3SRD

3x Short Royal Dutch Shell (RDSa) ETP

3SRD Product Description

GraniteShares 3x Short Royal Dutch Shell Daily ETP is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x Short Royal Dutch Shell PLC Index that seeks to provide -3 times the daily performance of Royal Dutch Shell plc shares.

For example, if Royal Dutch Shell plc rises by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments. However, if Royal Dutch Shell plc falls by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments.

What is Royal Dutch Shell plc (RDSa)?

Shell plc is a leading international energy and petrochemical company headquartered in London, UK. Founded in 1907, the company operates across multiple segments: Integrated Gas, Upstream, Marketing, Chemicals and Products, and Renewables and Energy Solutions. Integrated Gas: Focuses on liquefied natural gas (LNG), gas-to-liquids (GTL) fuels, and related products. It includes exploration, extraction, and marketing of natural gas and LNG. Upstream: Engages in the exploration and extraction of crude oil, natural gas, and natural gas liquids. Marketing: Comprises the Mobility, Lubricants, and Sectors & Decarbonisation businesses, offering retail services, lubricants, and low-carbon energy solutions. Chemicals and Products: Includes chemicals manufacturing and refineries that produce a range of oil products for domestic, industrial, and transport use. Renewables and Energy Solutions: Focuses on renewable power generation, hydrogen production, carbon credits trading, and digitally enabled customer solutions. Shell is a major player in the global energy sector, with operations in Europe, Asia, Africa, and the Americas. The company is transitioning towards cleaner energy solutions while maintaining its core oil and gas business.

Key Facts

3x Short Royal Dutch Shell (RDSa) ETP OVERVIEW

LISTING AND CODES for 3x Short Royal Dutch Shell (RDSa) ETP

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| London Stock Exchange | GBX | 3SRD | XS2698604308 | BRRD6C4 |

INDEX & PERFORMANCE of 3x Short Royal Dutch Shell (RDSa) ETP

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

COLLATERAL Details of 3x Short Royal Dutch Shell (RDSa) ETP

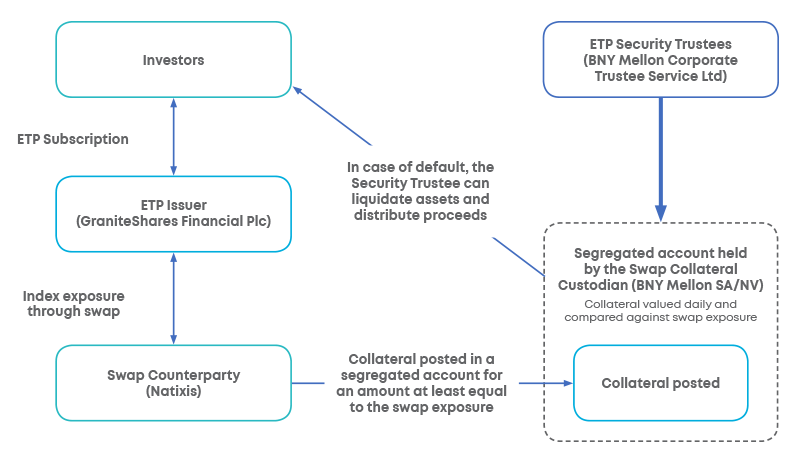

Understanding Collateral

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.