3SAZ

3x Short AstraZeneca (AZN) ETP

3SAZ Product Description

GraniteShares 3x Short AstraZeneca Daily ETP is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x Short AstraZeneca PLC Index that seeks to provide -3 times the daily performance of AstraZeneca PLC shares.

For example, if AstraZeneca PLC rises by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments. However, if AstraZeneca PLC falls by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments.

What is AstraZeneca(AZN)

AstraZeneca PLC is a biopharmaceutical company focused on discovering, developing, and commercializing prescription medicines. Its key areas include oncology, rare diseases, cardiovascular, renal and metabolic conditions, respiratory and immunology, and vaccines and immune therapies. The company develops and markets a range of treatments, including Tagrisso, Imfinzi, Lynparza, Calquence, Farxiga, Ultomiris, Soliris, Breztri, and others. AstraZeneca also engages in vaccine development and T-cell receptor therapies. It operates globally, serving healthcare providers and patients across the United Kingdom, the United States, Europe, and Asia. Founded in 1992 and headquartered in Cambridge, UK, AstraZeneca was formerly known as Zeneca Group PLC before adopting its current name in 1999.

Key Facts

3x Short AstraZeneca (AZN) ETP OVERVIEW

LISTING AND CODES for 3x Short AstraZeneca (AZN) ETP

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| London Stock Exchange | GBX | 3SAZ | XS2703639117 | BQ2JKV7 |

INDEX & PERFORMANCE of 3x Short AstraZeneca (AZN) ETP

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

COLLATERAL Details of 3x Short AstraZeneca (AZN) ETP

Understanding Collateral

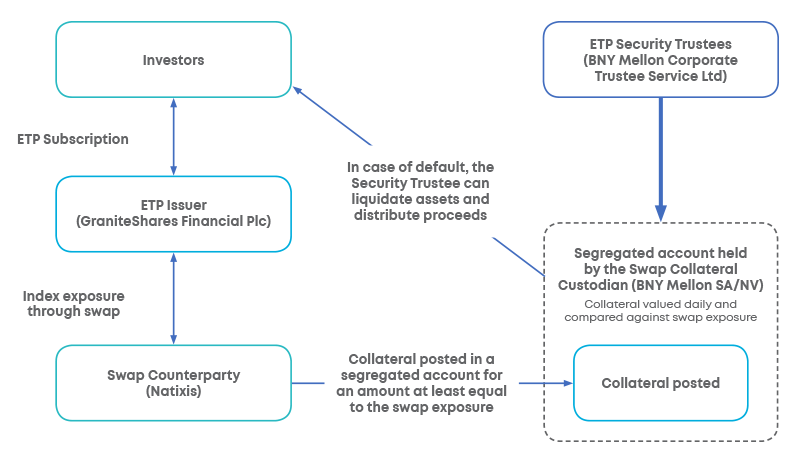

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.