3LAP

3x Leverage Apple (AAPL) ETP

3LAP Product Description

GraniteShares 3x Long Apple Daily ETP is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x Long Apple Inc Index that seeks to provide 3 times the daily performance of Apple shares.

For example, if Apple rises by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments. However, if Apple falls by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments.

GraniteShares +3x Apple is available in GBX,USD

What is Apple (AAPL)?

Apple Inc. designs, manufactures, and sells consumer electronics, software, and services. Its main products include the iPhone, Mac computers, iPad tablets, and accessories like AirPods, Apple Watch, HomePod, and Apple TV. The company develops software platforms such as iOS, macOS, iPadOS, watchOS, visionOS, and tvOS. Apple also provides cloud storage, customer support, and digital content through the App Store, where users can access apps, books, music, videos, and podcasts. Its subscription services include Apple Music, Apple TV+, Apple Arcade, Apple Fitness+, and Apple News+. The company offers financial services like Apple Pay and Apple Card. Apple distributes its products through its online and retail stores, direct sales, and third-party sellers. Founded in 1976, it is headquartered in Cupertino, California.

Key Facts

3x Leverage Apple (AAPL) ETP OVERVIEW

LISTING AND CODES for 3x Leverage Apple (AAPL) ETP

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| London Stock Exchange | USD | 3LAP | XS2722161424 | BNDSD80 | |

| London Stock Exchange | EUR | 3LAE | XS2722161424 | BNDSDG8 | |

| London Stock Exchange | GBX | 3LWP | XS2722161424 | BNDSDH9 | |

| Borsa Italiana | EUR | 3LAP | XS2722161424 | BNDSDK2 |

INDEX & PERFORMANCE of 3x Leverage Apple (AAPL) ETP

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

COLLATERAL Details of 3x Leverage Apple (AAPL) ETP

Understanding Collateral

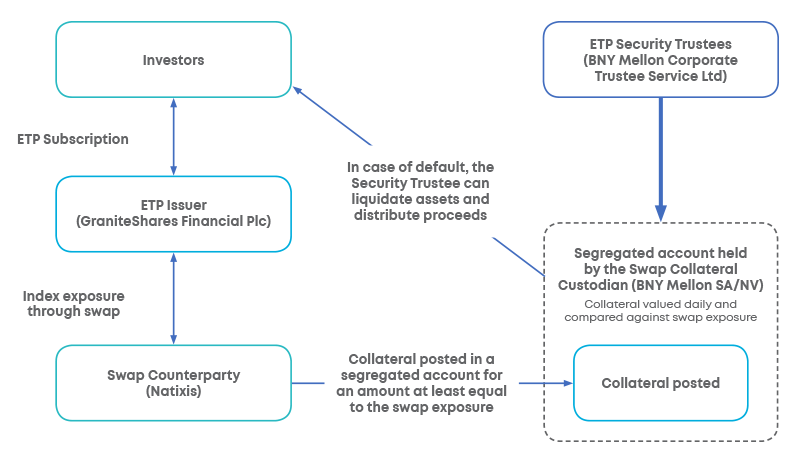

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.