3LUB

3x Leverage UBER (UBER) ETP

3LUB Product Description

GraniteShares 3x Long UBER Daily ETP is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x Long Uber Technologies Inc Index that seeks to provide 3 times the daily performance of Uber Technologies Inc shares.

For example, if Uber Technologies Inc rises by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments. However, if Uber Technologies Inc falls by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments.

GraniteShares +3x UBER is available in GBX,USD

What is Uber Technologies Inc (UBER) ?

Uber Technologies, Inc. operates a technology platform that facilitates various transportation and delivery services globally. It develops and manages proprietary applications that connect users with mobility, delivery, and freight solutions. The Mobility segment connects consumers with drivers for ridesharing across various vehicle types, including cars, auto-rickshaws, motorbikes, minibuses, and taxis. It also offers micromobility, car rentals, public transit integrations, and financial partnerships. The Delivery segment enables users to search for restaurants, order meals, and arrange for pickup or delivery. It also provides grocery, alcohol, and convenience store deliveries in certain markets, along with white-label delivery solutions for businesses. The Freight segment operates a digital marketplace that connects shippers and carriers, providing upfront pricing and automated logistics solutions for businesses of all sizes. Founded in 2009 and headquartered in San Francisco, Uber has expanded its reach across the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia-Pacific region.

Key Facts

3x Leverage UBER (UBER) ETP OVERVIEW

LISTING AND CODES for 3x Leverage UBER (UBER) ETP

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| London Stock Exchange | USD | 3LUB | XS2662640973 | BNYJXJ3 | |

| London Stock Exchange | EUR | 3LUE | XS2662640973 | BNYK987 | |

| London Stock Exchange | GBX | 3LUP | XS2662640973 | BNYK976 | |

| Borsa Italiana | EUR | 3LUB | XS2662640973 | BNYK9C1 |

INDEX & PERFORMANCE of 3x Leverage UBER (UBER) ETP

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

COLLATERAL Details of 3x Leverage UBER (UBER) ETP

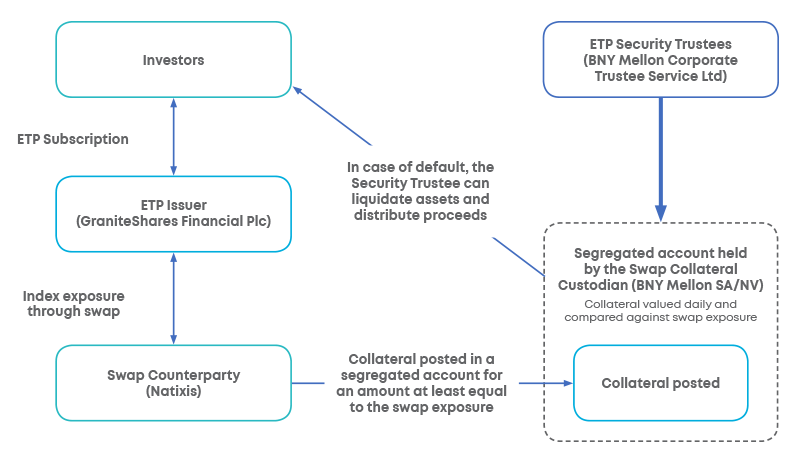

Understanding Collateral

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.