What is Short Selling

Posted:

When an investor goes long on investment, they buy the shares believing that the price of that stock will rise in the future. Conversely, when an investor decides to go short on a stock, they anticipate a decrease in the stock price.

Short selling is a strategy where investors aim to earn profit from the decline of an asset’s price. Since this depends on the anticipation or prediction of an investor it entails infinite risk, investors should understand their risk appetite before trading. Let’s understand how this strategy works.

What is Short Selling? How does short selling work?

Short selling is a trading strategy that beats the conventional idea of taking a long position in a stock, as mentioned above. It is where the investors short the stock at a higher price with an expectation that the prices will plunge.

So, to short a stock, the short sellers first initiate the position by borrowing the shares from a broker before then immediately selling those shares in the stock market with an expectation of the price to go down. Short selling involves borrowing the stocks from your respective brokers for this they will charge some fees and interest charges.

Further, if the price of the stock goes according to investors’ prediction and indeed falls, they can then buy back the stocks at a lower price, return the borrowed shares to the broker, and pocket the difference as profit.

How to short a stock?

Investors can buy stocks with just a few simple clicks. However, there are more steps involved to short stocks in the market.

To go short on a stock, investors are required to have a margin account. Apart from that, they are usually required to pay interest on the value of the borrowed shares while the position is open.

For example, let's say that an investor thinks according to the Tesla stock that trades in the United States stock exchange NYSE here for $100 is overpriced or has been going higher for some time and decide to short Tesla stock by borrowing and immediately shot selling Tesla.

The investor buys let’s say 10 shares. If Tesla goes down by goes down to $90, then the investor can buy back those Tesla shares and return them to the broker. The difference of $10 and a total of $100 profit is the investor’s profit. ($10*10 shares) (excluding fees).

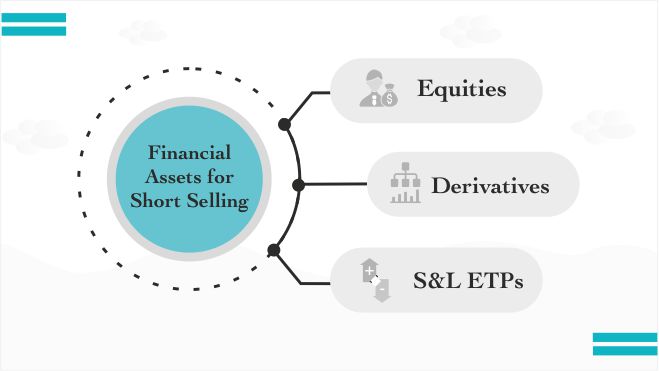

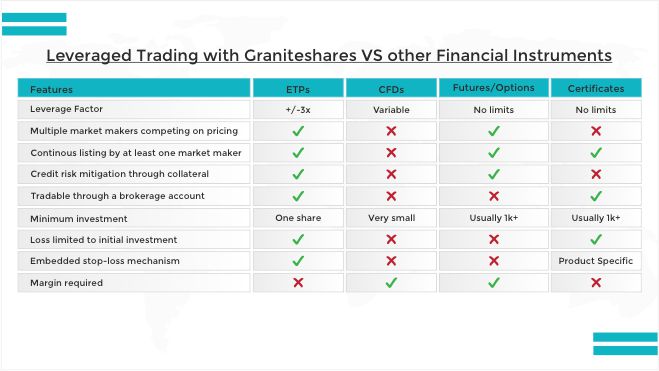

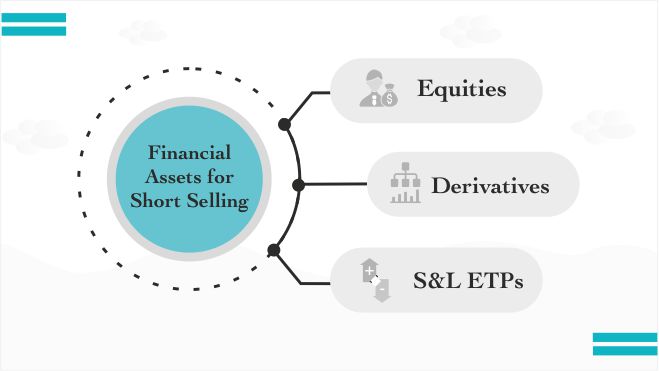

Moreover, to short, stock or any other asset investors can opt for various financial instruments as an alternative to direct equity short selling including options, futures, Exchange-Traded Products (ETPs) and other structured products. However, they come with their fair share of risks and complexities.

Going Short using Leveraged and Inverse ETP:

ETPs are exchange-listed leveraged vehicles designed to track the underlying security, an index, or other financial instruments. ETPs just like stocks trade on the exchange i.e., their prices fluctuate on an intraday basis based on the demand and supply.

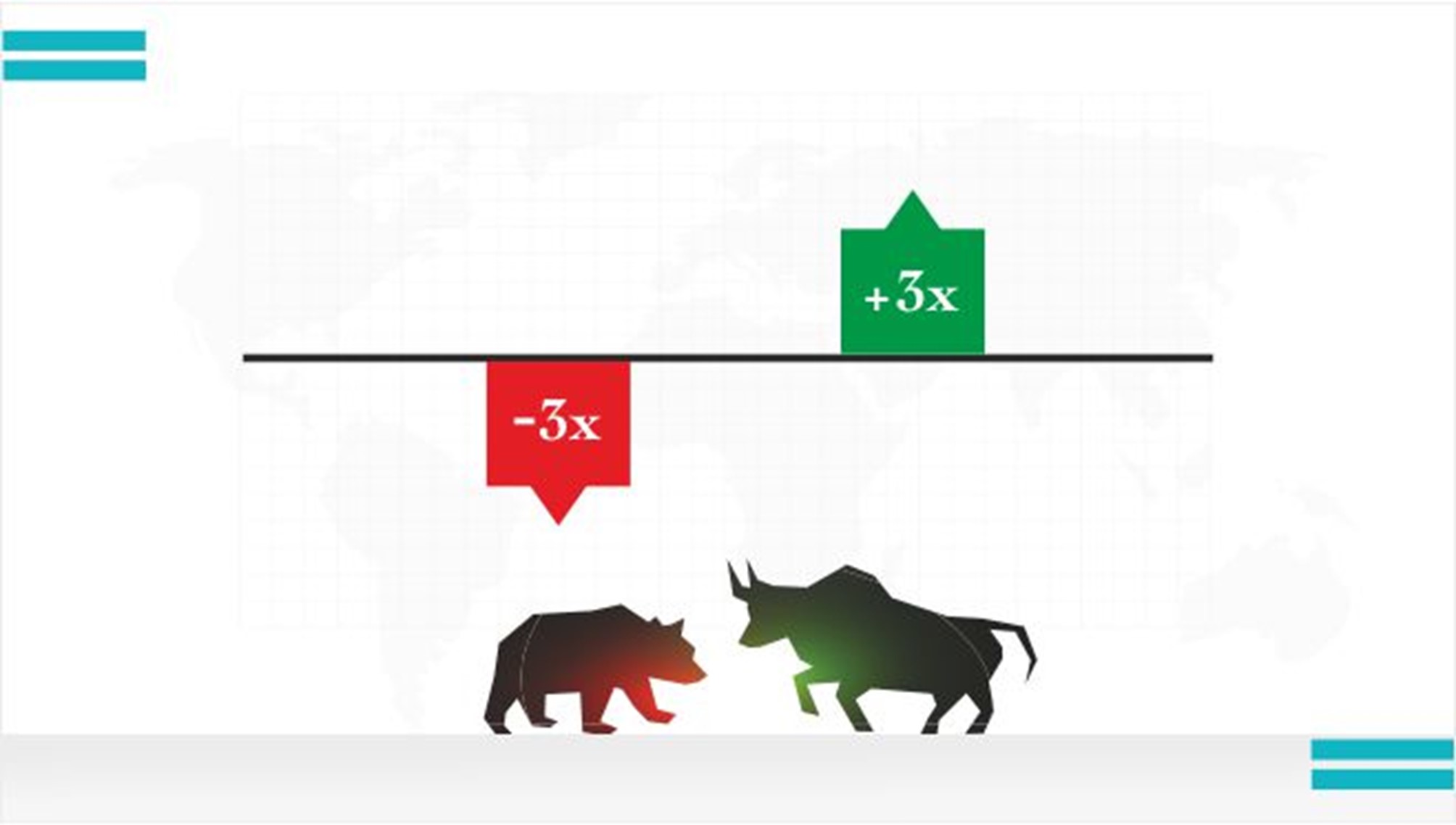

ETPs can also be used to short stocks or any other underlying assets. Inverse ETPs provide positive returns when the underlying asset, stock, or any other securities falls in price. Just like Leveraged ETPs, Inverse ETPs also mark returns based on the daily performance of the underlying security or index. Using Inverse or short ETPs is one of the ways to hedge your portfolios. They can be used to Profit when the market decides on the broad market index.

Furthermore, they are usually denoted as either a negative number like -2x, -3x or terms like “short” or “inverse” in the name of funds or product name.

Benefits of ETPs

Bottom Line:

Short selling allows investors and traders to profit from the market when it is in red and going down. Investors with a bearish view can borrow shares on margin and sell them in the market or use options, futures, or ETPs, hoping to repurchase them at some point in the future at a lower price. Traders and investors analyze and look at a stock's short interest and other ratios involving short positions to inform trading ideas. However, short positions with a huge number of shares can be squeezed due to margin calls and can result in losses. Investors and traders should carefully understand the risks involved with short trading and through various investments before trading.

|

Product name |

Ticker(USD) |

Ticker(EUR) |

Ticker(GBX) |

|---|---|---|---|

|

GraniteShares 3x Short Tesla Daily ETP |

3STS | 3STE | 3STP |

|

GraniteShares 3x Long Tesla Daily ETP |

3LTS | 3LTE | 3LTP |

|

GraniteShares 3x Short FATANG Daily ETP |

3SFT | 3S3E | 3S3P |

|

GraniteShares 3x Long FATANG Daily ETP |

3FTE | 3FTG | 3FTP |

|

GraniteShares FATANG ETP |

FTNG | FTNE | FTNP |

|

GraniteShares 1x Short FATANG Daily ETP |

SFTG | SFTE | SFTP |

DISCLAIMER

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks and liquidity risks. Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.