3SMO

3x Short Moderna Securities (MRNA) ETP

3SMO Product Description

GraniteShares 3x Short Moderna Daily ETP Securities is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x short Moderna Index that seeks to provide -3 times the daily performance of Moderna shares.

For example, if Moderna rises by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments. However, if Moderna falls by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments.

GraniteShares -3x Moderna Securities is available in GBP,USD

What is Moderna (MRNA) ?

Moderna, Inc. is a biotechnology company based in Cambridge, Massachusetts, that specializes in the development of messenger RNA (mRNA) therapeutics and vaccines. The company's mission is to harness the potential of mRNA technology to create transformative medicines for patients worldwide. Moderna's pipeline includes a diverse range of therapeutic and vaccine programs targeting infectious diseases, immuno-oncology, rare diseases, and autoimmune diseases. Moderna's products include the COVID-19 vaccine (Spikevax), an RSV vaccine (Mresvia), and various seasonal influenza vaccines. The company also has ongoing development programs for combination vaccines, CMV and EBV vaccines, and other infectious diseases like Zika and Nipah viruses. Additionally, Moderna is working on oncology therapeutics and treatments for rare diseases such as propionic acidemia and cystic fibrosis. The company collaborates with several major pharmaceutical companies and research institutions to advance its mRNA technology and expand its product offerings. Moderna was founded in 2010 and has become a leading player in the mRNA field, known for its rapid development of vaccines during the COVID-19 pandemic.

Key Facts

3x Short Moderna Securities (MRNA) ETP OVERVIEW

LISTING AND CODES for 3x Short Moderna Securities (MRNA) ETP

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| Borsa Italiana | EUR | 3SMO | XS2838543614 | BSMMN11 | |

| London Stock Exchange | GBP | SOL3 | XS2838543614 | BSMMN33 | |

| London Stock Exchange | USD | 3SMO | XS2838543614 | BSMMN22 |

INDEX & PERFORMANCE of 3x Short Moderna Securities (MRNA) ETP

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

COLLATERAL Details of 3x Short Moderna Securities (MRNA) ETP

Understanding Collateral

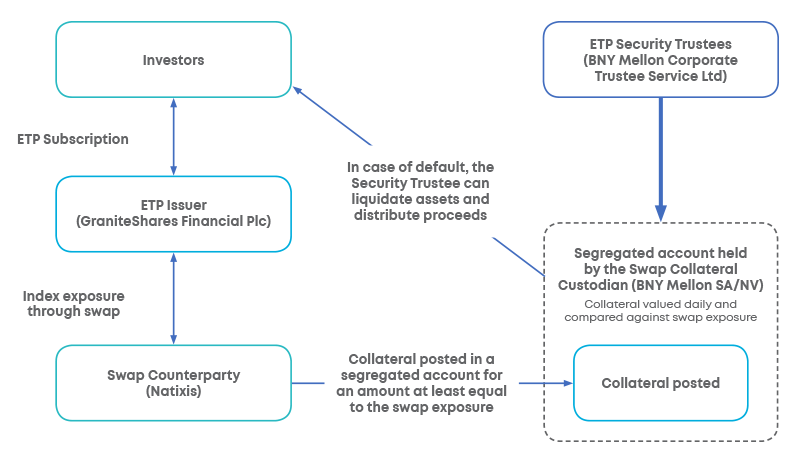

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.