3SNF

3x Short Netflix (NFLX) ETP

3SNE Product Description

GraniteShares 3x Short Netflix Daily ETP is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x Short Netflix Inc Index that seeks to provide -3 times the daily performance of Netflix Inc shares.

For example, if Netflix Inc rises by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments. However, if Netflix Inc falls by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments.

GraniteShares -3x Netflix is available in GBX,USD

Netflix Inc (NFLX) ?

Netflix, Inc. is a leading American entertainment services company that provides subscription-based streaming services for television series, documentaries, feature films, and games across multiple genres and languages. The company operates in over 190 countries, offering users the flexibility to stream content on various internet-connected devices, including TVs, digital video players, TV set-top boxes, and mobile devices. Netflix is renowned for its original programming, which includes critically acclaimed series and films. The company continues to expand its offerings by introducing new features such as games and live programming, enhancing user engagement and diversifying its content portfolio. Netflix also offers different subscription plans, including ad-supported and ad-free options, to cater to a wide range of consumer preferences and budgets. In 2025, Netflix is projected to have over 340 million paying subscribers, with its revenue expected to surpass YouTube's, driven by both subscription and advertising revenue. The company's growth is supported by its strategic investments in technology and content production, positioning it as a dominant player in the global streaming market.

Key Facts

3x Short Netflix (NFLX) ETP OVERVIEW

LISTING AND CODES for 3x Short Netflix (NFLX) ETP

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| London Stock Exchange | USD | 3SNF | XS3075487986 | BMVFBJ3 | |

| London Stock Exchange | EUR | 3SNE | XS3075487986 | BMVFBK4 | |

| London Stock Exchange | GBX | 3SNP | XS3075487986 | BMVFBL5 | |

| Borsa Italiana | EUR | 3SNF | XS3075487986 | BMZ8DJ2 |

INDEX & PERFORMANCE of 3x Short Netflix (NFLX) ETP

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

COLLATERAL Details of 3x Short Netflix (NFLX) ETP

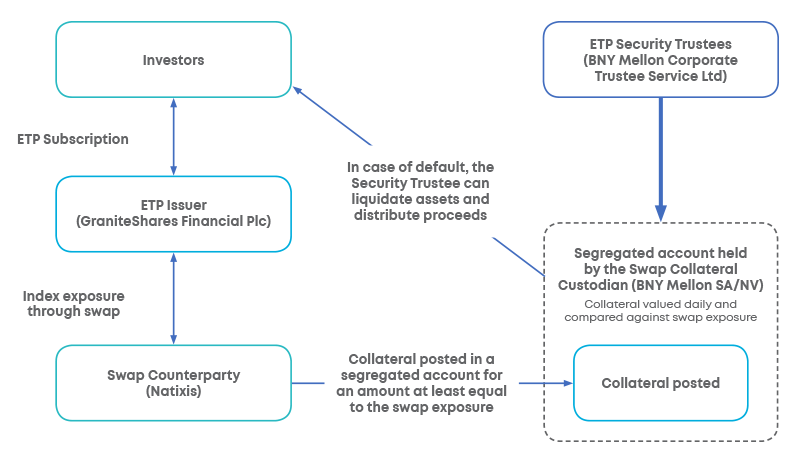

Understanding Collateral

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.