3SPO

3x Short Spotify (SPOT) ETP

3SPO Product Description

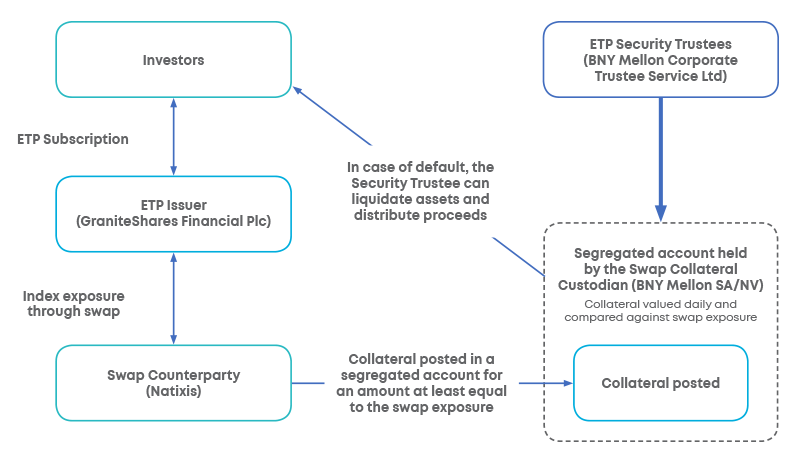

GraniteShares 3x Short Spotify Daily ETP is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x short Spotify Index that seeks to provide -3 times the daily performance of Spotify shares.

For example, if Spotify rises by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments. However, if Spotify falls by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments.

GraniteShares -3x Spotify is available in EUR,GBP,USD

What is Spotify (SPOT) ?

Spotify Technology SA is a Luxembourg-based digital music, podcast, and audiobook streaming service. Founded in 2006, Spotify is one of the largest audio streaming platforms globally, with over 675 million monthly active users and 263 million subscribers across more than 180 markets. Spotify operates primarily through two segments: Premium and Ad-Supported. The Premium segment offers unlimited online and offline streaming without ads, while the Ad-Supported segment provides on-demand access with advertisements. Users can choose from various subscription plans, including Individual, Duo, Family, and Student options. Spotify's services are available on multiple devices, including smartphones, tablets, and smart home devices. The company has expanded its offerings to include podcast hosting and audiobook distribution, further diversifying its content portfolio. Spotify generates revenue through premium subscriptions and advertising, paying royalties to rights holders based on streaming activity.

Key Facts

3x Short Spotify (SPOT) ETP OVERVIEW

LISTING AND CODES for 3x Short Spotify (SPOT) ETP

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| Borsa Italiana | EUR | 3SPO | XS2838543531 | BSMMMT2 | |

| London Stock Exchange | GBP | SPO3 | XS2838543531 | BSMMMX6 | |

| London Stock Exchange | USD | 3SPO | XS2838543531 | BSMMMW5 |

INDEX & PERFORMANCE of 3x Short Spotify (SPOT) ETP

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

COLLATERAL Details of 3x Short Spotify (SPOT) ETP

Understanding Collateral

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.