3LTS

3x Leverage Tesla (TSLA) ETP

3LTE Product Description

GraniteShares 3x Long Tesla Daily ETP is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x Long Tesla Inc Index that seeks to provide 3 times the daily performance of Tesla Inc shares.

For example, if Tesla Inc rises by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments. However, if Tesla Inc falls by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments.

GraniteShares +3x Tesla is available in GBX,USD

Everything You Need to Know About GraniteShares 3x Leverage Tesla ETP

What is Tesla (TSLA)?

"Tesla, Inc. designs, develops, manufactures, and sells electric vehicles (EVs) and energy generation and storage solutions. The company operates in two segments: Automotive and Energy Generation & Storage. The Automotive segment includes the design, production, and sale of fully electric vehicles, as well as leasing options. It also generates revenue from regulatory credits, used vehicle sales, after-sales services, body shop repairs, supercharging, vehicle insurance, and retail merchandise. Tesla’s lineup includes the Model 3, Model Y, Model S, Model X, and the Cybertruck. The Energy Generation & Storage segment focuses on solar energy solutions and battery storage products. Tesla designs, manufactures, sells, and leases solar panels and battery storage systems, including the Powerwall and Megapack. This segment also offers installation services, warranties, and financing options for residential and commercial customers. Founded as Tesla Motors, Inc. in 2003, the company rebranded to Tesla, Inc. in 2017. It is headquartered in Austin, Texas, and operates in markets worldwide. As of 31st December 2024, Tesla Inc. reported a total holding of 11,509 bitcoins."

Key Facts

3x Leverage Tesla (TSLA) ETP OVERVIEW

LISTING AND CODES for 3x Leverage Tesla (TSLA) ETP

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| London Stock Exchange | USD | 3LTS | XS2656472193 | BP83K61 | |

| London Stock Exchange | EUR | 3LTE | XS2656472193 | BP83K94 | |

| London Stock Exchange | GBX | 3LTP | XS2656472193 | BP83K83 | |

| Borsa Italiana | EUR | 3LTS | XS2656472193 | BP83KJ4 |

INDEX & PERFORMANCE of 3x Leverage Tesla (TSLA) ETP

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

COLLATERAL Details of 3x Leverage Tesla (TSLA) ETP

Understanding Collateral

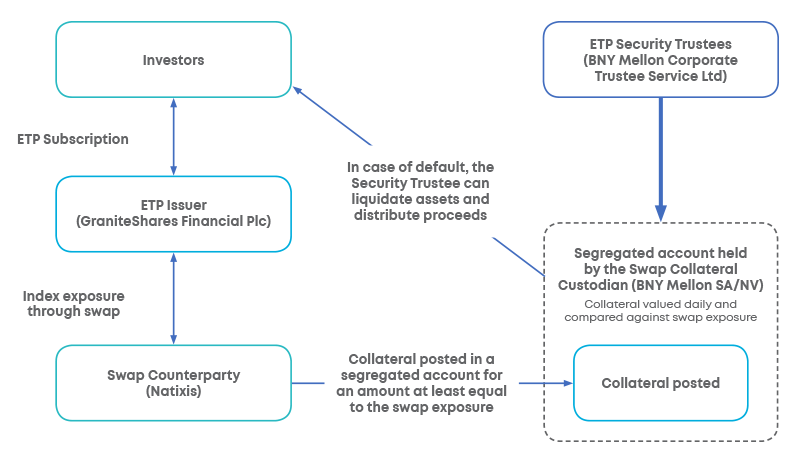

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.