3LBC

3x Leverage Barclays (BARC) ETP

3LBC Product Description

GraniteShares 3x Long Barclays Daily ETP is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x Long Barclays PLC Index that seeks to provide 3 times the daily performance of Barclays PLC shares.

For example, if Barclays PLC rises by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments. However, if Barclays PLC falls by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments.

What is Barclays PLC (BARC) ?

Barclays PLC is a global financial services provider operating in the United Kingdom, Europe, the Americas, Africa, the Middle East, and Asia. It has five key divisions: Barclays UK, Barclays UK Corporate Bank, Barclays Private Bank and Wealth Management, Barclays Investment Bank, and Barclays US Consumer Bank. Barclays UK includes personal and business banking, along with Barclaycard Consumer UK. The UK Corporate Bank provides lending, liquidity, payments, and foreign exchange solutions for corporate clients. The Private Bank and Wealth Management division offers wealth management and investment services. Barclays Investment Bank handles global markets, investment banking, and international corporate banking. The US Consumer Bank focuses on the credit card partnership market and online deposits. Originally established in 1690, Barclays is headquartered in London and has evolved into a major player in retail banking, investment banking, and wealth management.

Key Facts

3x Leverage Barclays (BARC) ETP OVERVIEW

LISTING AND CODES for 3x Leverage Barclays (BARC) ETP

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| London Stock Exchange | GBX | 3LBC | XS2708145904 | BMCLCB9 |

INDEX & PERFORMANCE of 3x Leverage Barclays (BARC) ETP

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

COLLATERAL Details of 3x Leverage Barclays (BARC) ETP

Understanding Collateral

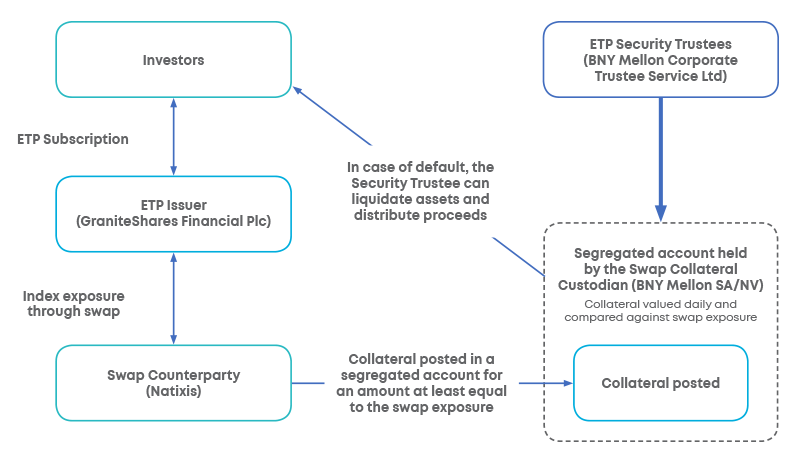

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.