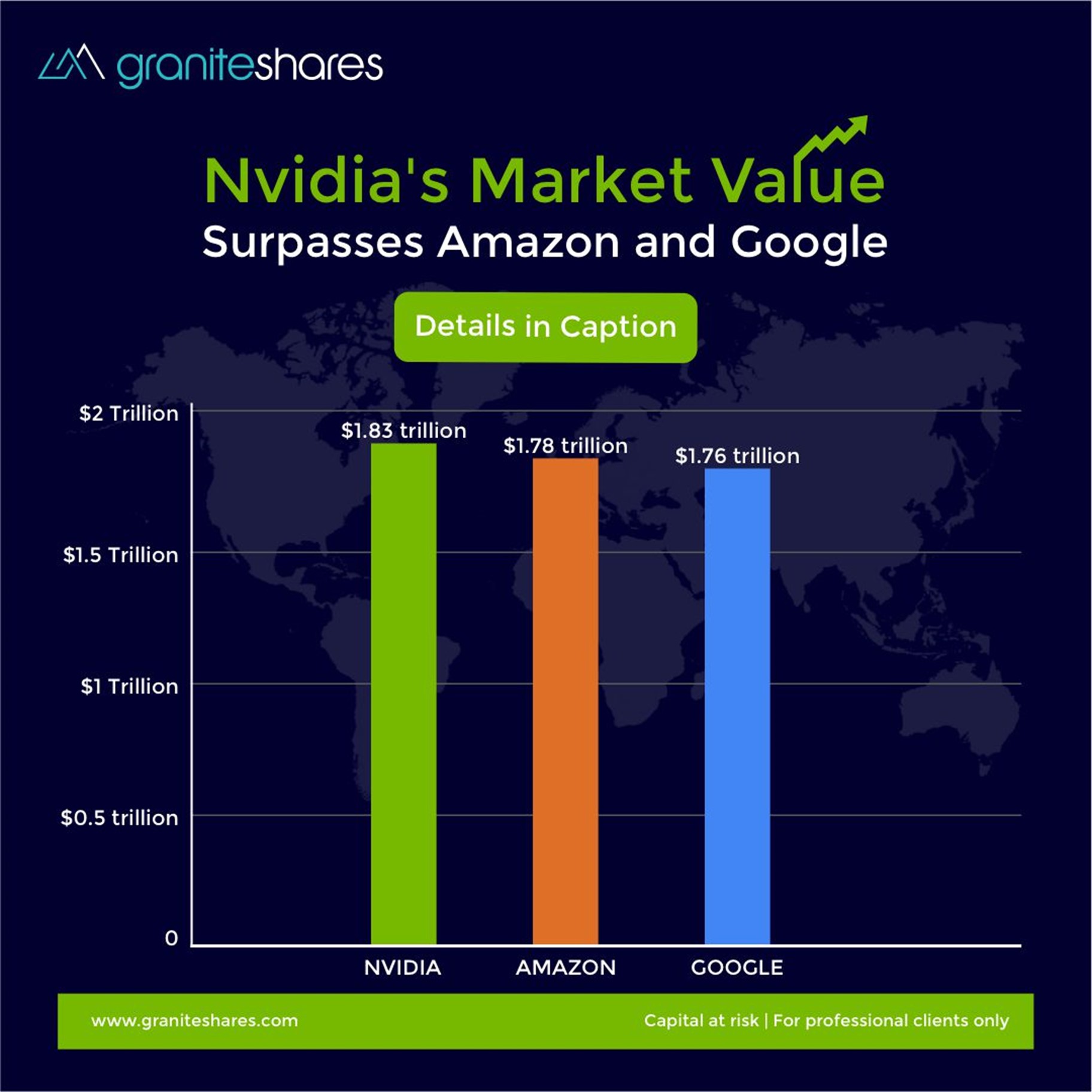

Nvidia's Market Value Surpasses Amazon and Google

Posted:

Nvidia has surpassed Alphabet in market capitalization, following closely after its recent overtaking of Amazon. Nvidia is now the fourth most valuable company in the world. According to Bloomberg, the chip manufacturer's stock now stands at $1.83 trillion in value, edging out Alphabet's market cap of $1.82 trillion. This achievement positions Nvidia as the fourth most valuable company globally amidst the AI surge, trailing behind Microsoft ($3.04T), Apple ($2.84T), and Saudi Aramco.

Currently, Nvidia is focusing on the production of the H100 chip, which serves as the primary component in the majority of Large Language Models (LLMs) in operation today, including ChatGPT developed by OpenAI, as well as numerous AI initiatives from Microsoft, Meta, and Amazon.

On 14th February, Nvidia saw a 2.5% increase in its stock, culminating in a market capitalization of approximately $1.83 trillion, which surpassed the value of Google by about $10 billion, according to data compiled by Bloomberg. This marks the first instance since 2002 that Nvidia has maintained a higher valuation after the market's closing bell. This ascent has propelled the chipmaker to the position of the fourth-most valuable company globally. Saudi Aramco, with a valuation of roughly $2 trillion, stands as the next significant milestone on the horizon. Further, Apple with $2.9 trillion, and Microsoft with a market capitalization of $3.1 trillion.

In 2002, Nvidia primarily focused on producing graphics cards for gaming PCs. However, in the last 12 months, Nvidia's stock has surged by over 246%, driven by significant demand for its server AI chips, which can command prices exceeding $20,000 each. Major companies like Microsoft, OpenAI, and Meta require tens of thousands of these chips to power products such as ChatGPT and Copilot.

Meanwhile, Amazon continues to demonstrate resilience and growth. Despite facing significant challenges, including laying off 27,000 employees, the company reported better-than-expected quarterly earnings on February 1. As a result, Amazon's shares have climbed approximately 78% over the past year. This ongoing trend underscores the dynamic nature of the world's most valuable companies, as they continuously adapt and evolve in response to market forces.

In January, Microsoft achieved a significant milestone by surpassing Apple to become the most valuable U.S. company by market capitalization. This achievement was primarily attributed to the strength of its cloud partnership with OpenAI and the integration of new AI features in Windows and Office.

Looking ahead, Nvidia is set to report its quarterly earnings on February 21 for the fiscal quarter ending December 2023. Analysts are anticipating that the company will announce its third consecutive quarter of record-breaking sales and profits. This expectation underscores the continued strong performance and growth trajectory of Nvidia in the market. (Source: CNBC)

Visit Us: https://graniteshares.com/institutional/uk/en-uk/

Capital at Risk | For Sophisticated investors only

NVIDIA ETPs by GraniteShares

| Product name | Ticker | ||

|---|---|---|---|

| USD | EUR | GBX | |

DISCLAIMER

Please note that GraniteShares' short and leveraged Exchange Traded Products are suitable only for sophisticated investors.

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks and liquidity risks. Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.