Vodafone Group Plc

Vodaphone, Leading European Telecommunication Company

Presentation of the Company

Vodafone Group Plc (LON: VOD) is a British leading telecommunications company in Europe and Africa, the largest mobile and fixed network operator in Europe. They operate mobile and fixed networks in 21 countries and partner with mobile networks in 48 more. As of 31 December 2020, they had over 300m mobile customer. Vodafone has a primary listing on the London Stock Exchange and is a constituent of the FTSE 100 Index. The company has a secondary listing on Nasdaq.

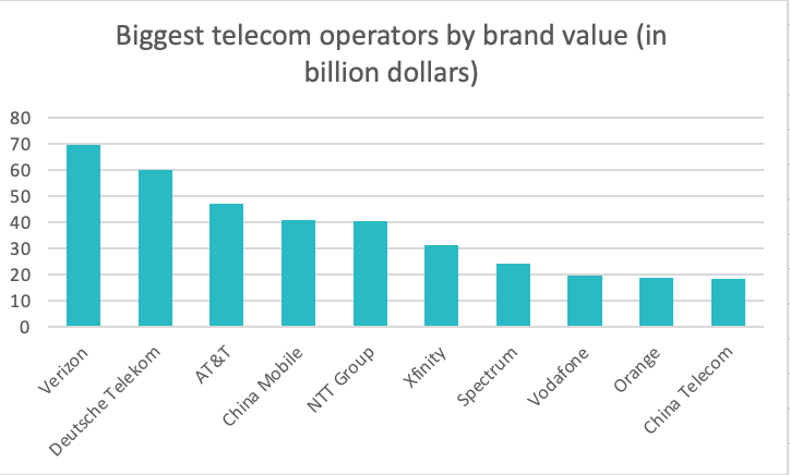

Vodafone's top competitors include Liberty Global, Orange, Telefonica, Nippon Telegraph and Telephone, AT&T, Deutsche Telekom and BT.

Source : macrotrends.com

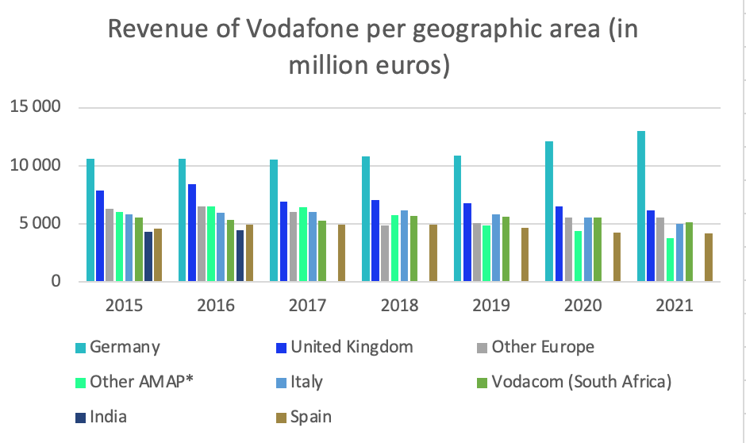

Source : statista.com

History of Vodafone

Vodafone (LON: VOD) was established in 1984 as a subsidiary of Racal Electronics under the name Racal Telecom. Racal Telecom became an independent company in September 1991 and was renamed Vodafone Group.

Following a period of worldwide expansion through acquisitions and partnerships which began in 1999, in the 2010s Vodafone entered a period of retrenchment and simplification of its operations.

Source : macrotrends.com

Source : statista.com

The Market

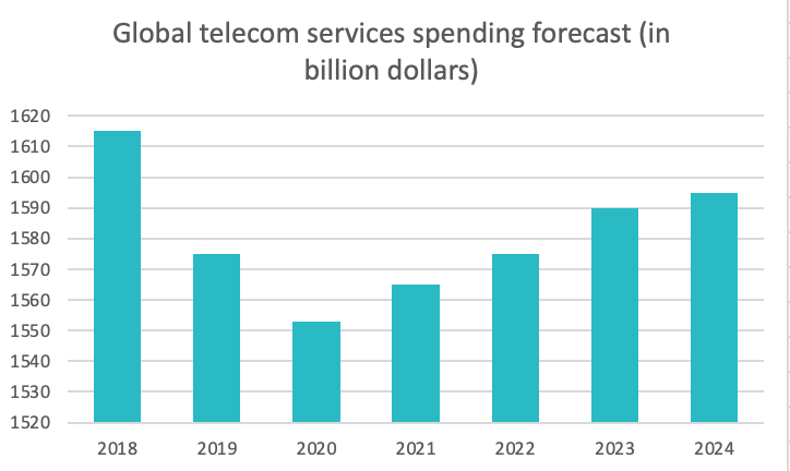

Vodafone (LON: VOD) is a telecommunications company. It is a very old sector but it only really developed towards the end of the 1900s with the appearance of many new technologies. The market greatly expanded as of today, as it was worth more than 2500 billion in 2021. It is an essential market for today’s world where communication is a an essential vector for growth and innovation. In 2020, Asia Pacific was the largest region in the global telecom market, North America was the and Africa was the smallest, But in the long term, with the growing demand in the developing countries, the demand tends to equalize more and more.

Logically, telecommunications is a sector where demand should never stop, and analysts forecast a CAGR of 6% until 2025.

Source : statista.com

Source : statista.com

Key Figures and Financial Ratios

Market capitalization: $44.3 billion1[2022]

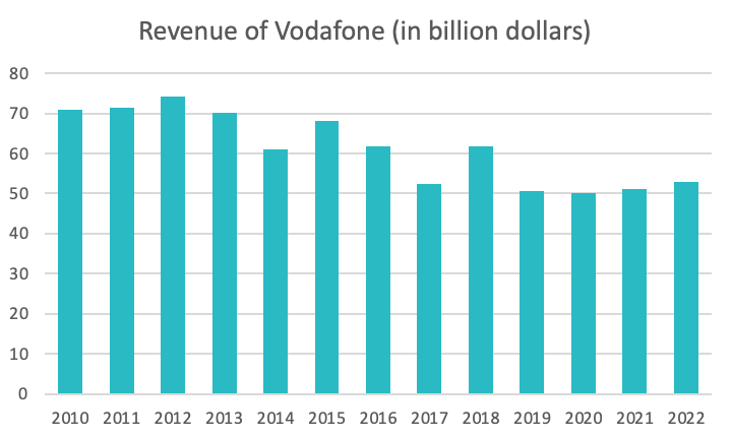

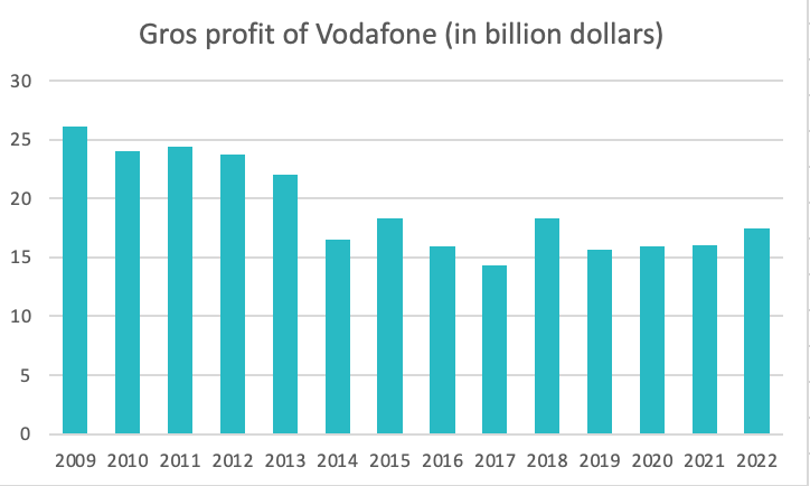

Revenue: $52.987 billion2[2022]

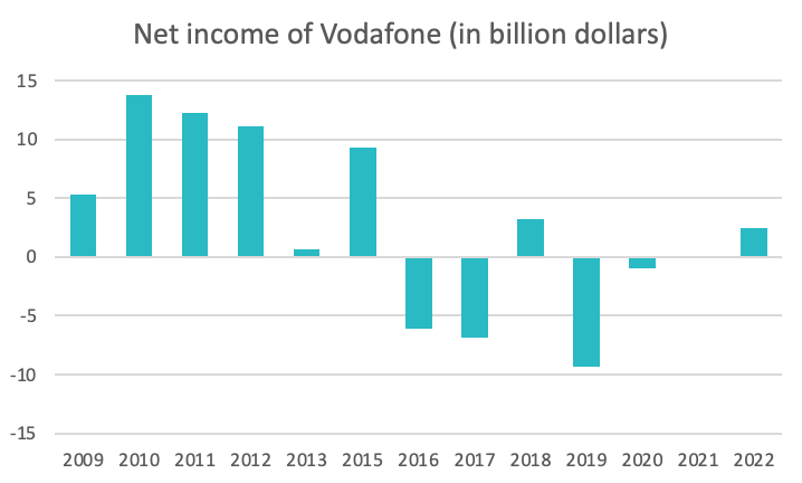

Net income: $2.427 billion 3[2022]

Dividends paid: Twice a year, for more than 20 years 4

Earnings per share: $0.84 5[2022]

Price to earnings ratio: ≃20.48 6[2022]

Debt to equity ratio: 1.11 7[2022]

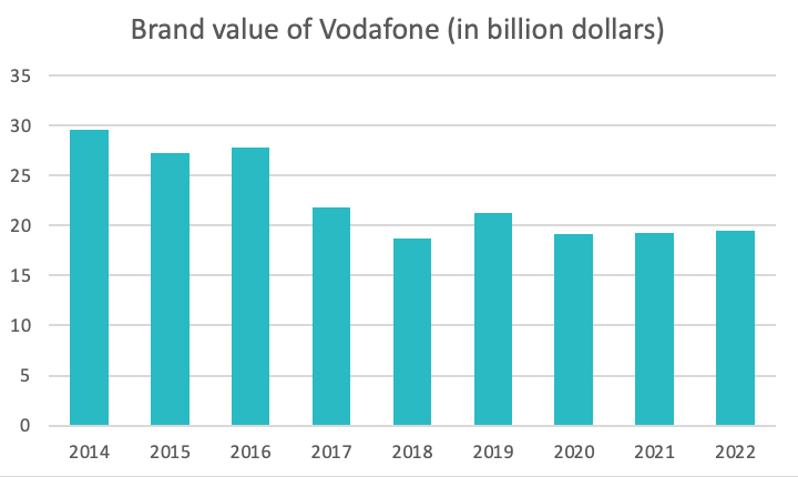

Source : macrotrends.com

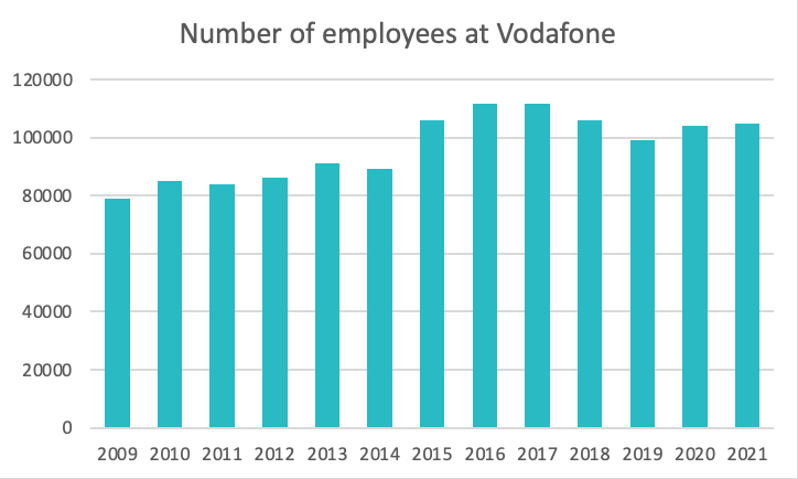

Source : macrotrends.com

Graniteshares Offering Products

VODAFONE

Sources

- Vodafone Group Market Cap 2010-2022 | VOD macrotrends

- Vodafone Group Revenue 2010-2022 | VOD macrotrends

- Vodafone Group Net Income 2010-2022 | VOD macrotrends

- Vodafone Group - 31 Year Dividend History | VOD macrotrends

- Vodafone Group EPS - Earnings per Share 2010-2022 | VOD macrotrends

- Vodafone (VOD) advfn

- Vodafone (VOD)advfn

DISCLAIMER

Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author, and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks, and liquidity risks.