3LMI

3x Leverage MicroStrategy (MSTR) ETP

3LMI Product Description

GraniteShares 3x Long MicroStrategy Daily ETP is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x long MicroStrategy Index that seeks to provide 3 times the daily performance of MicroStrategy Inc shares.

For example, if MicroStrategy Inc rises by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments. However, if MicroStrategy Inc falls by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments.

GraniteShares +3x MicroStrategy is available in EUR,GBP,USD

What is MicroStrategy Inc (MSTR) ?

MicroStrategy Incorporated, doing business as Strategy, is a bitcoin treasury company. The Company is engaged in the design, development, marketing, and sales of its software platform through licensing arrangements and cloud subscriptions and related services. It has adopted bitcoin as its primary treasury reserve asset. By using proceeds from equity and debt financings, as well as cash flows from its operations, it accumulates bitcoin and advocates for its role as digital capital. It provides investors with varying degrees of economic exposure to bitcoin by offering a range of securities, including equity and fixed income instruments. In addition, it provides artificial intelligence (AI)-powered enterprise analytics software. Its cloud-native flagship, MicroStrategy ONE, powers some of the analytics deployments for customers spanning a range of industries, including retail, banking, technology, manufacturing, insurance, consulting, healthcare, telecommunications and the public sector. As of 02nd March 2025, MicroStrategy Incorporated reported a total holding of 499,096 bitcoins.

Key Facts

3x Leverage MicroStrategy (MSTR) ETP OVERVIEW

LISTING AND CODES for 3x Leverage MicroStrategy (MSTR) ETP

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| Borsa Italiana | EUR | 3LMI | XS2617255760 | ||

| London Stock Exchange | GBP | LMI3 | XS2617255760 | BMHWFG3 | |

| London Stock Exchange | USD | 3LMI | XS2617255760 | BMHWD92 |

INDEX & PERFORMANCE of 3x Leverage MicroStrategy (MSTR) ETP

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

COLLATERAL Details of 3x Leverage MicroStrategy (MSTR) ETP

Understanding Collateral

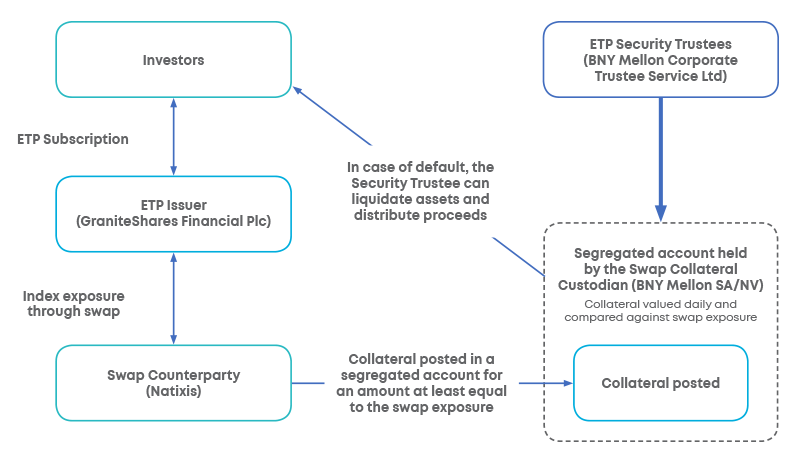

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.