NIO Inc

Nio, a Chinese electric vehicle manufacturer

Nio Stock price

Presentation of the company

NIO (NASDAQ: NIO) is a Chinese Automotive Manufacturer, specializing in the development and production of electric vehicles, founded in 2014. The company's philosophy is to “move towards a positive and sustainable future”. The company is currently only present in the Asian market but wants to start penetrating the international market, starting with Europe, in 2022.

The company has several innovative ideas: the Power Swap, a service that gives the car a set of new batteries and the creation of NIO homes.

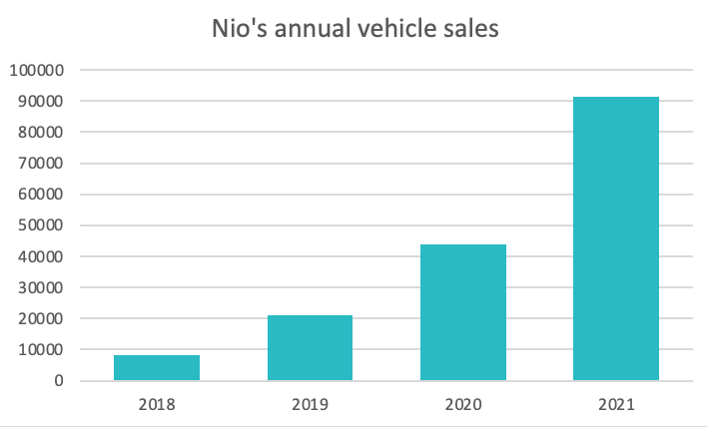

The brand currently offers three models for sale, and two in development, with prices starting at around $50,000. In 2021, it has sold more than 90,000 vehicles. As of June 1, 2022, NIO is the ninth largest automotive market capitalization1

Source : macrotrends.com

Source : carsalesbase.com

History of Nio

NIO is a relatively young company, founded in 2014. Their first model is a 1300+ horsepower electric supercar, the EP9, which competed for om the Formula E championship, and broke several records on various tracks.

In 2017, the brand launched its first mainstream model, the ES8 electric SUV. In 2018, NIO introduced the ES6 a compact SUV. In September 2018, the company went public on the New York Stock Exchange with an initial valuation of $1.8 billion.

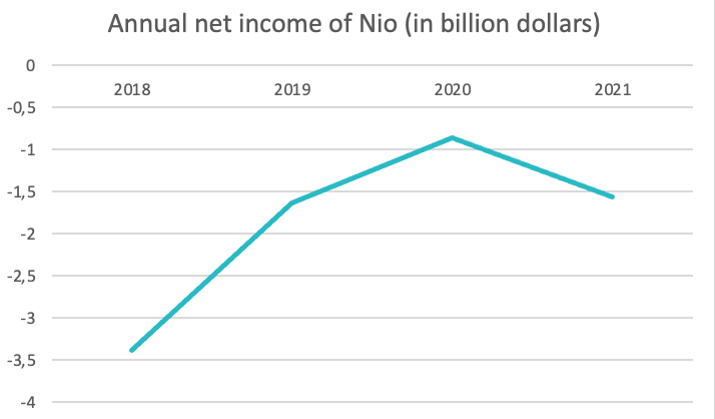

At the end of April 2020, NIO announced a $1 billion new fundraising financed via a group of Chinese investors. That same year, it launched BaaS, batteries available for rent.

In 2021, NIO’s ES8 SUV was made available for purchase in Norway.

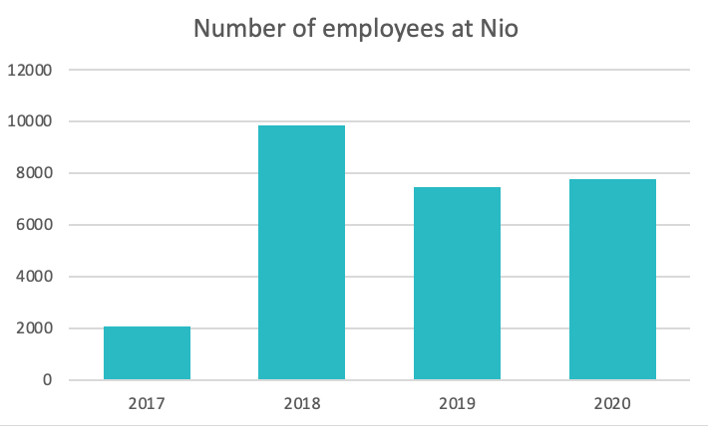

Source : macrotrends.com

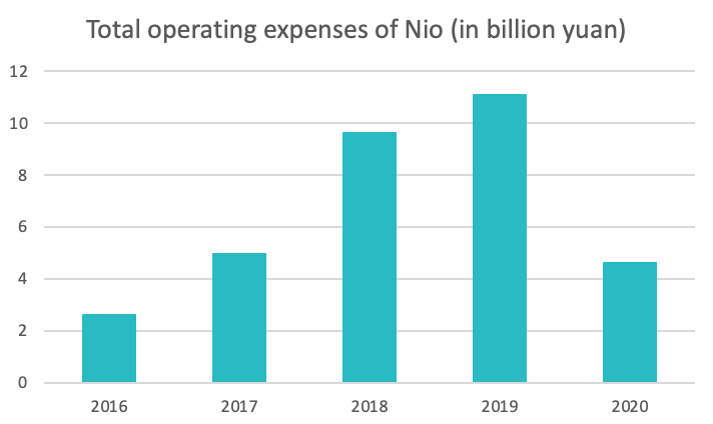

Source : statista.com

The market

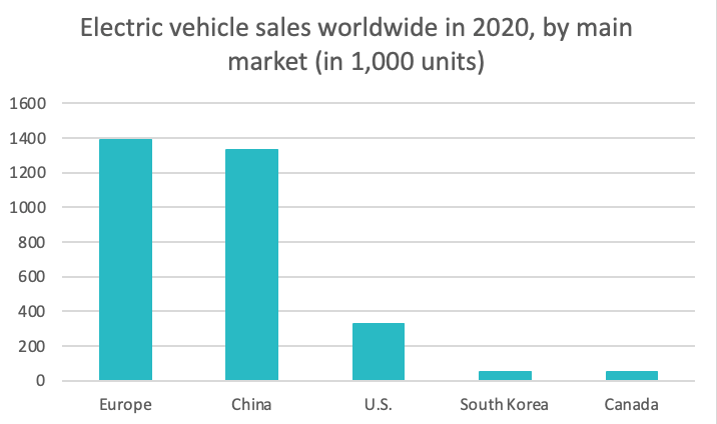

NIO is a Chinese headquarter company that sells electric cars. China is one of the largest automotive markets in the world, and the largest in terms of electric cars, accounting for 45% of global sales2 , although only 4% of these sales are made internationally. If China sells a lot of electric cars, it produces even more, as almost 60% of electric car production takes place there3.

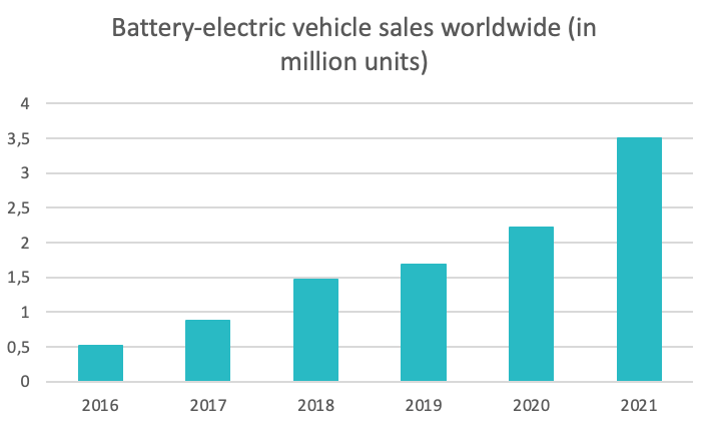

The global electric vehicle market is still recent. In a concern for sustainable development, the world is increasingly interested in this type of transportation, creating opportunities for new companies specialized in this field.

Electric vehicles continue to improve, whether it concerns autonomy, engine power, or the recharging system. A more companies enter the market it seems likely that improvements and innovation will continue to happen.

China is among the biggest world’s polluter, and the government has shown intention to take measure to limit carbon emission. That has resulted in China in being one of the largest markets for electric vehicles.

Source : statista.com

Source : statista.com4

{4} As of May 16, 2022

Key Figures and Financial Ratio

Market capitalisation as of June 01, 2022: $31.67 billions5

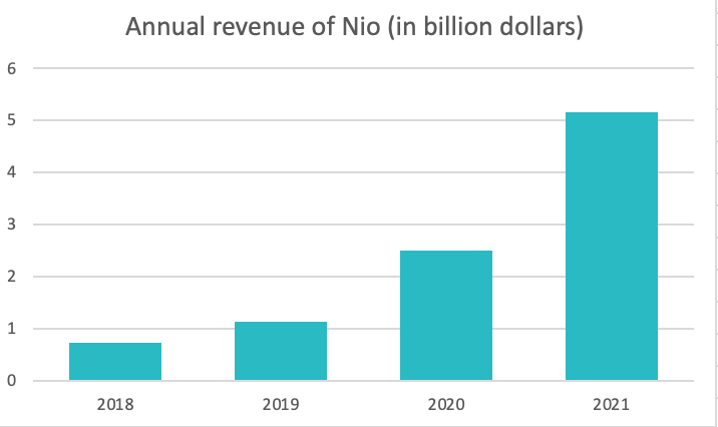

Revenue – FY 2021: $5.153 billions6

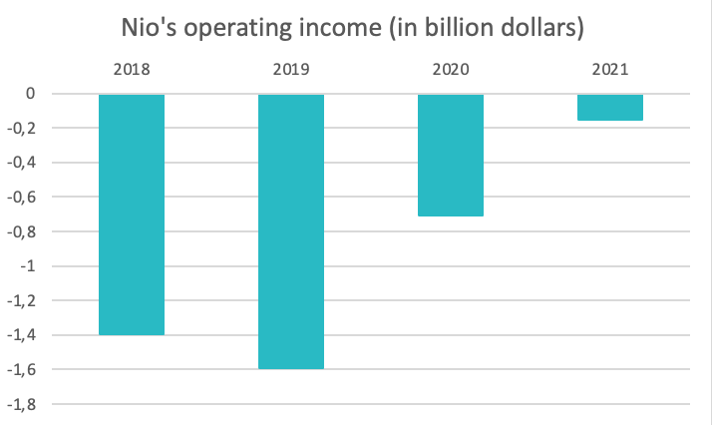

Net income – FY 2021: ($1.561) billion7

Dividends paid – FY 2021 : N/A

Earnings per share – FY 2021: -$1.038

Estimated as of June 2022 of the December 2022 debt to equity ratio: 0.499

Source : macrotrends.com

Source : macrotrends.com

GraniteShares Offering Product

NIO

DISCLAIMER

This website and its content have been provided by GraniteShares.

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the Fund, please call (844) 476 8747 or click here. Read the prospectus or summary prospectus carefully before investing.

Index performance does not represent the ETF’s performance. It is not possible to invest directly in an index.

Indexes are unmanaged and index returns do not include investment fees and expenses.

FUND RISKS

The Fund is not suitable for all investors. The Fund is designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily leveraged (2X) investment results, understand the risks associated with the use of leverage, under the Index rules and are willing to monitor their portfolios frequently. The Fund is not intended to be used by, and is not appropriate for, investors who do not intend to actively monitor and manage their portfolios. For periods longer than a single day, the Fund will lose money if the Underlying Stock’s performance is flat, and it is possible that the Fund will lose money even if the Underlying Stock’s performance increases over a period longer than a single day. An investor could lose the full principal value of his/her investment within a single day.

Because of daily rebalancing and the compounding of each day’s return over time, the return of the Fund for periods longer than a single day will be the result of each day’s returns compounded over the period, which will very likely differ from 200% of the return of the Underlying Stock over the same period. The Fund will lose money if the Underlying Stock’s performance is flat over time, and as a result of daily rebalancing, the Underlying Stock volatility and the effects of compounding, it is even possible that the Fund will lose money over time while the Underlying Stock's performance increases over a period longer than a single day.

An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with the Fund concentrating its investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Risks of the Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Counterparty Risk, Rebalancing Risk, Intra-Day Investment Risk, Daily Index Correlation Risk, Other Investment Companies (including ETFs) Risk, and risks specific to the securities of the Underlying Stock and the sector in which it operates. These and other risks can be found in the prospectus.

This information is not an offer to sell or a solicitation of an offer to buy shares of any Funds to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Please consult your tax advisor about the tax consequences of an investment in Fund shares, including the possible application of foreign, state, and local tax laws. You could lose money by investing in the ETFs. There can be no assurance that the investment objective of the Funds will be achieved. None of the Funds should be relied upon as a complete investment program. The investment program of the funds are speculative, entails substantial risks and include asset classes and investment techniques not employed by more traditional mutual funds. Investments in the ETFs are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

The Fund is distributed by ALPS Distributors, Inc, which is not affiliated with GraniteShares or any of its affiliates

©2022 GraniteShares Inc. All rights reserved. GraniteShares, GraniteShares Trusts, and the GraniteShares logo are registered and unregistered trademarks of GraniteShares Inc., in the United States and elsewhere. All other marks are the property of their respective owners.