3LNV

3x Leverage NVIDIA (NVDA) ETP

3LNV Product Description

GraniteShares 3x Long NVIDIA Daily ETP is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x Long NVIDIA Corp Index that seeks to provide 3 times the daily performance of NVIDIA Corp shares.

For example, if NVIDIA Corp rises by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments. However, if NVIDIA Corp falls by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments.

GraniteShares +3x NVIDIA is available in GBX,USD

Everything You Need to Know about Graniteshares 3x Long NVIDIA ETP

What is Nvidia (NVDA)?

The Compute & Networking segment includes Data Center accelerated computing platforms and AI solutions, providing essential hardware and software for high-performance computing. It also encompasses networking technologies like Quantum InfiniBand and Spectrum Ethernet, designed to enhance data transfer speeds. Additionally, NVIDIA develops automotive platforms for autonomous and electric vehicles through its NVIDIA DRIVE technology. The segment also features Jetson robotics and embedded computing platforms, as well as DGX Cloud computing services, which support AI workloads and enterprise applications. The Graphics segment focuses on GeForce GPUs, which power gaming and high-performance PCs, along with the GeForce NOW cloud-based game streaming service. The company also provides NVIDIA RTX and Quadro GPUs for professional visualization and enterprise workstation graphics. Its Virtual GPU (vGPU) software enables cloud-based visualization, while Omniverse software supports industrial AI and digital twin applications. Additionally, NVIDIA’s automotive infotainment systems enhance in-car digital experiences. NVIDIA’s products serve a wide range of industries, including gaming, professional visualization, data centers, and automotive technology. The company distributes its solutions through OEMs, device manufacturers, system integrators, cloud providers, and automotive suppliers. Founded in 1993, NVIDIA is headquartered in Santa Clara, California, and operates globally, including in the United States, Singapore, Taiwan, China, and Hong Kong.

Key Facts

3x Leverage NVIDIA (NVDA) ETP OVERVIEW

LISTING AND CODES for 3x Leverage NVIDIA (NVDA) ETP

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| London Stock Exchange | USD | 3LNV | XS2734938835 | BNDQSX4 | |

| London Stock Exchange | EUR | 3LVE | XS2734938835 | BNDQT08 | |

| London Stock Exchange | GBX | 3LVP | XS2734938835 | BNDQSZ6 | |

| Borsa Italiana | EUR | 3LNV | XS2734938835 | BNDQT19 |

INDEX & PERFORMANCE of 3x Leverage NVIDIA (NVDA) ETP

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

COLLATERAL Details of 3x Leverage NVIDIA (NVDA) ETP

Understanding Collateral

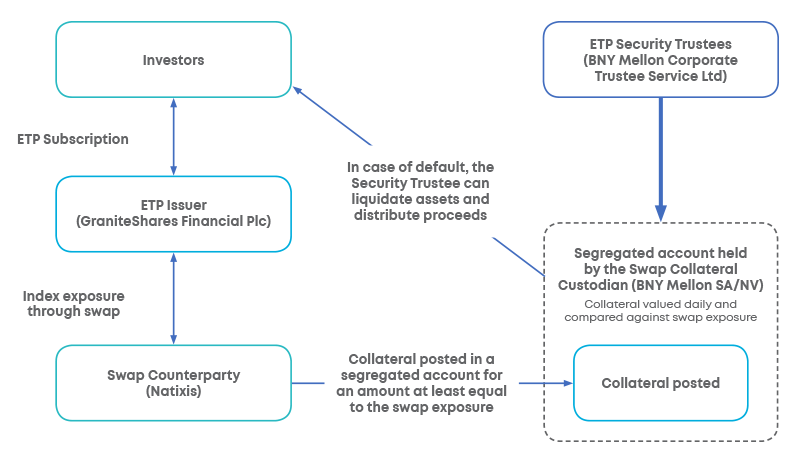

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.