3LBP

3x Leverage BP ETP

3LBP Product Description

GraniteShares 3x Long BP Daily ETP is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x Long BP PLC Index that seeks to provide 3 times the daily performance of BP p.l.c. shares.

For example, if BP p.l.c. rises by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments. However, if BP p.l.c. falls by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments.

What is BP?

BP p.l.c. is a UK-based integrated energy company engaged in oil, gas, and low-carbon energy production. It operates through four main segments: Gas & Low Carbon Energy, Oil Production & Operations, Customers & Products, and Other Businesses & Corporate. The Gas & Low Carbon Energy segment includes natural gas production, integrated gas and power, and gas trading, along with renewable energy initiatives such as solar, wind, hydrogen, and carbon capture and storage. The Oil Production & Operations segment focuses on crude oil production, including activities under bpx energy. The Customers & Products segment covers retail fuels, electric vehicle charging, Castrol lubricants, aviation, refining, bioenergy, and midstream operations. The Other Businesses & Corporate segment includes BP Ventures and Launchpad, supporting innovation and new business development. Founded in 1908, BP is headquartered in London, United Kingdom.

Key Facts

3x Leverage BP ETP OVERVIEW

LISTING AND CODES for 3x Leverage BP ETP

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| London Stock Exchange | GBX | 3LBP | XS2708145227 | BMCLC86 |

INDEX & PERFORMANCE of 3x Leverage BP ETP

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

COLLATERAL Details of 3x Leverage BP ETP

Understanding Collateral

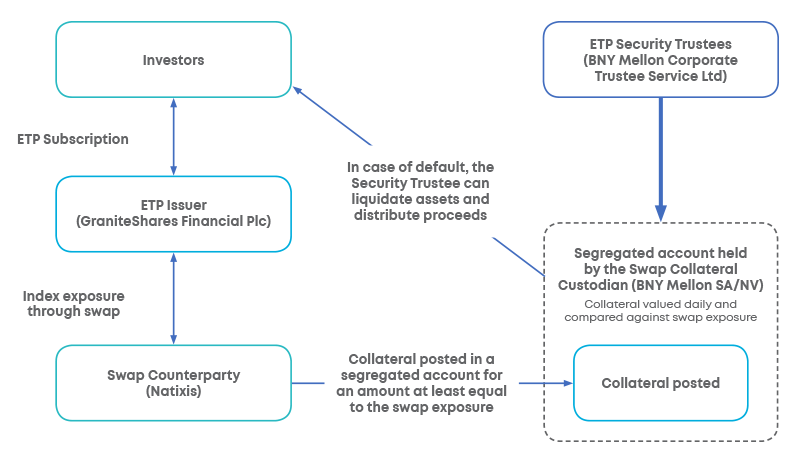

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.