3SRI

3x Short Rio Tinto (RIO) ETP

3SRI Product Description

GraniteShares 3x Short Rio Tinto Daily ETP is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x Short Rio Tinto plc Index that seeks to provide -3 times the daily performance of Rio Tinto plc shares.

For example, if Rio Tinto plc rises by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments. However, if Rio Tinto plc falls by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments.

What is Rio Tinto (RIO)?

"Rio Tinto plc is a UK-based mining and metals company operating in 35 countries with a diverse portfolio of iron ore, copper, aluminum, and other minerals. It has four key segments: Iron Ore – Mining operations in Western Australia, including 17 mines and four port terminals, as well as salt and gypsum production. Aluminum – Bauxite mining, alumina refining, and aluminum smelting and recycling. Copper – Mining and refining of copper, gold, silver, and molybdenum, along with extraction technology licensing. Minerals – Borates, titanium dioxide feedstock, iron concentrate, and pellets, as well as diamond mining and battery materials development (e.g., lithium). Rio Tinto operates open-pit and underground mines, along with refineries, smelters, processing plants, and shipping facilities. Founded in 1873, it is headquartered in London, UK."

Key Facts

3x Short Rio Tinto (RIO) ETP OVERVIEW

LISTING AND CODES for 3x Short Rio Tinto (RIO) ETP

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| London Stock Exchange | GBX | 3SRI | XS2596086350 | BQXR5P9 |

INDEX & PERFORMANCE of 3x Short Rio Tinto (RIO) ETP

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

COLLATERAL Details of 3x Short Rio Tinto (RIO) ETP

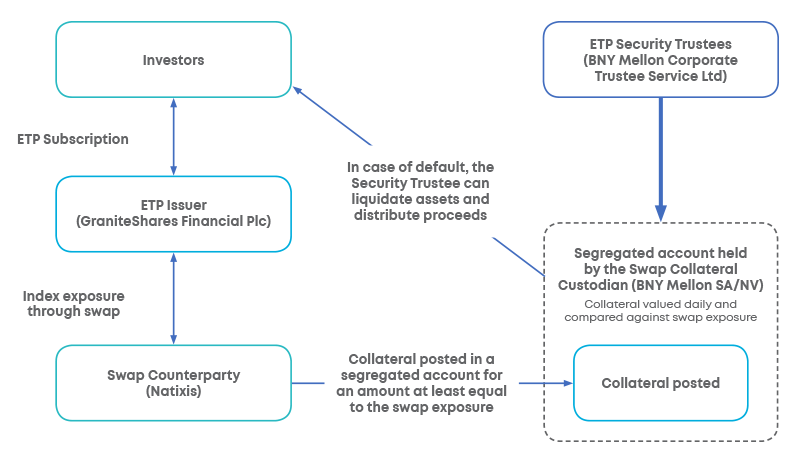

Understanding Collateral

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.