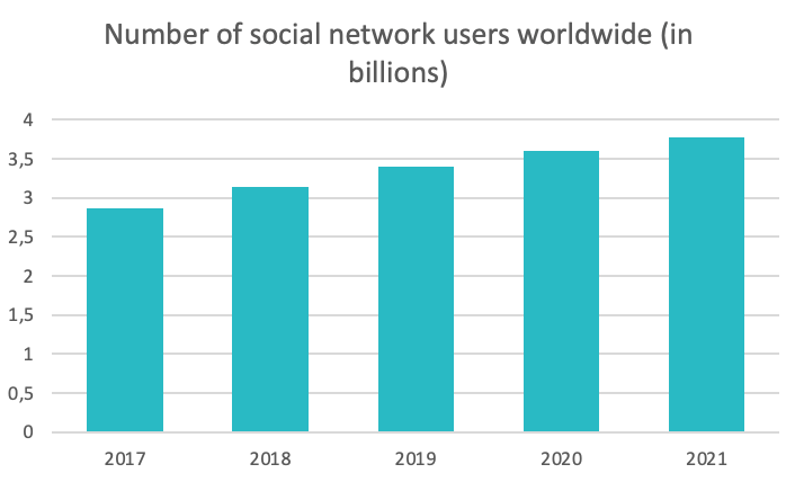

The market in which Facebook operates is the social networks market. Social networks are an integral part of the habits of the majority of the world's population. In 2021, more than 44% of the time spent on the Internet was on social networks. Globally, 74 billion social network applications have been downloaded to date. It is a constantly evolving market, always looking for novelties, with for example streaming / live applications such as TikTok or Twitch that are taking more and more ground in the last two years.

Social networks are also a strong source of revenue, whether for ads or premium features. In the first half of 2021, spending within social apps was up 50% year-over-year.

Source : statista.com

Source : statista.com

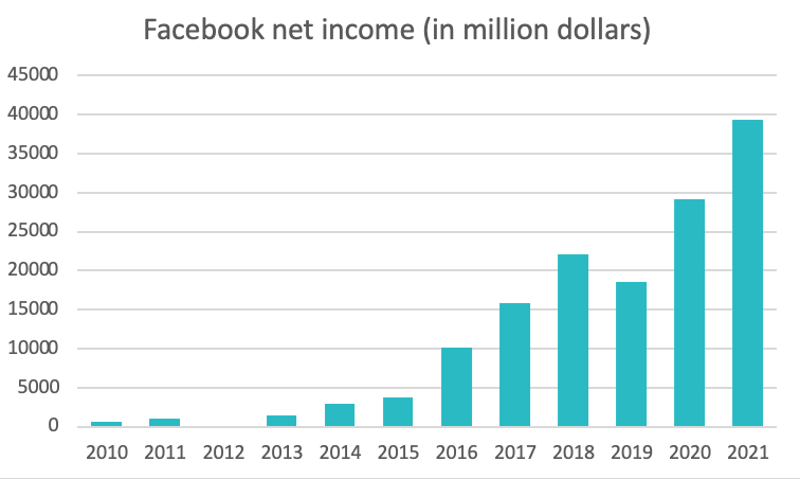

Key figures and financial ratios

Market capitalization: $562.905 billion 1(May 13, 2022)

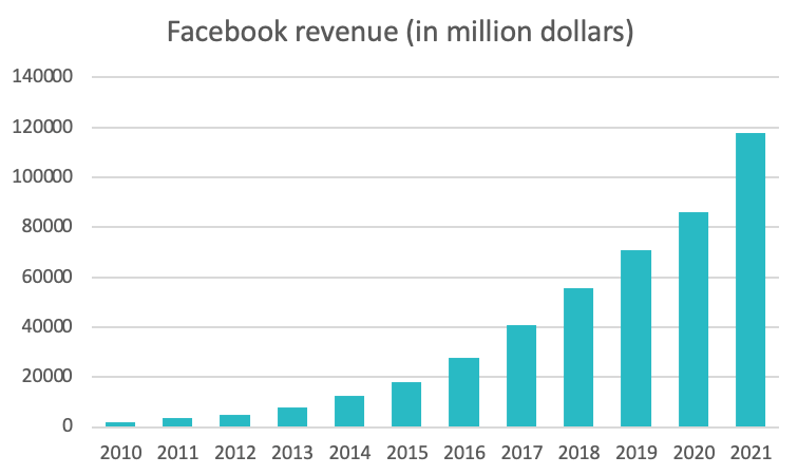

Revenue: $117.929 billion 2(2022)

Net income: $39.37 billio 3(2022)

Dividends paid: No dividends4(2021)

Earnings per share: $13.77 For the twelve months ending December 31, 2021

Price-to-earnings ratio: ≃ 15.08 5(2022)

Debt-to-capital ratio: 0(2022)

Source : statista.com

Source : statista.com

Graniteshares Offering Products

FAANG

GraniteShares FAANG ETPs provide exposure to the equal weight to following companies: Facebook, Amazon, Apple, Netflix and Alphabet

GAFAM

GraniteShares GAFAM ETPs provide exposure to the equal weight to following companies: Alphabet, Amazon, Facebook, Apple and Microsoft

FATANG

GraniteShares FATANG ETPs provide exposure to the equal weight to following companies: Facebook, Amazon, Tesla, Apple, Netflix and Alphabet

Sources

- Yahoo! Finance.

- Meta Investor Relations investor Fb

- macrotrends

- investing

DISCLAIMER

Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author, and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks, and liquidity risks.