FAANG – The Future of Tech Investing

Posted:

FAANG – The Future of Tech Investing

FAANG refers to the world's five most successful and prominent technology companies: Facebook (now Meta), Amazon, Apple, Netflix, and Google (now Alphabet).

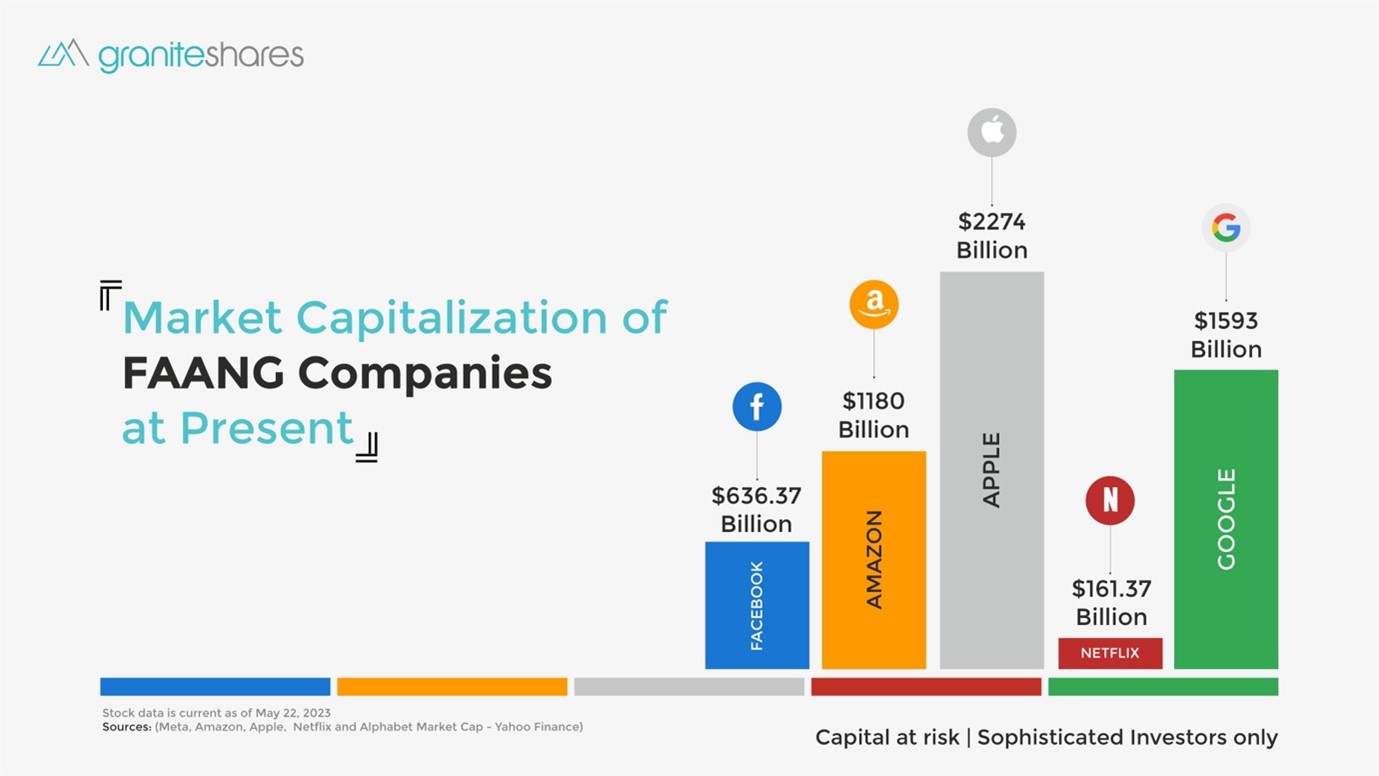

The Five FAANG stocks are among the largest companies in the world, with a combined market capitalization of around $7 trillion as of Q1 2022. (Source: Yieldstreet)

As of August 2021, the FAANGs account for around 19% of the S&P 500, an astounding proportion given that the S&P 500 is generally seen as a proxy for the US economy as a whole.

These stocks account for approximately 30% of the NASDAQ Index. (Source: Themotleyfool)

In 2013, investment experts Jim Cramer and Bob Lang popularized the phrase. In 2017, Cramer added Apple to the group, coining the term FAANG. (Source: Nerdwallet).

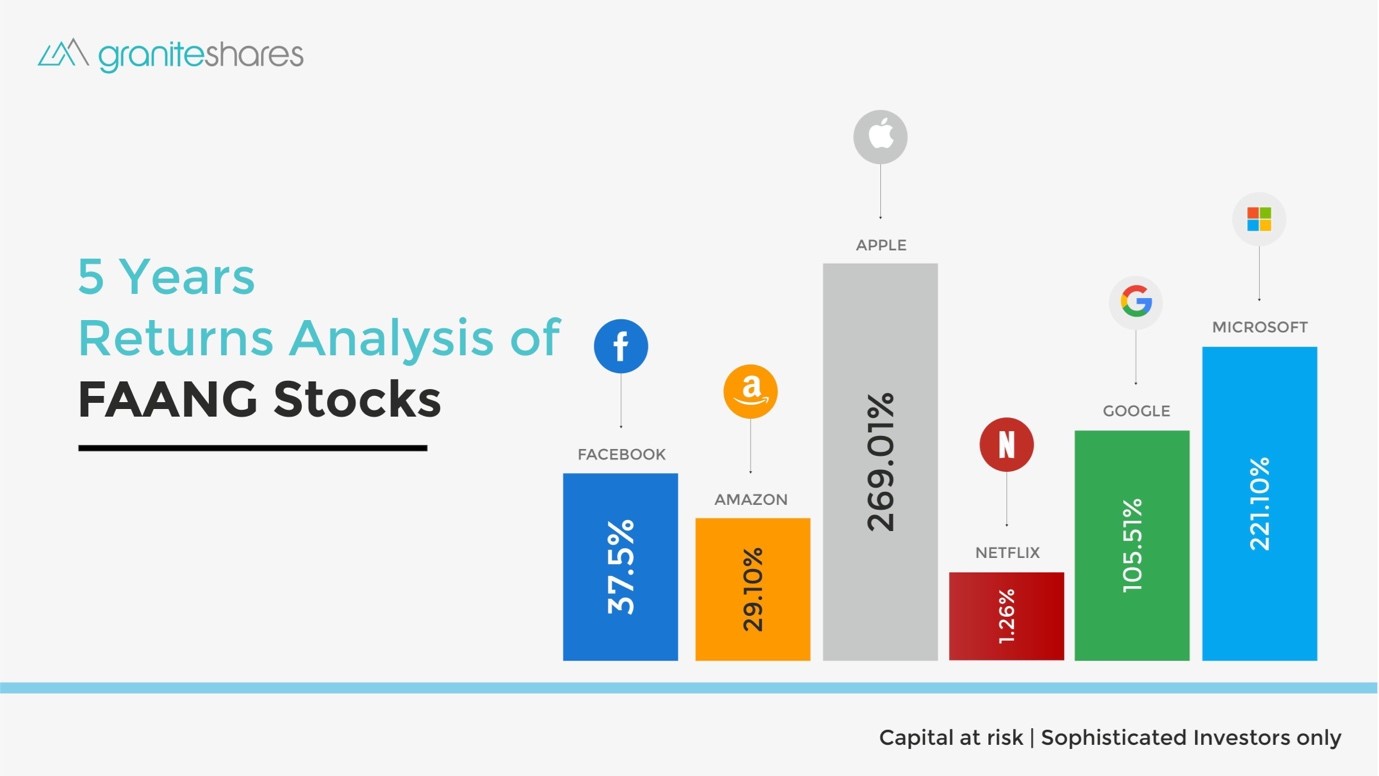

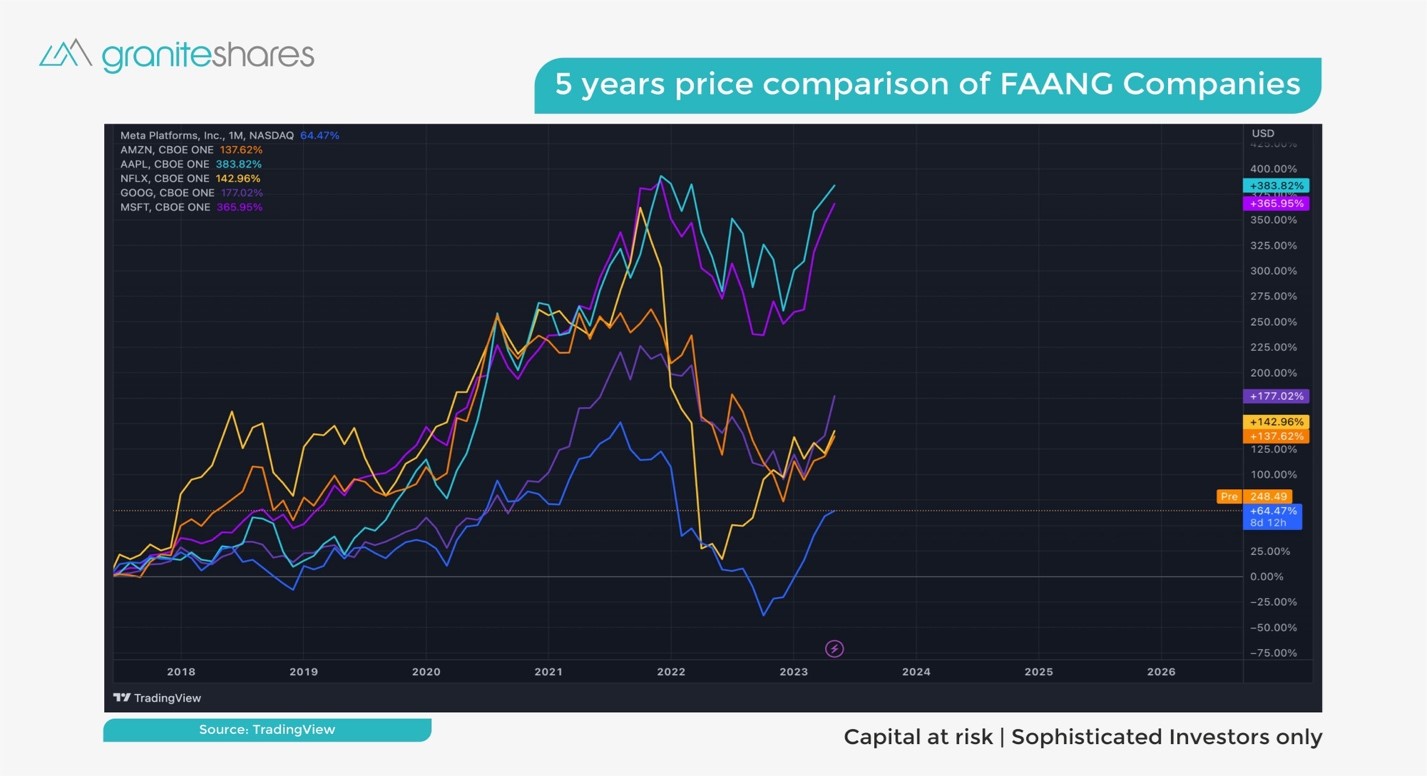

Five Years Return Analysis of FAANG Stocks:

How to Invest in FAANG Stocks?

ETPs and ETFs offer diversification and exposure to FAANG rather than investing individually in each FAANG stock.

The GraniteShares FAANG ETF aims to provide investors with exposure to the performance of FAANG stocks. The ETF aims to replicate the performance of the FAANG stocks.

By investing in FAANG, you can gain exposure to these popular technology and internet companies through a single investment. However, as with any investment, it is essential to conduct thorough research, consider your investment goals and risk tolerance, and evaluate the ETF's prospectus and historical performance before making any investment decisions.

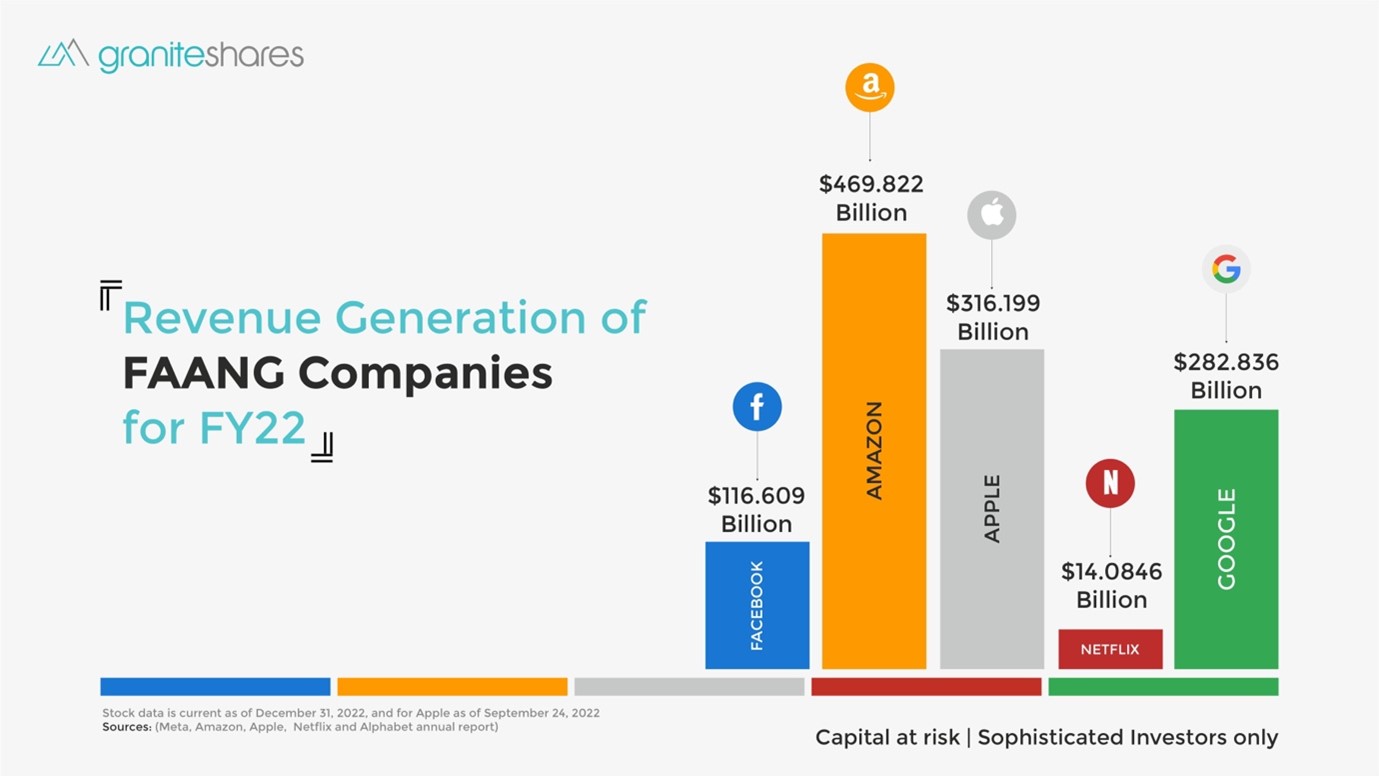

Revenue Generation of FAANG Companies for FY22

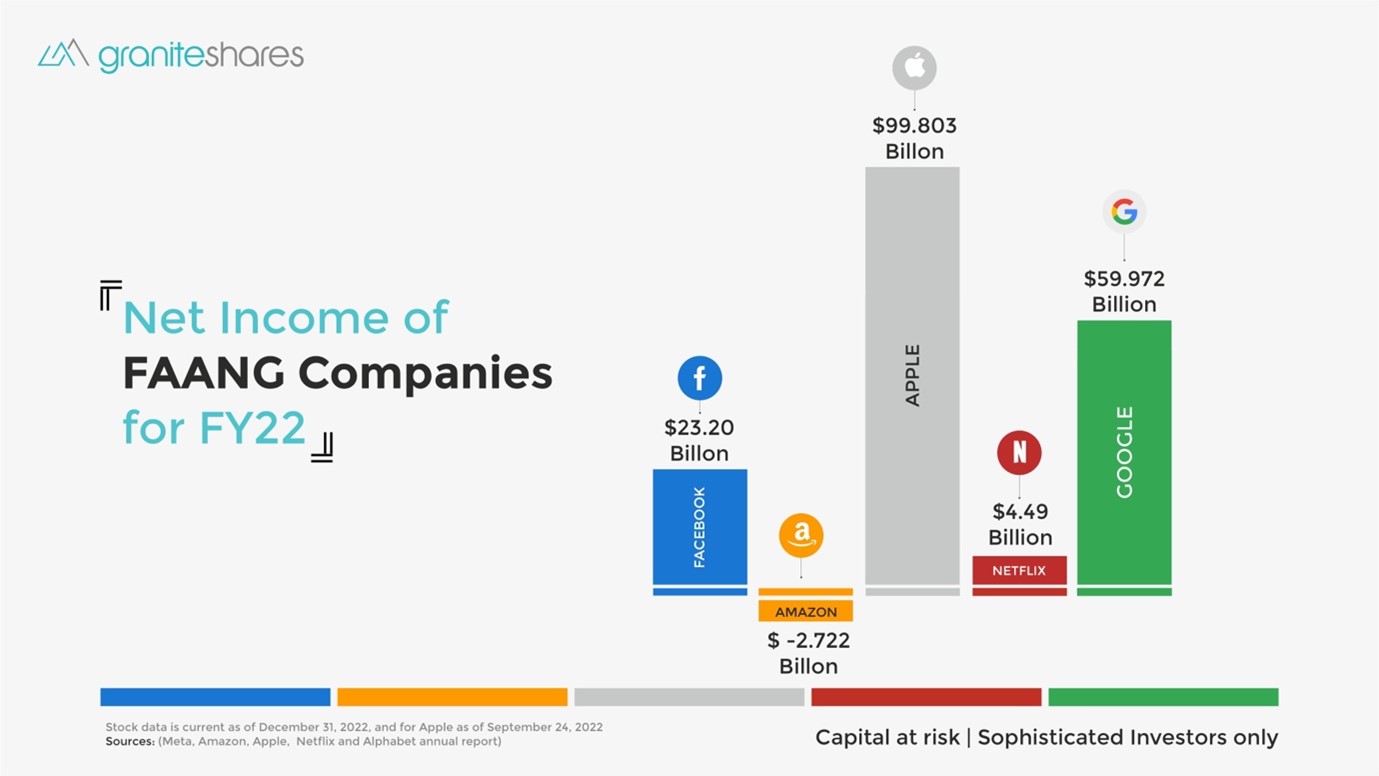

Net Income of FAANG Companies for FY22

Market Capitalization of FAANG Companies as of May 22, 2023

Why invest in GraniteShares FAANG ETP?

GraniteShares FAANG ETPs provide exposure to the FAANG stocks while reducing risk through diversification.

GraniteShares FAANG ETPs are traded like stocks on major exchanges, making them easy to buy and sell.

Since inception till May 22, 2023, Graniteshares FAANG ETPs generated a return of 11.35% year to date. Over the same time period, S&P 500 Index generated -0.96%

(Source: Graniteshares) (Source: Investing.com)

Five Years Price Comparison of FAANG Stocks:

If you would like to diversify your portfolio and invest in FAANG companies, ETFs are the most efficient way to invest due to their pure play nature and straightforward access.

| Product Name | Ticker | Leverage Factor |

|---|---|---|

Disclaimer

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents.

This does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This information contains the opinions of the author and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results.The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks and liquidity risks.Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.