3LAA

3x Leverage Alibaba (BABA) ETP

3LAA Product Description

GraniteShares 3x Long Alibaba Daily ETP is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x long Alibaba Index that seeks to provide 3 times the daily performance of Alibaba Group Holding Limited shares.

For example, if Alibaba Group Holding Limited rises by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments. However, if Alibaba Group Holding Limited falls by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments.

GraniteShares +3x Alibaba is available in EUR,GBP,USD

What is Alibaba?

Alibaba Group Holding Limited is a technology and e-commerce company that provides digital infrastructure and marketing platforms for businesses in China and internationally. It operates through multiple segments, including China Commerce, which covers retail and wholesale marketplaces such as Taobao, Tmall, and 1688.com; International Commerce, which includes Alibaba.com, AliExpress, Lazada, and Trendyol; and Local Consumer Services, which encompasses Ele.me for food delivery and Koubei for local services. The company also runs Cainiao, a logistics network; a Cloud segment offering computing, storage, and AI services; and a Digital Media and Entertainment division that includes Youku, Alibaba Pictures, and other content platforms. Additionally, it provides business and productivity tools like Amap for navigation and DingTalk for workplace communication. Founded in 1999, Alibaba is headquartered in Hangzhou, China.

Key Facts

3x Leverage Alibaba (BABA) ETP OVERVIEW

LISTING AND CODES for 3x Leverage Alibaba (BABA) ETP

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| Borsa Italiana | EUR | 3LAA | XS2842095320 | BS4DNL2 | |

| London Stock Exchange | GBP | LAA3 | XS2842095320 | BS4DNK1 | |

| London Stock Exchange | USD | 3LAA | XS2842095320 | BS4DNJ0 |

INDEX & PERFORMANCE of 3x Leverage Alibaba (BABA) ETP

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

COLLATERAL Details of 3x Leverage Alibaba (BABA) ETP

Understanding Collateral

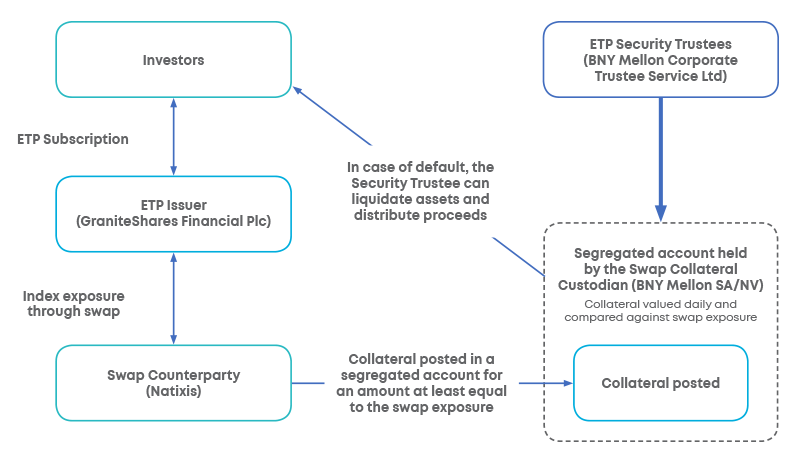

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.