Netflix Inc

Netflix, the Precursor of video streaming

All that you need to know about Netflix Inc.

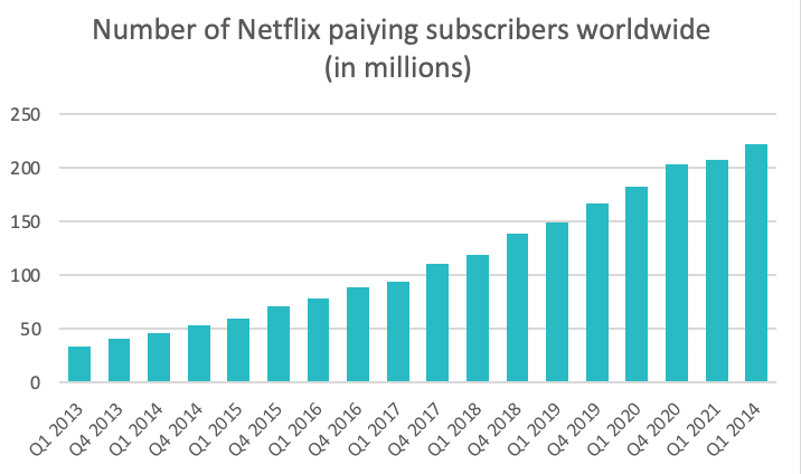

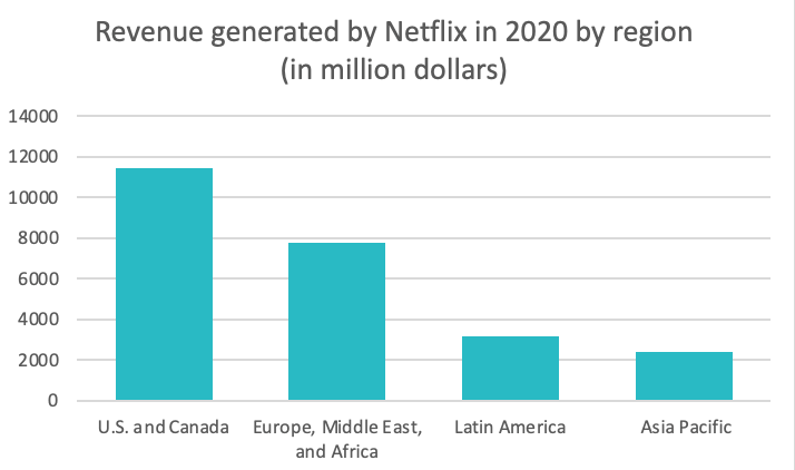

Netflix is an American multinational company created in 1997 that specializes in distributing and exploiting film and series through a dedicated platform. It is one of the world’s leading subscription streaming services and production companies offering 221 million paid memberships in over 190 countriessup1. The platform broadcasts mostly programs already released on television or in the cinema, but also, for 8% of the content, exclusive programs that it holds the license. The latter is then labelled "Netflix Original". The series and content from the company are available on their website and applications (apps). All the paid members can watch and enjoy unlimited Netflix content with a variety of genres of TV series, documentaries, feature films, and movies on any device and screen with internet connection.

The company has different prices and catalogues show steaming in different countries. For example, more than 5500 movies are available in the United States against almost 2000 in France. They also stream various Netflix series with exclusive or shared ownership right in various countries. They also come up with a trending Netflix series list that month to help increase customer engagement.

In 2021, Netflix launched a series of mobile games, for the moment exclusively available on Android.

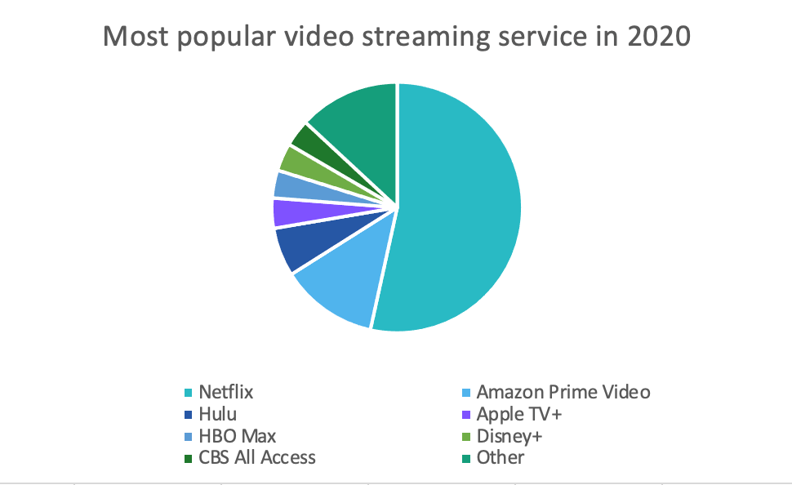

Netflix is one of the largest video-on-demand platforms in the world. The company is considered a pioneer in this field.

Source : macrotrends.com

Source : statista.com

Netflix Company History

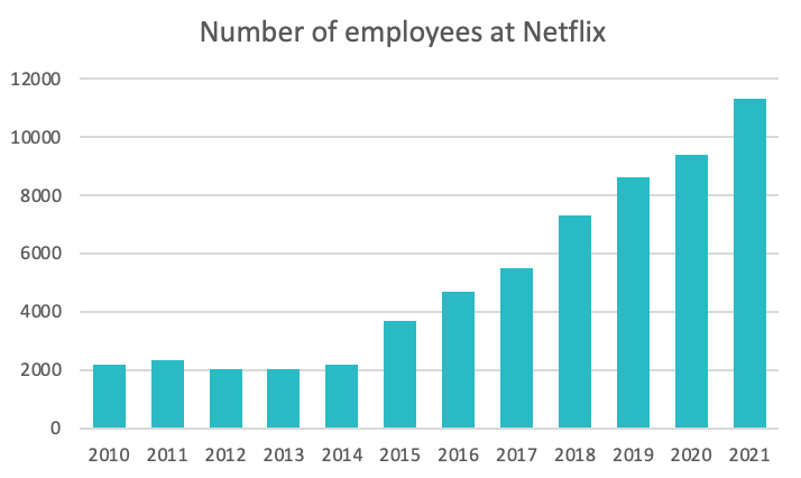

The Netflix company was created by Mr. Reed Hastings (current CEO) and Mr. Marc Randolph in 1997. Mr. Reed Hastings is Netflix's owner. The company originally intended to take advantage of the rise of the DVD format to offer monthly rentals. That is how their business started in 1999. At the very beginning of the 21st century, Netflix is facing financial difficulties.

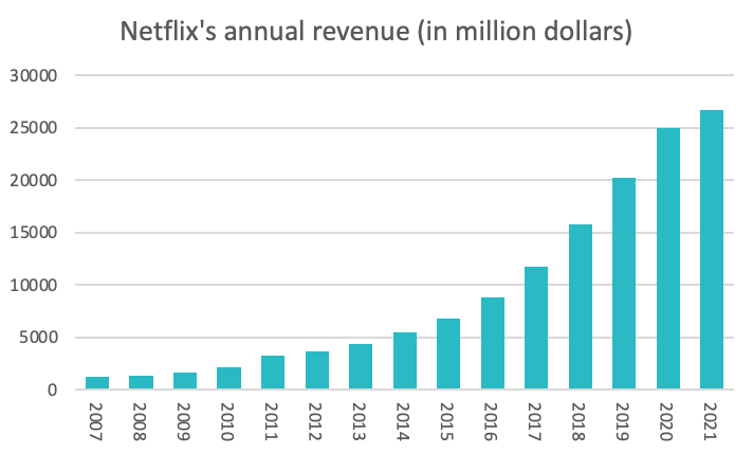

In 2007 Netflix started renting a video on demand on computers. In the 2010s, Netflix is experiencing significant development. Their offer extends to the entire world. Finally, their catalogue is growing year after year.

Today, the company is a giant of video on demand, known worldwide, with a market capitalization of over $80.12 billion

Source : macrotrends.com

Source : statista.com

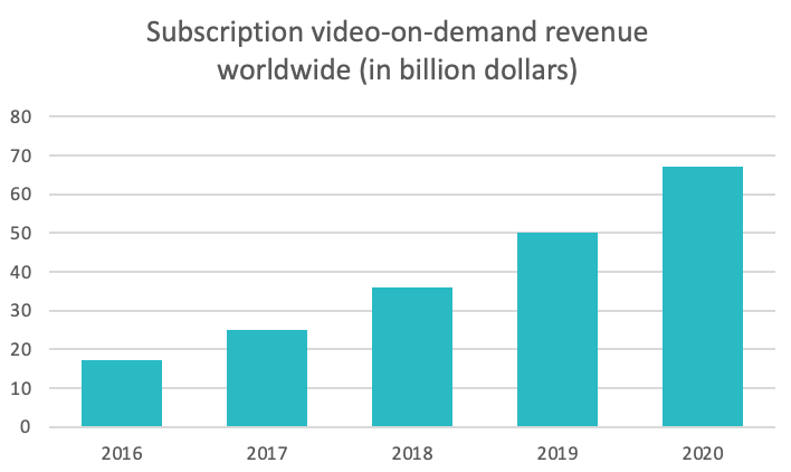

The market

The main activity of Netflix is the exploitation and distribution of movies and series. It is a relatively young sector as it only really appeared in 2000 with the development of broadband internet. It is a market where demand is very strong, with intense competition. Communication and updating of offers and programs are essential to attract and retain customers.

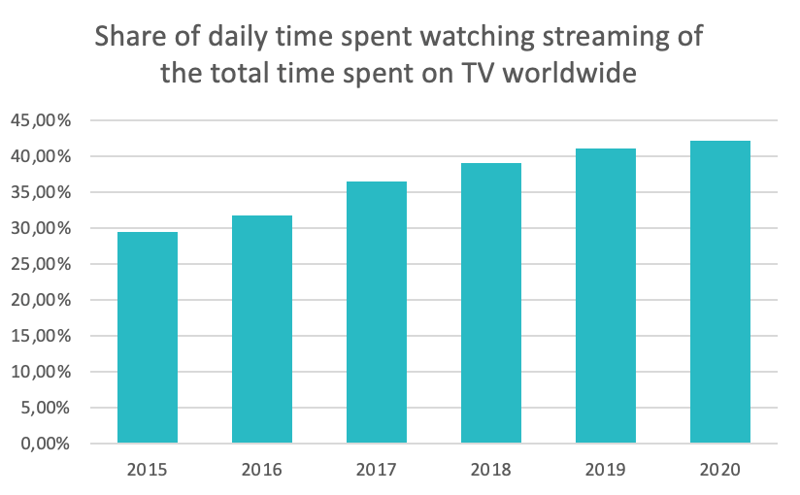

Due to the global health crisis, the lifestyle of the world's population has changed dramatically. Staying at home has been a boon to this market, creating a huge demand. Moreover, these new customers have become regular due to this habit change. This market looks interesting post-COVID, and analysts see it growing in the coming years.

Source : cafedelabourse.com

Source : statista.com

Key Figures and Financial Ratios

Market capitalization: $80.12 billion [1] (May 24, 2022)

Turnover: $29.698 billion[2] (2021)

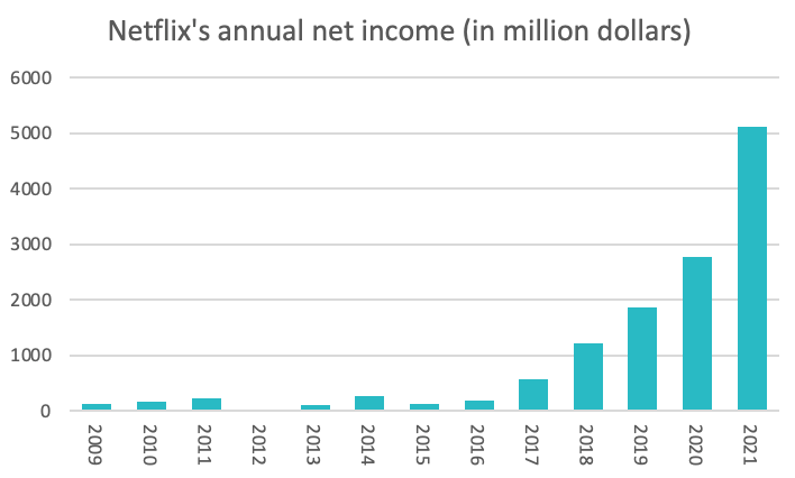

Net income: $5.116 billion[3] (2021)

Dividends paid: No dividends

Earnings per share: 3.20x[4] June 2022

Price/earnings ratio: ≃35.01[5] (July 22, 2022

Debt to capital ratio: 6.3% [6] ( 2022)

Source : statista.com

Source : macrotrends.com

Graniteshares Offering Products

NETFLIX

FAANG

GraniteShares FAANG ETPs provide exposure to the equal weight to following companies: Facebook, Amazon, Apple, Netflix and Alphabet

GAFAM

GraniteShares GAFAM ETPs provide exposure to the equal weight to following companies: Alphabet, Amazon, Facebook, Apple and Microsoft

FATANG

GraniteShares FATANG ETPs provide exposure to the equal weight to following companies: Facebook, Amazon, Tesla, Apple, Netflix and Alphabet

DISCLAIMER

Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author, and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks, and liquidity risks.