Alphabet

Everything you need to know about Alphabet

Google's Mother Company

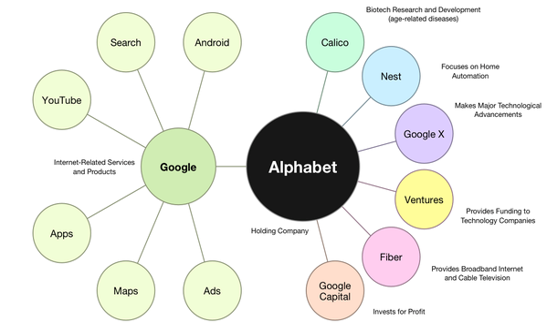

Alphabet Inc is a holding company created in 2015 following a vast reorganization at Google. Alphabet is Google’s parent company. Alphabets’ subsidiaries offer various services including web-based search, hardware solutions, software applications, enterprise solutions, hardware products, maps, and advertisements. For most, Google was synonymous with a search engine, perhaps also for some mailbox. But since its creation, the group has grown enormously, and by the creation of this holding, not only the other brands of the group can be more visible, but also more efficient: each one is now more autonomous.

In 2015 the IT company rebranded itself as Alphabet. On the stock exchange, Alphabet Inc stocks are listed under the ticker name of GOOG or GOOGL.

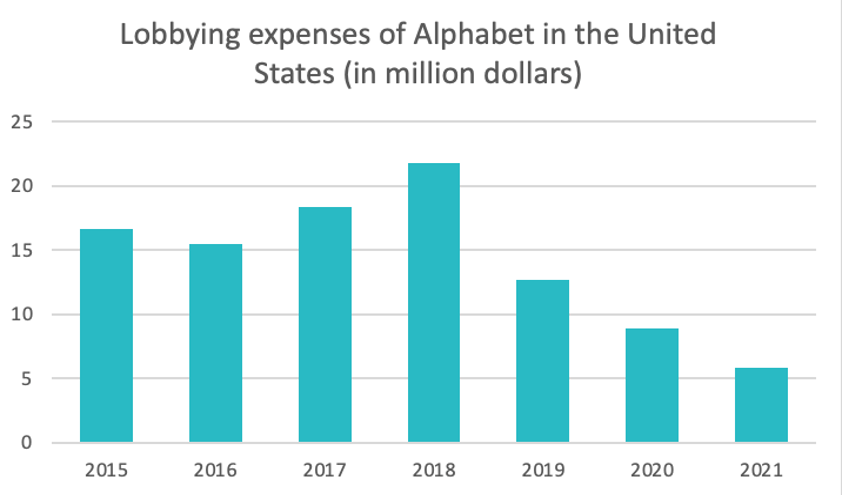

This reorganization also aims to please investors. The different branches of Google are now clearer, and easier to analyse separately. Alphabet has been accused many times of violating competition laws, especially because of its monopolistic position.

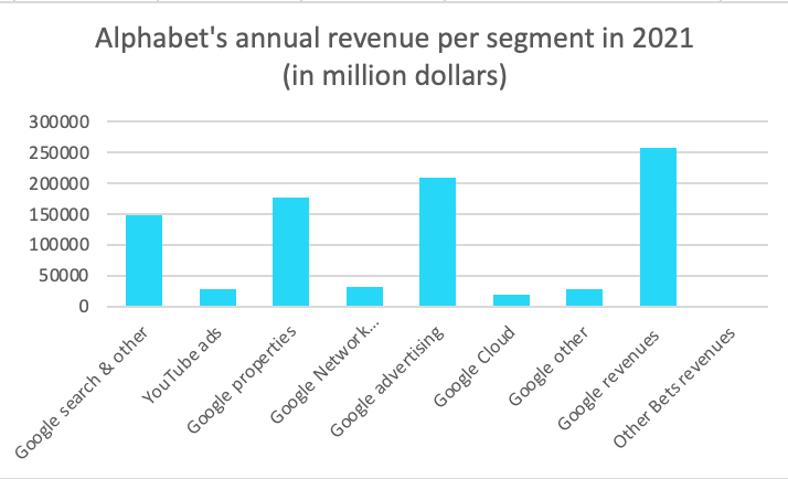

Source : statista.com

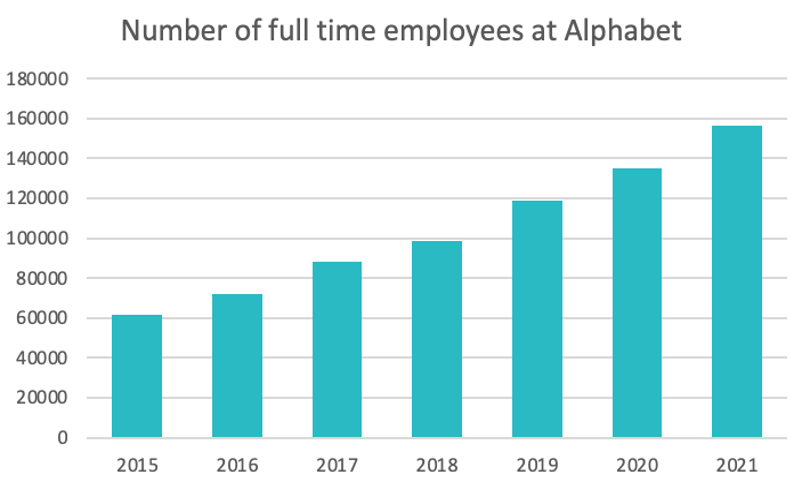

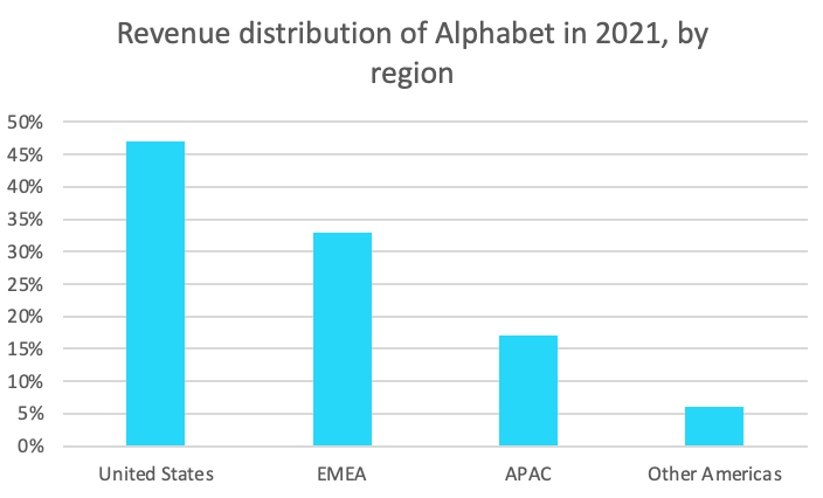

Source : statista.com

History of Alphabet Inc.

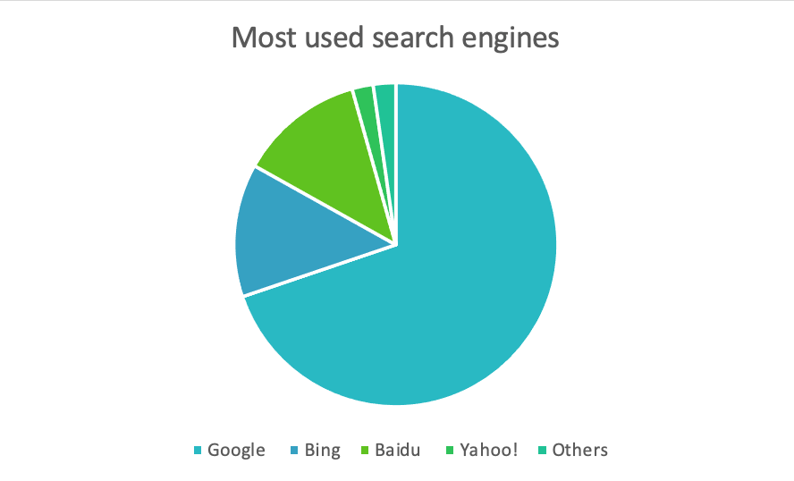

Google is an American technology services company founded in 1998 by Larry Page and Sergey Brin in Silicon Valley. The company became known mainly for its monopolistic position as a search engine. It then proceeded to numerous developments and acquisitions, including YouTube, Google Maps, and Gmail. In 2015, for various reasons and following a major reorganization, Alphabet was created, a holding company that owns Google and all its related companies. Alphabet is a company recognized in its various fields and has a market capitalization of € 1.519 trillion. (Source: Companies Market Cap)

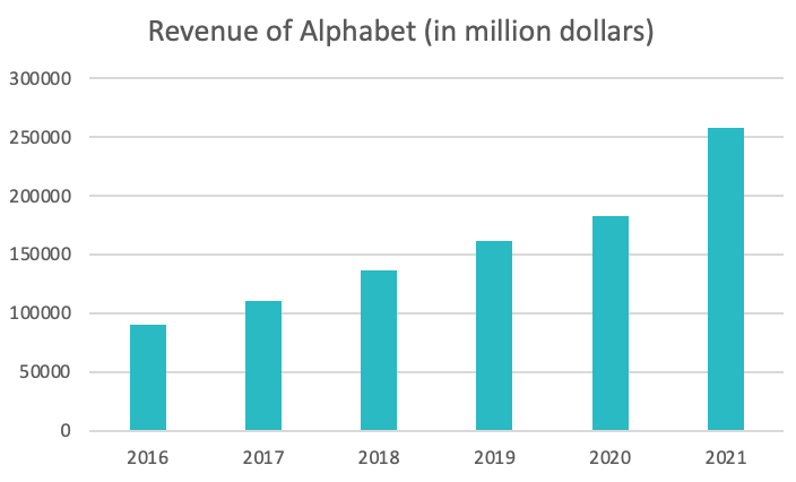

Source : statista.com

Source : netmarketshare.com

Who Owns Google?

The company was formerly led by co-founders Mr. Larry Page and Mr. Sergey Brin. In December 2019 the reins of Alphabet were handed over to Sundar Pichai when the duo announced their decision to step down from the management board. Mr. Sundar Pichai was then announced as CEO of Google.

The Market

Alphabet Alphabet is a holding company that includes all the services offered by Google. The market in which it operates includes many areas: the Cloud (Google Cloud), entertainment (YouTube), and advertising (Google Ads) for example. Almost all the markets in which Alphabet operates are related to new technologies, a relatively young field with a lot of possibilities and potential. Google, or Alphabet, is known to be dominant in this market.

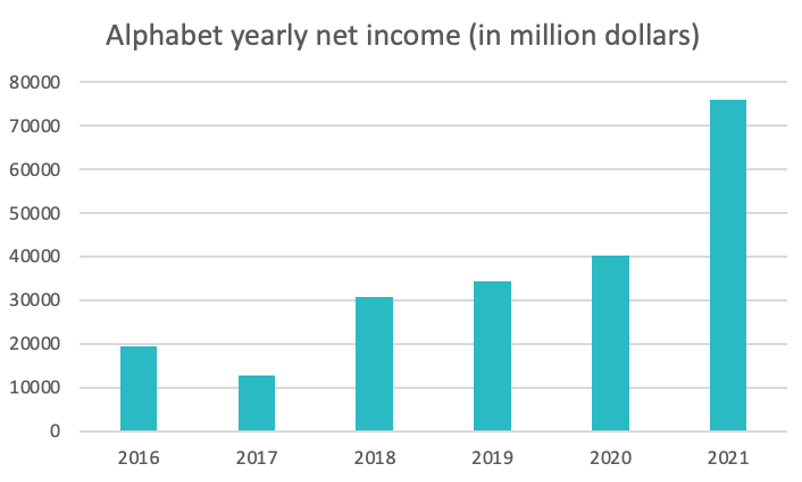

Source : statista.com

Source : statista.com

Key Figures and Financial Ratios

Market capitalization : €1.519 trillion 1(August 1, 2022)

Revenue : €257.637 billion 2(2021)

Net income : €67.64 billion 3(2021)

Dividends paid : none

Earnings per share : €99.82 4(2021)

Price to earnings ratio : ≃23.65 5(2022)

Debt-to-liquidity ratio : 2.93 6(2022)

Source : statista.com

Source : macrotrends.com

Graniteshares Offering Products

Alphabet

FAANG

GraniteShares FAANG ETPs provide exposure to the equal weight to following companies: Facebook, Amazon, Apple, Netflix and Alphabet

GAFAM

GraniteShares GAFAM ETPs provide exposure to the equal weight to following companies: Alphabet, Amazon, Facebook, Apple and Microsoft

FATANG

GraniteShares FATANG ETPs provide exposure to the equal weight to following companies: Facebook, Amazon, Tesla, Apple, Netflix and Alphabet

Sources

DISCLAIMER

Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents. Graniteshares Limited is an appointed representative of Messels Limited which is authorised and regulated by the Financial Conduct Authority.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author, and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks, and liquidity risks.