UK CPI Inflation Soars to 4.0% in December

Posted:

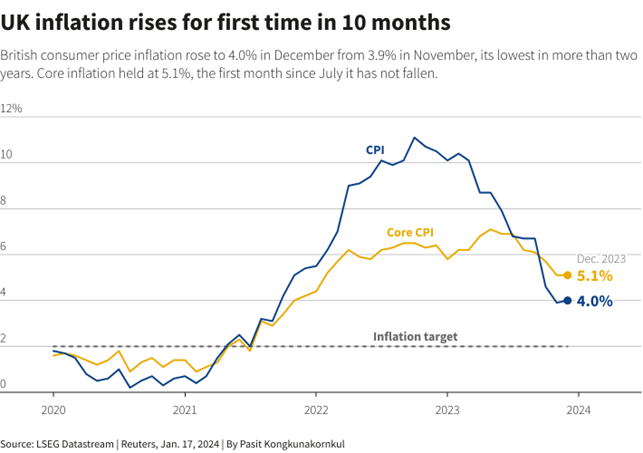

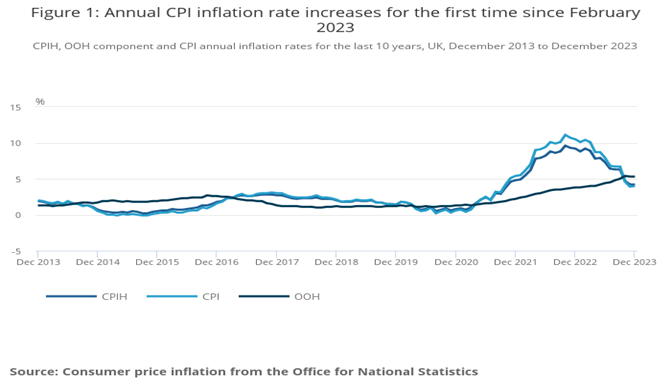

In December 2023, the United Kingdom's annual Consumer Price Index (CPI) accelerated for the first time in 10 months, reaching 4.0%, marking an increase from the 3.9% rise observed in November, according to data released by the Office for National Statistics (ONS) on January 17, 2024.

The Office for National Statistics in Britain attributed the December increase in inflation to the implementation of a tobacco duty hike in late November, resulting in the sharpest rise in tobacco prices since 1992 and contributing nearly 0.1% points to the CPI. (Source: ONS)

CPIH - Consumer Prices Index including owner occupiers’ housing.

CPI - Consumer Price Index

OOH - Owner Occupiers' Housing

Additionally, air travel made a significant contribution to the CPI rate. Although flight costs experienced a typical seasonal increase in December 2023 compared to the previous year, the Office for National Statistics had earlier in 2023 increased the weighting of airfares in the inflation basket, amplifying their impact on overall inflation.

Upward pressures on inflation were also observed in clothing and entertainment prices. However, these were partially offset by a decrease in the annual inflation rate for food and non-alcoholic drinks to 8.0% from 9.2%, marking its lowest point since April 2022.

Moreover, this news further heightened concerns about Britain's cost-of-living crisis, especially as the rate had touched a two-year low of 3.9 percent in November.

Additionally, the Core CPI, which excludes volatile food and energy items, increased by 5.1% year-over-year in December, maintaining the same pace observed in November. Travel and transport services made the most significant upward contribution to the core figure, according to ONS.

The annual rate for the Consumer Prices Index including owner occupiers’ housing costs (CPIH) goods decelerated from 2.0% to 1.9%, whereas the CPIH services annual rate held steady at 6.0%. (Source: ONS)

The slight acceleration is a setback for Prime Minister Rishi Sunak, who aimed to bring the CPI below five percent in October.

Responding to the data, Finance Minister Jeremy Hunt stated, "As we have seen in the United States, France, and Germany, inflation does not fall in a straight line, but our plan is working, and we should stick to it." (Source: CNBC)

The Bank of England is scheduled to convene its next monetary policy meeting on February 1, following a series of interest rate hikes over the past two years aimed at curbing rampant inflation.

Suren Thiru, Economics Director at ICAEW, remarked, "This unexpected rise in inflation is a timely reminder that the struggle against soaring inflation is not yet over, particularly given stubbornly high core and services inflation." (Source: CNBC)

While ongoing tensions in the Red Sea may contribute to the persistence of core inflation, Thiru suggested that the rate is likely to ease throughout the year. Slower wage growth and a stagnant economy are expected to exert downward pressure on demand, potentially mitigating inflationary pressures.

Data released on January 16, 2024, indicated that average weekly earnings, excluding bonuses, increased by 6.6% on an annual basis in the three months leading up to the end of November. This represents the slowest increase in almost a year, though it remains roughly double the pace that the Bank of England considers necessary for achieving sustainable inflation at 2%. Despite wages now outpacing inflation, overall living standards have experienced a period of stagnation in recent years. (Source: CNBC)

On January 17, the pound increased following the release of data revealing that Britain's annual consumer inflation rate increased in December. This development posed a challenge to the prevailing expectations of imminent rate cuts by the Bank of England. (Source: CNBC)

As a result, sterling saw a 0.1% increase against the U.S. dollar, reaching $1.2650. Prior to the data release, it had been down 0.19%. (Source: Reuters)

The pound also strengthened against the euro, with the euro weakening by 0.16% to 85.93 pence. (Source: Reuters)

Moreover, the Stoxx 600 index concluded with a 1.1% decline, exhibiting a broad-based negative performance across all sectors and major stock exchanges. Mining stocks were particularly impacted, leading the losses and finishing the session 2.1% lower. (Source: Reuters)

Apart from that, The FTSE 100 index in Britain declined by 1.5% following an unexpected uptick in UK inflation to 4% YoY in December. (Source: Reuters)

GraniteShares

GraniteShares