Rio Tinto plc

Rio Tinto, International mining company

Presentation of the Company

Rio Tinto (LSE: RIO) is an Anglo-Australian multinational mining group, mainly established in Australia where one of its two headquarters is located (the other one is in London) and in North America. The group is present in many countries on five continents, but its mining assets are mainly concentrated in Australia and Canada. Aluminum and iron are the activities representing the most turnover for the company with more than 65% of the turnover. Rio Tinto has also had many environmental scandals since 1888, the latest occured in 2020.

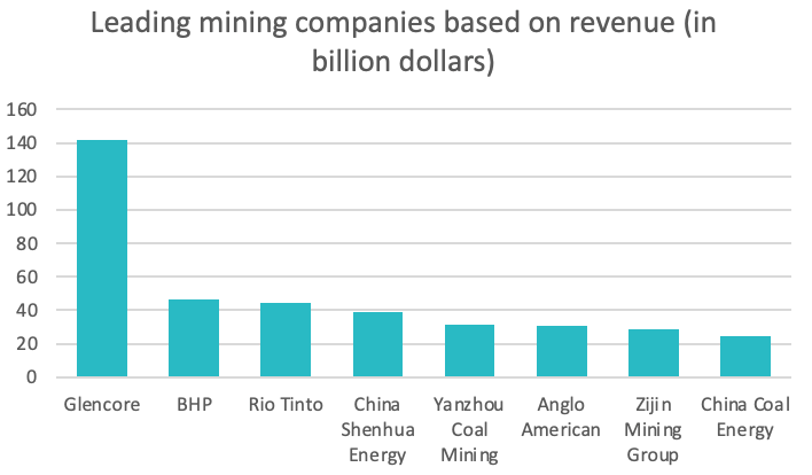

Rio Tinto (LSE: RIO) main competitors are BHP Billiton and Glencore.

Source : macrotrends.com

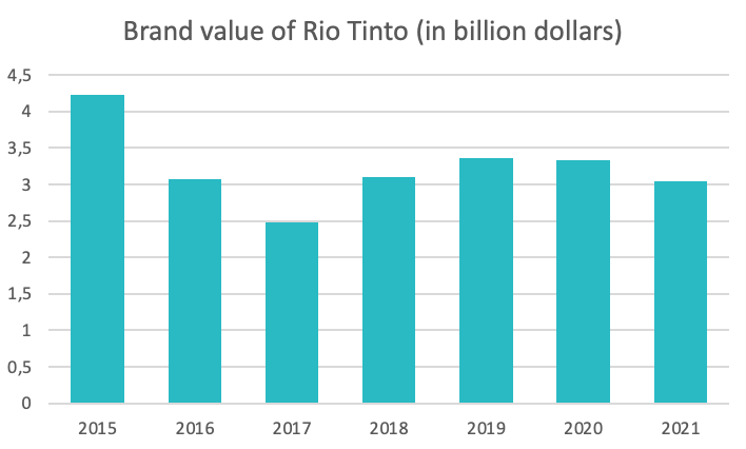

Source : statista.com

History of Rio Tinto

Rio Tinto (LSE: RIO) was founded in 1873, when a multinational consortium of investors formed to buy the Rio Tinto mine in Spain. The company grew rich through a long series of mergers and acquisitions and extended its activities until the first world war. The war had the effect of greatly slowing down Rio Tinto's activities. However, the post-war period boosted new markets, helped by the reconstruction of the world, and the company took advantage of this to diversify its activities.

Much more recently, between 2007 and 2017, numerous mergers and acquisitions have taken place for Rio Tinto, contributing to its status as a mining giant and its international development.

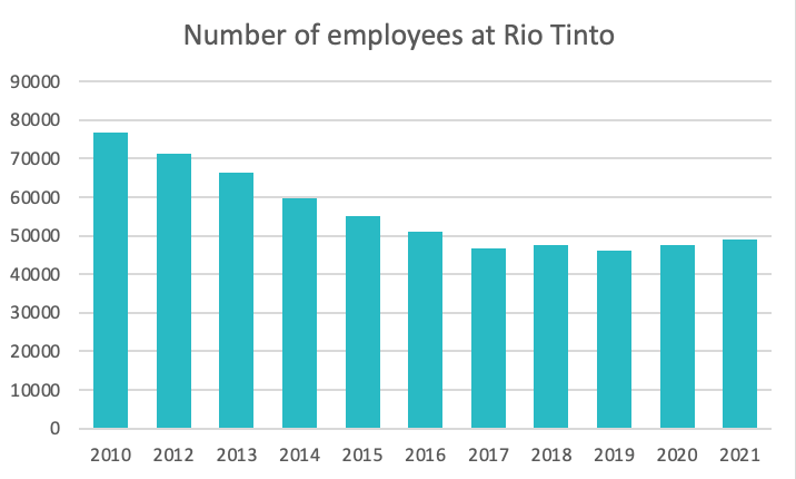

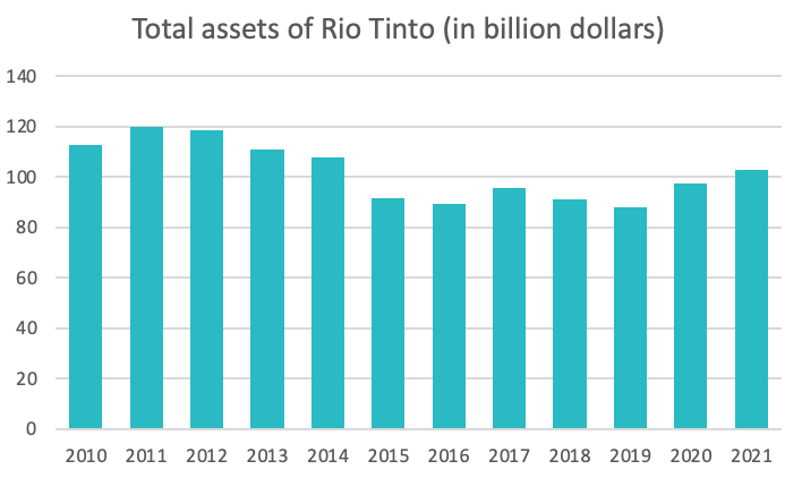

Today, Rio Tinto (LES: RIO) is seen as one of the biggest company in the mining sector, with almost 50,000 employees and more than $100 billion in assets.

Source : macrotrends.com

Source : statista.com

The Market

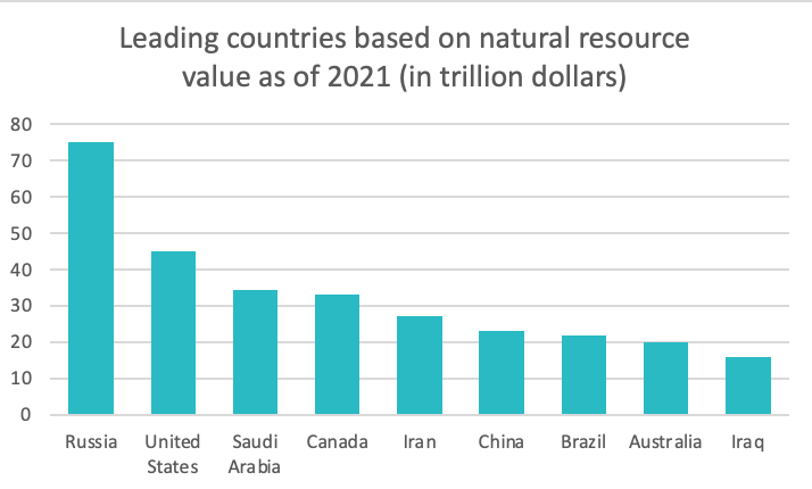

Rio Tinto (LSE: RIO) business is focused on commodities. This is a market that has been established for centuries and that had its golden age in the 20th century with the acceleration of industrial production and its expansion to five continents. The products are not available in any geographical area, but are sold all over the world.

It is a market where the supply is finite, but where the demand is very strong and growing. This is very good news for the good of the companies operating in this market, with an almost continuous increase in prices, but not so good news for the states that are worried about the environmental damage caused by this market.

Source : statista.com

Source : statista.com

Key Figures and Financial Ratios

Market capitalization: $92.23 billion1[2022]

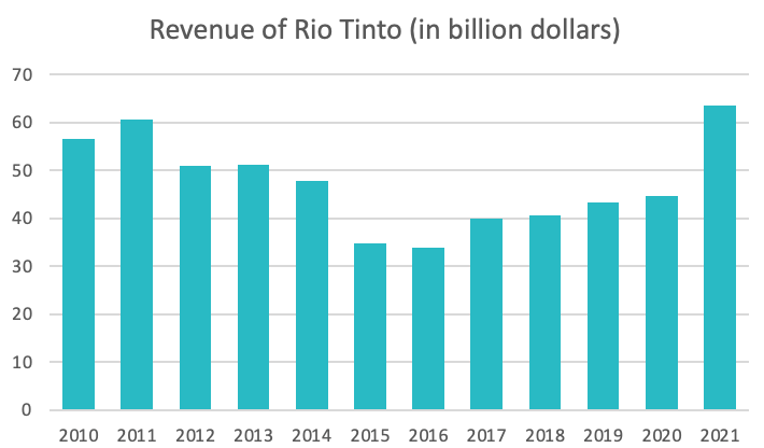

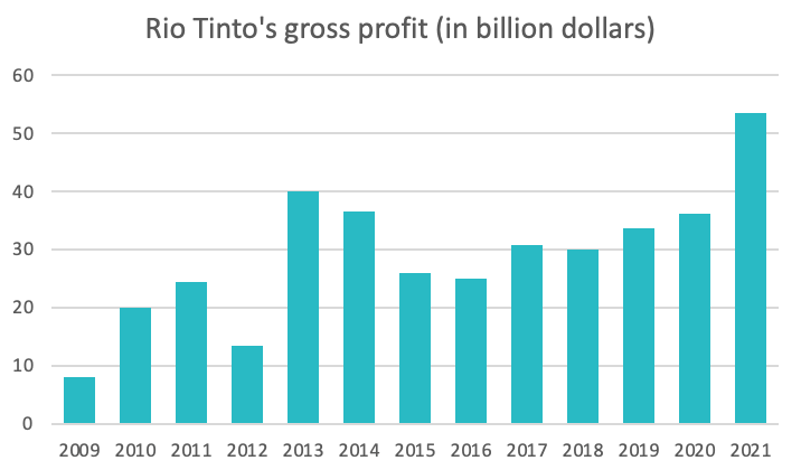

Revenue: $63,495 billion2[2021]

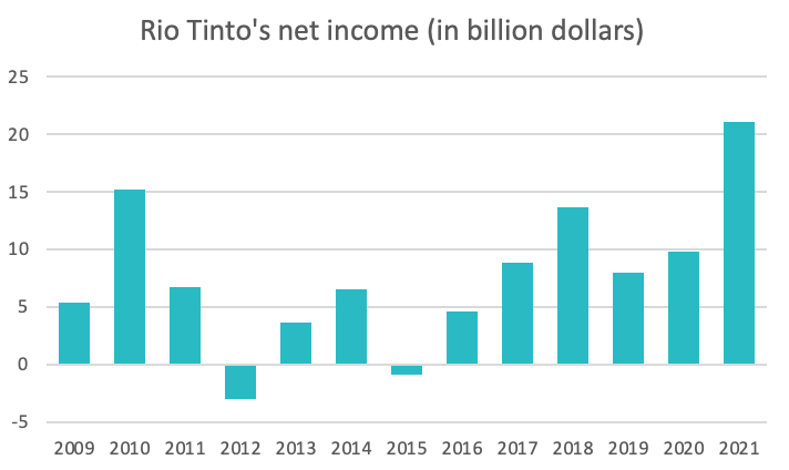

Net income: $21,094 billion 3[2021]

Dividends paid: Twice a year, for more than 20 years 4

Earnings per share: $12.95 5[2021]

Price to earnings ratio: ≃6.28 6[2022]

Debt to equity ratio: 0.2377[2022]

Source : macrotrends.com

Source : macrotrends.com

Graniteshares Offering Products

RIO TINTO

Sources

- Rio Tinto Market Cap 2010-2021 | RIO macrotrends

- Rio Tinto Revenue 2010-2021 | RIO macrotrends

- Rio Tinto Net Income 2010-2021 | RIO macrotrends

- Rio Tinto - 30 Year Dividend History | RIO macrotrends

- Rio Tinto Limited Google Finance

- Rio Tinto Limited Google Finance

- Rio Tinto Debt to Equity Ratio ycharts

DISCLAIMER

Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author, and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks, and liquidity risks.