3LMS

3x Leverage Microsoft (MSFT) ETP

3LMS Product Description

GraniteShares 3x Long Microsoft Daily ETP is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x Long Microsoft Corp Index that seeks to provide 3 times the daily performance of Microsoft shares.

For example, if Microsoft rises by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments. However, if Microsoft falls by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments.

GraniteShares +3x Microsoft is available in GBX,USD

What is Microsoft(MSFT)?

Microsoft Corporation is a global technology company that develops and supports software, services, devices, and solutions. It operates through three key segments: Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. The Productivity and Business Processes segment includes Office Commercial and Consumer products, Microsoft 365, LinkedIn, and Dynamics 365, which provides cloud-based ERP and CRM solutions. This segment focuses on productivity, communication, and business applications. The Intelligent Cloud segment covers Azure cloud services, SQL Server, Windows Server, Visual Studio, System Center, and related enterprise solutions. It also includes GitHub, Nuance AI solutions, and enterprise support services. The More Personal Computing segment consists of Windows OS, Surface devices, HoloLens, PC accessories, and gaming (including Xbox consoles, Game Pass, and cloud gaming). It also includes search and news advertising, covering Bing, Microsoft News, and Edge. Founded in 1975, Microsoft is headquartered in Redmond, Washington, and distributes its products through OEMs, resellers, digital marketplaces, and retail stores worldwide.Key Facts

3x Leverage Microsoft (MSFT) ETP OVERVIEW

LISTING AND CODES for 3x Leverage Microsoft (MSFT) ETP

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| London Stock Exchange | USD | 3LMS | XS2662640627 | BNYJ898 | |

| London Stock Exchange | EUR | 3LME | XS2662640627 | BNYJ8C1 | |

| London Stock Exchange | GBX | 3LMP | XS2662640627 | BNYJ8B0 | |

| Borsa Italiana | EUR | 3LMS | XS2675292309 | BMZ8DV4 |

INDEX & PERFORMANCE of 3x Leverage Microsoft (MSFT) ETP

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

COLLATERAL Details of 3x Leverage Microsoft (MSFT) ETP

Understanding Collateral

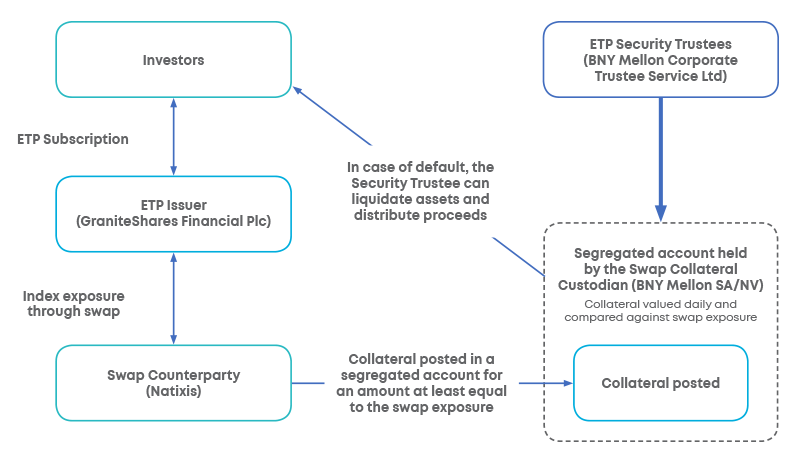

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.