SFNG

1x Short FAANG ETP

SFNG Product Description

GraniteShares 1x Short FAANG Daily ETP is a collateralised Exchange Traded-Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 1x short FAANG Index that seeks to provide -1 times the daily performance of the Solactive FAANG Equal Weight Index.

The Solactive FAANG Equal Weight Index provides exposure to Amazon, Apple, Alphabet, Meta Platforms Inc, Netflix Inc with each component equally weighted after each quarterly rebalancing.

Key Facts

1x Short FAANG ETP OVERVIEW

LISTING AND CODES for 1x Short FAANG ETP

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| London Stock Exchange | USD | SFNG | XS2679090162 | BNT9V50 | |

| London Stock Exchange | EUR | SFNE | XS2679090162 | BNT9V72 | |

| London Stock Exchange | GBX | SFNP | XS2679090162 | BNT9V61 | |

| Borsa Italiana | EUR | SFNG | XS2679090162 | BNT9VB6 | |

| Deutsche Börse Xetra | EUR | FNNS | XS2679090162 | BNT9V94 | A3G796 |

PORTFOLIO of 1x Short FAANG ETP

Top Fund Exposures

| Alphabet | 20% |

| Amazon | 20% |

| Apple | 20% |

| Meta Platforms Inc | 20% |

| Netflix Inc | 20% |

Fund exposures are subject to change

INDEX & PERFORMANCE of 1x Short FAANG ETP

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

COLLATERAL Details of 1x Short FAANG ETP

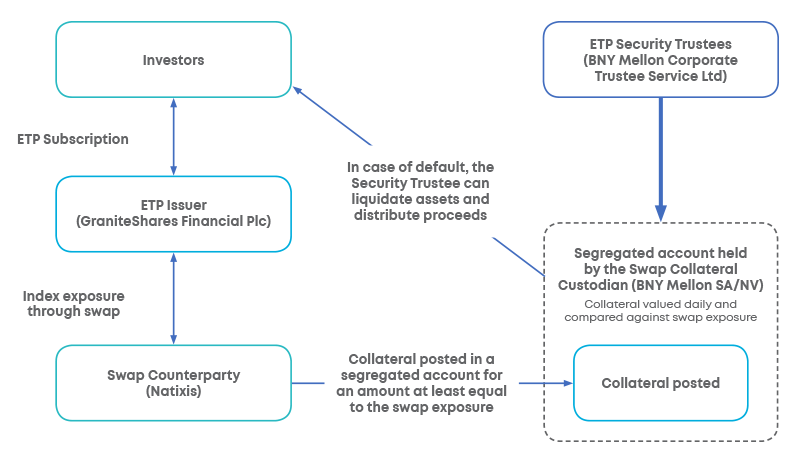

Understanding Collateral

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.