3LAL

3x Leverage Alphabet (GOOG) ETP

3LAL Product Description

GraniteShares 3x Long Alphabet Daily ETP is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x Long Alphabet Inc Index that seeks to provide 3 times the daily performance of Alphabet shares.

For example, if Alphabet rises by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments. However, if Alphabet falls by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments.

GraniteShares +3x Alphabet is available in GBX,USD

What is Alphabet (GOOG)

Alphabet Inc. is a multinational technology conglomerate that operates through three primary segments: Google Services, Google Cloud, and Other Bets. The Google Services segment includes a wide range of products and services such as advertising, Android, Chrome, Google Maps, Search, and YouTube. Google Cloud provides enterprise-ready cloud services, including artificial intelligence (AI) infrastructure, cybersecurity solutions, data analytics, and collaboration tools like Google Workspace, which includes Gmail, Docs, Drive, and Meet. The Other Bets segment focuses on emerging technologies and businesses, including healthcare-related services and internet services. Alphabet is headquartered in Mountain View, California, and is known for its innovative approach to technology and its diverse portfolio of subsidiaries, which include Waymo, Verily, and Nest.

Key Facts

3x Leverage Alphabet (GOOG) ETP OVERVIEW

LISTING AND CODES for 3x Leverage Alphabet (GOOG) ETP

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| London Stock Exchange | USD | 3LAL | XS2675292309 | BMZ8DQ9 | |

| London Stock Exchange | EUR | 3LGE | XS2675292309 | BMZ8DR0 | |

| London Stock Exchange | GBX | 3LGP | XS2675292309 | BMZ8DS1 | |

| Borsa Italiana | EUR | 3LAL | XS2679084603 | BNT9FQ9 |

INDEX & PERFORMANCE of 3x Leverage Alphabet (GOOG) ETP

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

COLLATERAL Details of 3x Leverage Alphabet (GOOG) ETP

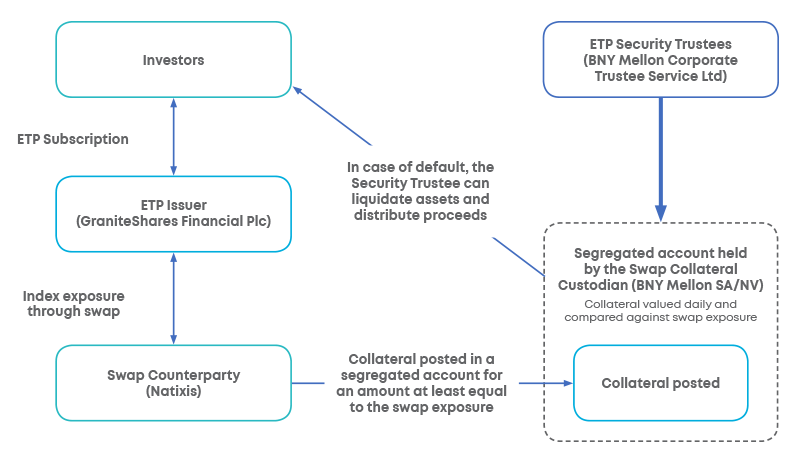

Understanding Collateral

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.