Commodities & Precious Metals Weekly Report: Apr 1 (1)

Posted:

Key points

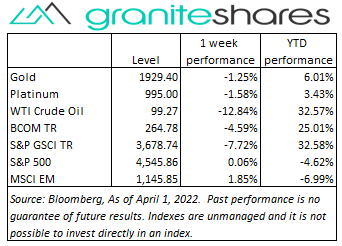

Energy prices, except for natural gas prices, moved markedly lower last week. May WTI and July Brent crude oil futures prices fell 12.9% and 9.5%. respectively. Heating oil, gasoil and gasoline prices fell between 8% and 9%. Natural gas prices increased 2%.

Energy prices, except for natural gas prices, moved markedly lower last week. May WTI and July Brent crude oil futures prices fell 12.9% and 9.5%. respectively. Heating oil, gasoil and gasoline prices fell between 8% and 9%. Natural gas prices increased 2%.- Grain prices also moved markedly lower. Chicago and Kansas wheat prices fell 10.7% and 8.8%, respectively. Corn and soybean prices decreased 2.5% and 7.5%, respectively.

- Precious metal prices were all lower. June gold futures prices decreased 1.8% and May silver futures prices fell 3.8%. Spot platinum prices fell 1.3% and palladium prices dropped close to 3%.

- Base metal prices were mixed. Aluminum and nickel prices fell 4.5% and 6.4%, respectively. Copper prices edged lower 0.2% and zinc prices rose 7.3%.

- The Bloomberg Commodity Index fell 4.6%. Half the loss came from the energy sector with another ¼ of the loss coming from the grains sector. Only the softs sector moved higher on the week.

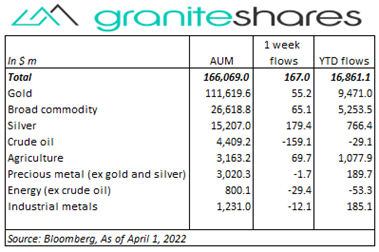

- Smaller flows into commodity ETPs last week. Inflows into gold ($55m), broad commodity ($65m), agriculture ($69m) and silver ($179m) ETPs were partially offset by outflows from crude oil (-$159m) ETPs.

Commentary

U.S. stock markets moved slightly higher last week moving higher the first two days of the week on rising hopes of a Russia-Ukraine ceasefire, falling the next two days as hopes faded and then slightly increasing Friday on the back of an overall stronger-than-expected Non-Farm Payroll Report. Ceasefire hopes and Chinese Covid-related lockdowns helped move oil prices lower Monday and Tuesday, supporting stock prices, while rising oil prices Wednesday (on fading ceasefire hopes) pushed stock prices lower. President Biden’s announcement the U.S. would release 1 million barrels/day from the SPR for the next 6 months (beginning May) drove oil prices 7% lower but failed to push U.S. stock markets higher. Thursday’s PCE Price Index release (the Fed’s preferred inflation measure) showed continued elevated price pressures perhaps pushing stock markets lower due to increasing expectations of a more aggressive Fed. Quarter-end rebalancing and fading Russia-Ukraine ceasefire hopes may also may have helped moved markets lower. Friday’s Non-Farm Payroll showing strong job gains along with a decline in the unemployment rate to close to pre-pandemic levels also showed strong wage growth, capping stock market gains and causing the 2-year Treasury yield to rise above the 10-year Treasury yield for the first time since 2019. 10-year inflation expectations fell 16bps last week (perhaps because of falling oil prices) while 10-year real rates increased 6bps resulting in 10-year Treasury rates falling 10bps over the week. At week’s end, the S&P 500 Index increased 0.1% to 4,545.86, the Nasdaq Composite Index rose 0.7% to 14,261.50, the Dow Jones Industrial Average decreased 0.1% to 34,818.14, the 10-year U.S. Treasury rate fell 10bps to 2.39% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 0.2%.

U.S. stock markets moved slightly higher last week moving higher the first two days of the week on rising hopes of a Russia-Ukraine ceasefire, falling the next two days as hopes faded and then slightly increasing Friday on the back of an overall stronger-than-expected Non-Farm Payroll Report. Ceasefire hopes and Chinese Covid-related lockdowns helped move oil prices lower Monday and Tuesday, supporting stock prices, while rising oil prices Wednesday (on fading ceasefire hopes) pushed stock prices lower. President Biden’s announcement the U.S. would release 1 million barrels/day from the SPR for the next 6 months (beginning May) drove oil prices 7% lower but failed to push U.S. stock markets higher. Thursday’s PCE Price Index release (the Fed’s preferred inflation measure) showed continued elevated price pressures perhaps pushing stock markets lower due to increasing expectations of a more aggressive Fed. Quarter-end rebalancing and fading Russia-Ukraine ceasefire hopes may also may have helped moved markets lower. Friday’s Non-Farm Payroll showing strong job gains along with a decline in the unemployment rate to close to pre-pandemic levels also showed strong wage growth, capping stock market gains and causing the 2-year Treasury yield to rise above the 10-year Treasury yield for the first time since 2019. 10-year inflation expectations fell 16bps last week (perhaps because of falling oil prices) while 10-year real rates increased 6bps resulting in 10-year Treasury rates falling 10bps over the week. At week’s end, the S&P 500 Index increased 0.1% to 4,545.86, the Nasdaq Composite Index rose 0.7% to 14,261.50, the Dow Jones Industrial Average decreased 0.1% to 34,818.14, the 10-year U.S. Treasury rate fell 10bps to 2.39% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 0.2%.

Oil prices declined significantly last week, pressured by the ongoing Russia-Ukraine war, Chinese Covid-related lockdowns and Thursday’s announcement of a large release from the SPR. WTI crude oil prices fell every day but one last week, pausing briefly Wednesday on fading hopes of a Russia-Ukraine ceasefire and a larger-than-expected drop in U.S. oil inventories. Oil prices fell sharply Monday, pushed lower by news of lockdowns in Shanghai and on increased hopes of a Russia-Ukraine ceasefire. President Biden’s announcement Thursday that the U.S. would release 1 million barrels/day from the SPR for the next 6 months (beginning May) drove WTI crude oil prices 7% lower while the OPEC+ decision to leave oil production unchanged seemingly had no effect. For the week, May WTI crude oil futures prices dropped just shy of 13% and July Brent crude oil futures prices fell 9.5%.

Gold prices moved lower last week, falling with declining haven-investment demand and growing expectations of aggressive Fed tightening in the coming months. 10-year U.S Treasury rates fell 10bps last week, driven entirely by falling inflation expectations. 10-year real rates rose 6bps, affected by increased expectations of a more aggressive Fed and falling haven-investment demand. Silver and platinum prices declined with gold and most base metal prices. Spot palladium prices fell close to 3%, reacting to falling auto sales and lessened supply concerns.

Base metal prices, in general, moved lower last week pressured by increased hopes of a Russia-Ukraine ceasefire (early in the week) and slowing Chinese manufacturing activity due mainly to Covid-related lockdowns. Nickel prices, lower on the week, traded the entire week without triggering limit up or down trading halts. Zinc prices moved higher powered by reduced European smelter activity (due to even higher energy costs) and very low supplies in Europe and the U.S.

Grain prices moved lower last week with wheat and soybean prices faring the worst. Early-in-the-week hopes of a Russia-Ukraine ceasefire moved wheat prices 8% lower through Tuesday and while prices rose Wednesday on fading ceasefire hopes, they continued lower Thursday and Friday reportedly on quarter-end adjustments in fund positions. Soybean prices also moved lower with ceasefire hopes, but also suffered from Thursday’s USDA Prospective Plantings and Quarterly Stocks report showing much larger-than-expected acreage “planting expectations” for soybeans. Wheat prices benefited from the report with Thursday’s USDA report showing much smaller-than-expected acreage “planting expectations" for wheat. Reports from Argentina of possible frost damage to soybean and corn crops seemingly had little affect on prices.

Coming up this week

Light data-week accentuated by the release of FOMC minutes on Wednesday.

Light data-week accentuated by the release of FOMC minutes on Wednesday.- Factory Orders on Monday.

- International Trade in Goods and Services and ISM Services Index on Tuesday.

- FOMC Minutes on Wednesday.

- Jobless Claims on Thursday.

- EIA Petroleum Status Report Wednesday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.