3SPA

3x Short Palantir Securities (PLTR) ETP

3SPA Product Description

GraniteShares 3x Short Palantir Daily ETP Securities is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x short Palantir Index that seeks to provide -3 times the daily performance of Palantir shares.

For example, if Palantir rises by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments. However, if Palantir falls by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments.

GraniteShares -3x Palantir Securities is available in GBP,USD

What is Palantir (PLTR) ?

Palantir Technologies Inc. is a software company specializing in big data analytics platforms. Headquartered in Denver, Colorado, Palantir was founded in 2003 and is known for its work with defense agencies and intelligence communities. The company's primary software platforms include Palantir Gotham, Palantir Foundry, Palantir Apollo, and Palantir Artificial Intelligence Platform (AIP). Palantir Gotham is a flagship product used by defense and intelligence agencies to integrate, analyze, and visualize large datasets, facilitating mission-critical applications such as threat identification and predictive analytics. Palantir Foundry serves as a central operating system for data across organizations, enabling users to integrate and analyze data in a unified environment. Palantir Apollo is a cloud-agnostic platform that manages the continuous delivery of software updates and configurations, ensuring seamless operation of critical systems. Palantir AIP integrates large language models into secure environments, providing AI-driven insights and tools for various applications. Palantir's software is used by both government agencies and private companies, supporting decision-making through real-time intelligence and data analysis. The company has seen significant growth, driven by its AI capabilities and expanding commercial market presence.

Key Facts

3x Short Palantir Securities (PLTR) ETP OVERVIEW

LISTING AND CODES for 3x Short Palantir Securities (PLTR) ETP

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| Borsa Italiana | EUR | 3SPA | XS3069876582 | BQGD0P9 | |

| London Stock Exchange | GBP | SPL3 | XS3069876582 | BQ82BG2 | |

| London Stock Exchange | USD | 3SPA | XS3069876582 | BQ82BB7 |

INDEX & PERFORMANCE of 3x Short Palantir Securities (PLTR) ETP

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

COLLATERAL Details of 3x Short Palantir Securities (PLTR) ETP

Understanding Collateral

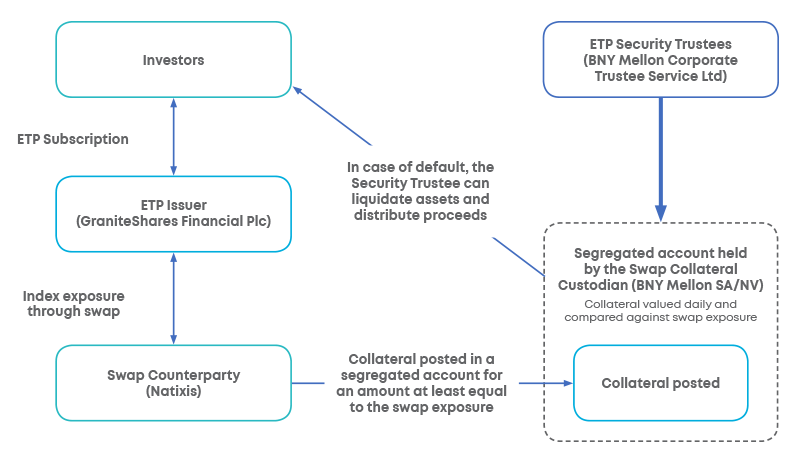

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.