3LLL

3x Leverage Lloyds Banking Group (LLOY) ETP

3LLL Product Description

GraniteShares 3x Long Lloyds Banking Group Daily ETP is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x Long Lloyds Banking Group PLC Index that seeks to provide 3 times the daily performance of Lloyds Banking Group plc shares.

For example, if Lloyds Banking Group plc rises by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments. However, if Lloyds Banking Group plc falls by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments.

What is Lloyds Banking Group?

Lloyds Banking Group plc is a leading UK-based financial services company, primarily serving retail and commercial customers. It operates through three main segments: Retail, Commercial Banking, and Insurance, Pensions & Investments. The Retail segment offers a variety of financial products to personal customers, including current accounts, savings, mortgages, credit cards, loans, and motor finance. The Commercial Banking segment provides services for small and medium-sized businesses, corporates, and institutions, including lending, working capital management, debt financing, and risk management solutions. The Insurance, Pensions & Investments segment delivers insurance, pension, and investment solutions to help customers with long-term financial security. Lloyds also offers digital banking services and operates under well-known brands such as Lloyds Bank, Halifax, Bank of Scotland, Scottish Widows, and MBNA. Founded in 1695 and headquartered in London, it remains a key player in the UK banking sector.

Key Facts

3x Leverage Lloyds Banking Group (LLOY) ETP OVERVIEW

LISTING AND CODES for 3x Leverage Lloyds Banking Group (LLOY) ETP

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| London Stock Exchange | GBX | 3LLL | XS2708145573 | BMCLC97 |

INDEX & PERFORMANCE of 3x Leverage Lloyds Banking Group (LLOY) ETP

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

COLLATERAL Details of 3x Leverage Lloyds Banking Group (LLOY) ETP

Understanding Collateral

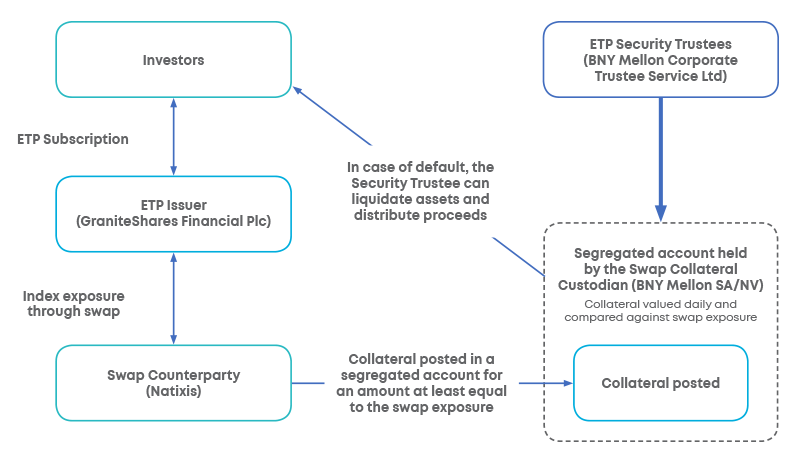

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.