Rolls Royce: is it worth investing in now?

Posted:Rolls Royce: is it worth investing in now?

The Rolls Royce Holding Plc (LON: RR) brand has always been synonymous with precision engineering and high-quality machinery for around a century. The company designs, manufactures, builds, and services integrated power systems that are used on water land or air. However, recently the stock took severe beatings due to various external factors affecting the economy as well as the company’s stock price and financials.

Rolls-Royce is a British multinational company specializing in the defense and aerospace industry. The company was established a century ago in 1904 as a car manufacturer by Mr. Charles Rolls and Mr. Henry Rolls. They started as car manufacturers during World War I and soon became renowned for their quality. Later, the company graduated to manufacturing aero engines.

The company manufactured RB211 jet engines during the 1960s and 70s. This was one of the most successful aero engines created and this engine forms the foundation of the current series of Trent engines.

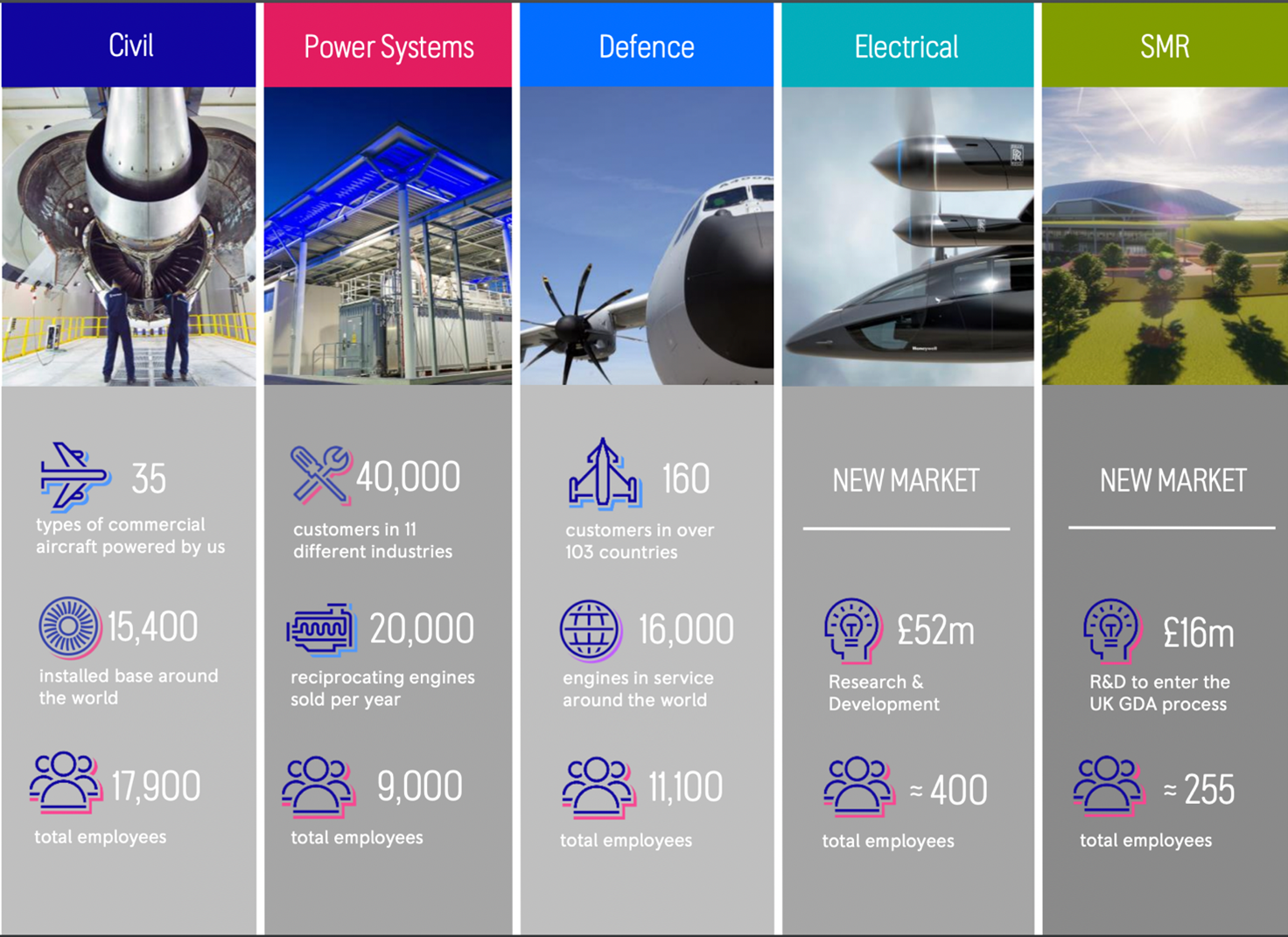

Business Segment:

The company operates under five business segments namely civil aerospace, power system, and defense. The civil aerospace segment manufactures and builds engines powering wide-body craft, regional, and business jets. Two decades ago, the company pioneered full-service flight hour contracts with the Total Care package. The power system segment of the business provides power solutions to various end markets including defense, agriculture, power generation, and marine. The defense segment offers military, ground vehicle, and naval Propulsion. Rolls-Royce recently expanded its horizon by entering the Electrical and SMR segment. Rolls-Royce Electrical is a complete power and propulsion system for all electrical and hybrid electric applications. The portfolio of the company for this segment stretches from electric motors to power electronics, control systems, and battery systems to power generation. The company’s Small Modular Division (SMR) is a 470mw and 50Hz nuclear power station that is designed to help decarbonize power generation globally.

Business Segment Snapshot:

Source: Rolls-Royce June 2022 Investor presentation

Growth opportunities:

Over the last 10 years, the company has been investing in new jet engines for example Trent 1000 and CWB range engines. These engines are used to power widebody aircraft like Airbus A350.

The company has mentioned that they have engines that power 58% of the relevant aircraft in services. The company has just one major competitor.

Likewise, the company’s Pearl engines, used on business jets, have an 88% share of the long-range sector of this market.

The young engines have 70% to 90% of their estimated flying life going forward. The company mentioned that they are well-positioned to outperform the wider market in this sector, due to their big market share.

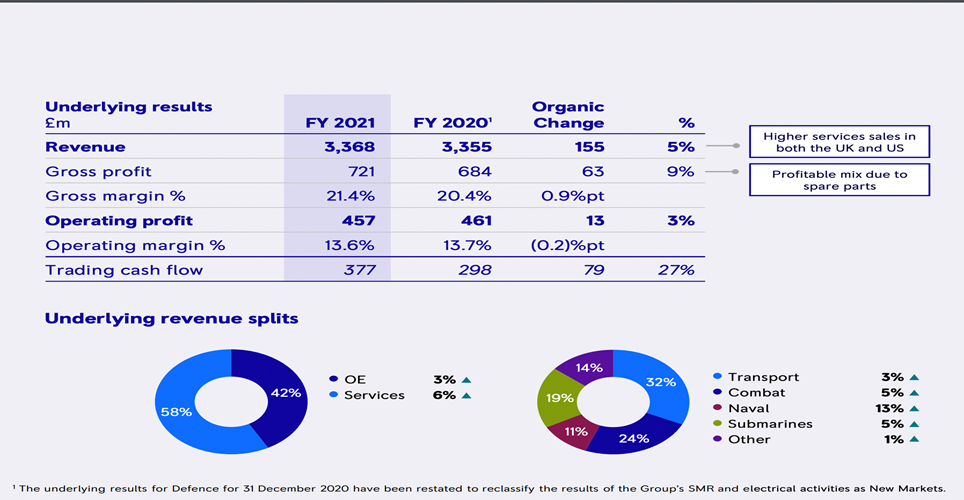

Defense Segment Returns:

Rolls Royce has a sizeable defense business along with civil aerospace operations. The company’s defence segment generated revenue of 3,368 pounds and 457 million pounds in operating profit in FY21.

Also due to the concerns related to the Rusia-Ukraine war, the government has increased its spending on the defence sector. Apart from that, the company is planning to increase its investment in this sector.

Source: Rolls-Royce June 2022 Investor presentation

Current Concerns:

The company had been hit hard by the pandemic since a substantial portion of its revenue had been tied to the number of hours its engines are flown by its airline customers.

In the company’s civil aerospace segment, the flying hours in their large engine long-term service agreement increased by 42% YoY, with passenger demand recovering since various places the Covid restrictions have eased.

In the Defence segment of the business, it is said that the products were delivered and maintained for over a decade. This means that the products are not exposed to any individual geopolitical events. However, the increased government spending as mentioned above has underpinned the long-term outlook for the growth of the company.

Outlook:

The company has continued its restructuring process, and the restructuring has seen success in every metric you could look at. Operating costs have gone down by 35% YoY, the footprint has gone down by 27% through 13 plants closed, consolidated, or sold, and investments have seen a 46% reduction across the entire organization.

The company aims to win through quality, product lifetime, and existing aviation trends going forward.

With volatility arising due to external economic factors, investors can through various investment instruments according to the risk appetite.

Rolls Royce Plc Stock Price:

Source: Rolls Royce website

@*

Keywords:

Rolls Royce plc, Rolls Royce holding plc, Rolls Royce stock, Rolls Royce stock price, rr plc.

*@

DISCLAIMER

Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents. GraniteShares Limited (“GraniteShares”) (FRN: 798443) is an appointed representative of Messels Limited which is authorized and regulated by the Financial Conduct Authority.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author, and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein are intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks, and liquidity risks. Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.