Microsoft

Everything you need to know about the Microsoft Company

Microsoft Company, History and Background

Microsoft Corporation is an American-based multinational technology giant that produces computer software, personal computers, consumer electronics, and related services headquartered at the Microsoft Redmond campus located in Redmond, Washington, United States.

The company also publishes books and multimedia titles, manufactures its own line of hybrid tablet computers, provides e-mail services, as well as sells electronic game systems and computer peripherals.

The company’s most known products are the Windows line of operating systems, Internet explorer, Microsoft Office Suite, and Edge web browsers. The company’s flagship hardware products include the Xbox video game consoles as well as the Surface line-up of touch screen personal computers series.

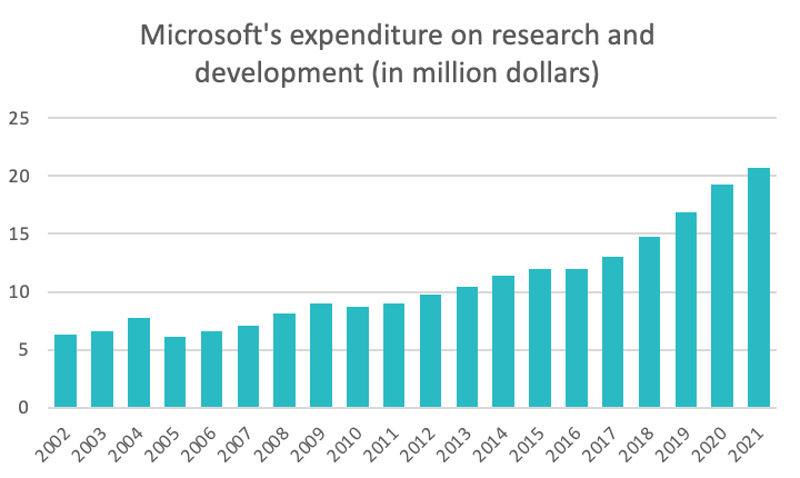

Furthermore, the company partnered with around 17 American intelligent agencies to develop cloud-based computing products. Microsoft Azure Service Platform was the entry of the company into the cloud computing market launched on October 27, 2008. In 2016, Microsoft announced a project named Microsoft Windows Azure Information Protection with an aim to help enterprises protect their data as it moves between servers and devices.

Contrary to past years, Microsoft is more focused on deepening the specific needs of each industry and supporting customers to work more closely on the needs of each industry and on new features that can be implemented.

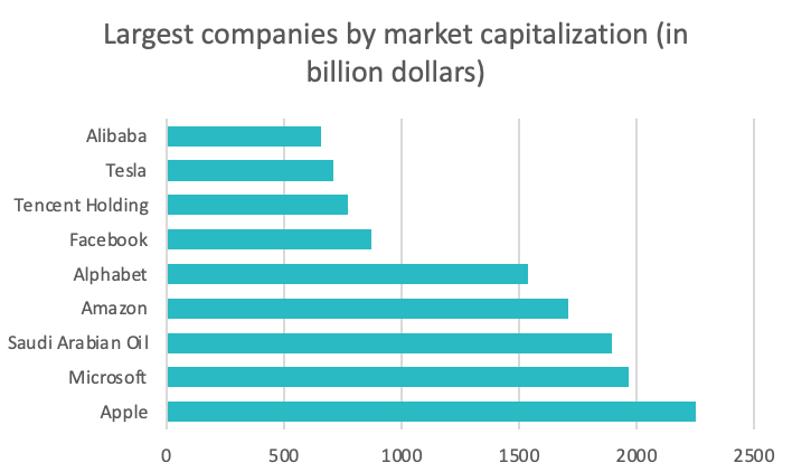

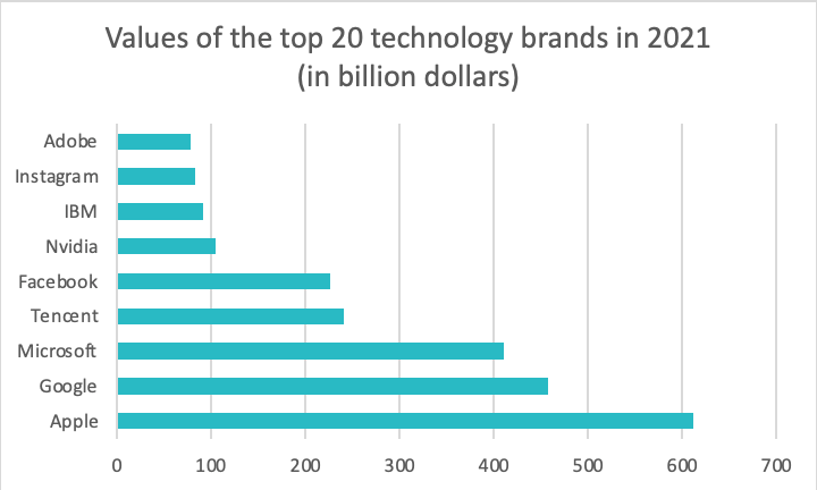

Microsoft's main competitors are Apple, IBM, Oracle, and Intel.

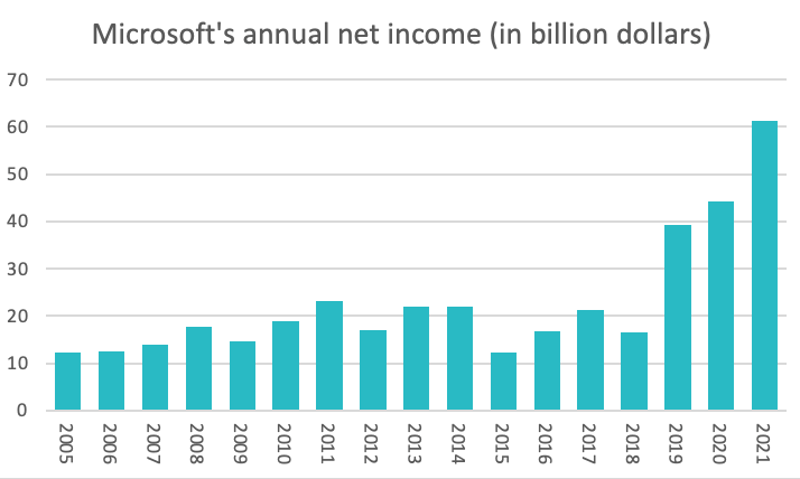

Source : statista.com

Source : statista.com

Evolution of Microsoft and its Business Model

Microsoft was founded on April 4, 1975, in the United States by Bill Gates and Paul Allen. The first goal of the company was to develop and sell computer programs, then it became one of the subcontractors of IBM. In December 1978, the company exceeded one million in sales. In the mid-1980s, Microsoft broke away from IBM by dominating the personal computer operating system market with MS-DOS.

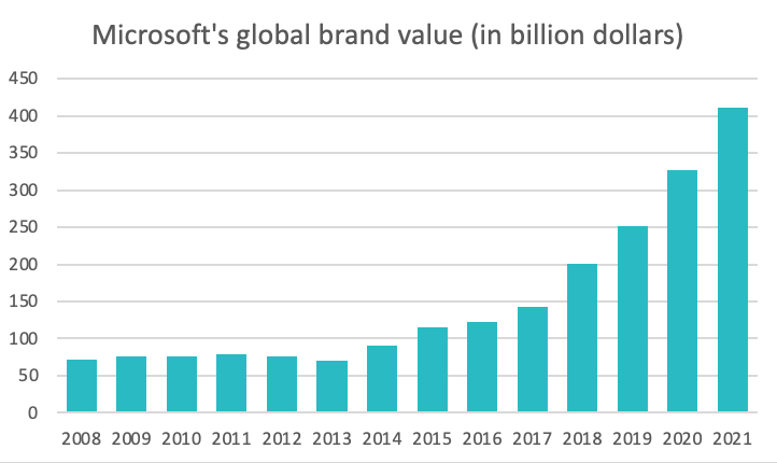

In 1986, the company was listed on the stock exchange at a $21 per share.

During the period 1993-2001, along with some marketing moves, Windows, previously a simple graphical environment for MS-DOS, became a full-fledged operating system. Windows quickly became Microsoft's biggest success, and a company's flagship product, generating a lot of profits. This was Folt's strategy lowed by the launch of the Xbox in 2001, the acquisition of Skype in 2011, and the acquisition of LinkedIn in 2016.

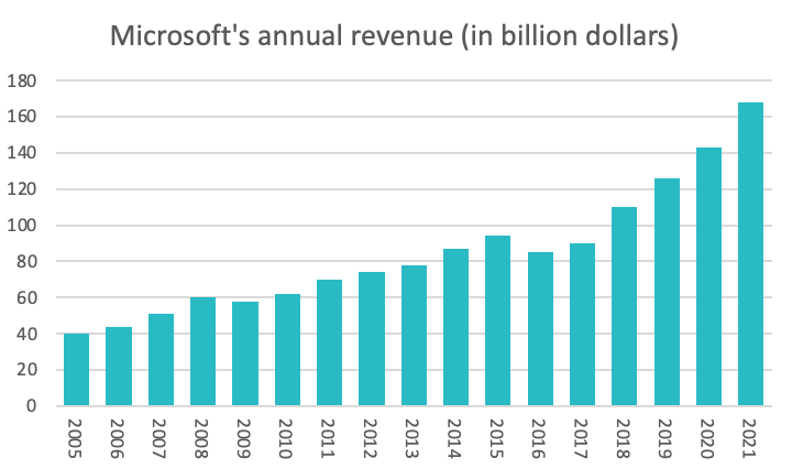

Source : macrotrends.com

Source : statista.com

Who is the CEO and Co-founder of Microsoft?

Bill Gates, born in 1955 in the United States, is a computer scientist, entrepreneur, and billionaire known worldwide as the co-founder of Microsoft. In 1973, he entered Harvard as a first-year student but did not go further than that. With his colleague Paul Allen, he started to develop the first computer language compatible with the Altair 8800 microcomputer. They then created Microsoft to market their software.

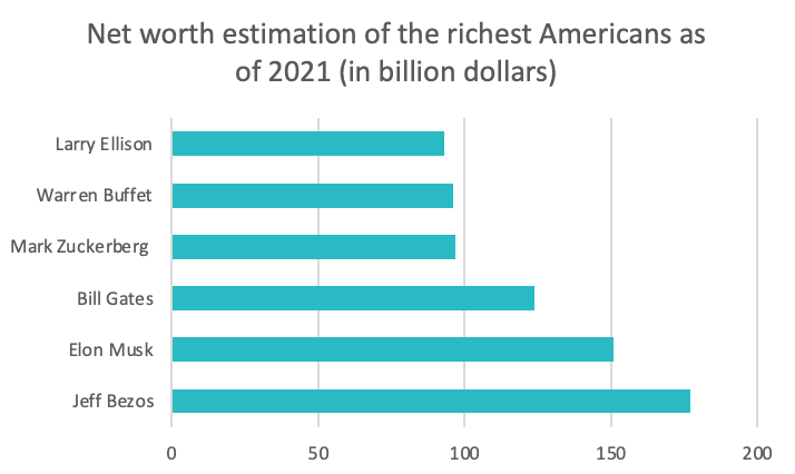

The company received g and Bill Gates became a billionaire when Microsoft went public in 1986. In 1996, he became the richest man in the world. Today, he is in fifth place in this ranking. (Source: business today)

In the eyes of many, Bill Gates is considered one of the pioneers of opening the computer world to the general public. Very few companies have an image as closely linked to their founder as Microsoft.

Source : statista.com

Source : statista.com

The market

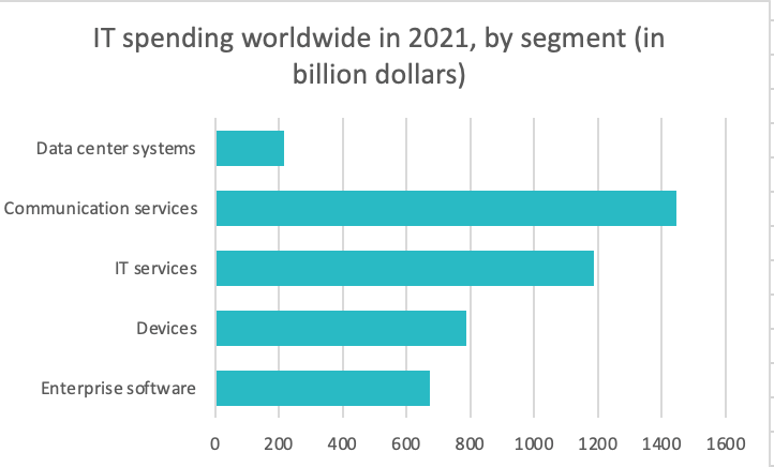

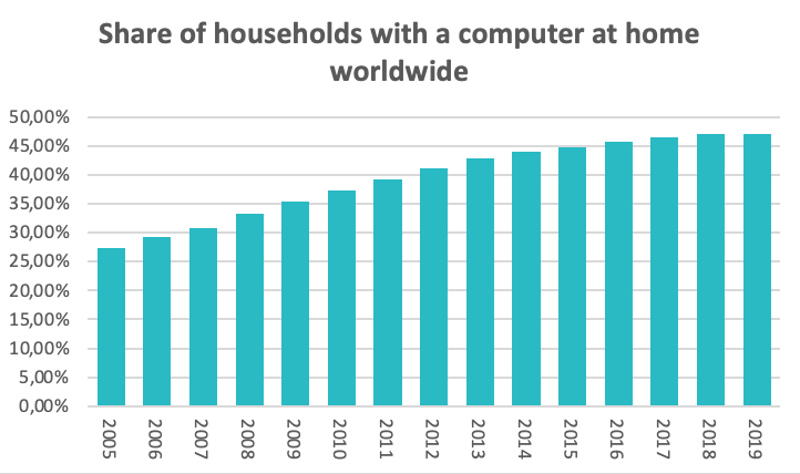

Microsoft Corporation is an American multinational technology company that develops, manufactures, licenses support, and sells computer software, consumer electronics, personal computers, and services. The computer business has experienced an explosion of opportunities created by the democratization of the Internet and computer tools in the late twentieth century. Today, although many new companies are created each year in this sector, some have dominated the market for a long time.

The more time passes, the more customers there are in this market. To stand out and remain competitive, companies must innovate and always offer higher and higher performances. It is a very dynamic sector, in constant development, and the actors in this market must take this into account.

Source : statista.com

Source : statista.com

Key figures and financial ratios

Market capitalisation : $2.049 trillion 1(August 3, 2022)

Revenue : $184.903 billions 2(2021)

Net income: $71.185 billions 3( 2021)

Dividends paid: Continuously since 2015, 4 times a year

Earnings per share: $9.344(2021)

Price to earnings ratio : ≃27.26 5(May 13, 2022)

Debt to equity ratio : 0.30 6(2022)

Source : statista.com

Source : statista.com

Graniteshares Offering Products

MICROSOFT

GAFAM

GraniteShares GAFAM ETPs provide exposure to the equal weight to following companies: Alphabet, Amazon, Facebook, Apple and Microsoft

Sources

- Market Cap: Companies Market Cap

- Microsoftreports index

- Microsoft Investor reports

- 2021 Annual Report

- Macrotrends

- Macrotrends

DISCLAIMER

Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author, and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks, and liquidity risks.