3LMI - NOTICE OF AMENDMENT OF MRA 20220519

19 May, 2022 | GraniteShares

Leverage the daily return of MicroStrategy Inc (MSTR) stocks with 3x Long MicroStrategy ETP. Available for trading on Borsa Italiana, London Stock Exchange.

GraniteShares 3x Long MicroStrategy Daily ETP is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x long MicroStrategy Index that seeks to provide 3 times the daily performance of MicroStrategy Inc shares.

For example, if MicroStrategy Inc rises by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments. However, if MicroStrategy Inc falls by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments.

GraniteShares +3x MicroStrategy is available in EUR,GBP,USD

19 May, 2022 | GraniteShares

07 Mar, 2023 | GraniteShares

16 Dec, 2020 | GraniteShares

04 Jul, 2022 | GraniteShares

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| Borsa Italiana | EUR | 3LMI | XS2617255760 | ||

| London Stock Exchange | GBP | LMI3 | XS2617255760 | BMHWFG3 | |

| London Stock Exchange | USD | 3LMI | XS2617255760 | BMHWD92 |

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

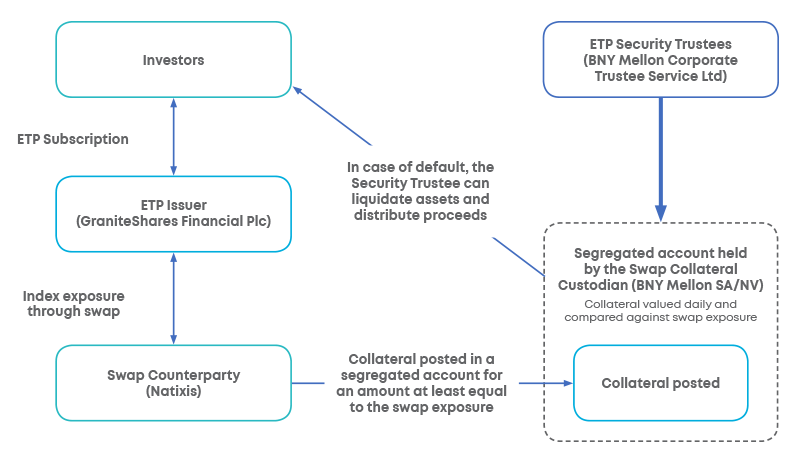

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.