3LFB

3x Leverage Facebook (FB) ETP

3LFB Product Description

GraniteShares 3x Long Facebook Daily ETP is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x Long Facebook Inc Index that seeks to provide 3 times the daily performance of Meta Platforms Inc shares.

For example, if Meta Platforms Inc rises by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments. However, if Meta Platforms Inc falls by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments.

GraniteShares +3x Facebook is available in GBX,USD

What is Meta Platforms Inc (FB) ?

Meta Platforms, Inc. is a technology company focused on connecting people, building communities, and supporting businesses through digital platforms and hardware. The company operates through two main segments: Family of Apps (FoA) and Reality Labs (RL). The FoA segment includes social media platforms like Facebook, Instagram, Messenger, Threads, and WhatsApp, enabling users to share content, communicate, and engage with businesses. Reality Labs focuses on virtual reality (VR), augmented reality (AR), and mixed reality (MR) products, including Meta Quest headsets and software. Originally founded as Facebook, Inc. in 2004, the company rebranded to Meta Platforms, Inc. in October 2021 to emphasize its vision for the metaverse. Meta is headquartered in Menlo Park, California and operates worldwide.

Key Facts

3x Leverage Facebook (FB) ETP OVERVIEW

LISTING AND CODES for 3x Leverage Facebook (FB) ETP

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| London Stock Exchange | USD | 3LFB | XS2656469561 | BPLW322 | |

| London Stock Exchange | EUR | 3LFE | XS2656469561 | BPLW366 | |

| London Stock Exchange | GBX | 3LFP | XS2656469561 | BPLW333 | |

| Borsa Italiana | EUR | 3LFB | XS2656469561 | BPLW377 |

INDEX & PERFORMANCE of 3x Leverage Facebook (FB) ETP

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

COLLATERAL Details of 3x Leverage Facebook (FB) ETP

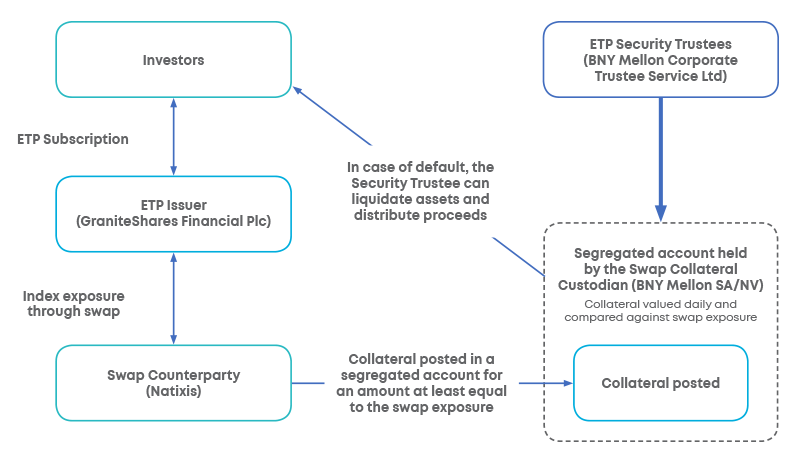

Understanding Collateral

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.