Commodities & Precious Metals Weekly Report: Jul 29

Posted:

Key points

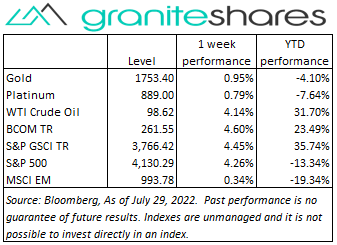

Energy prices were higher last week. WTI and Brent crude oil and heating oil prices were up between 4% and 6%. Gasoline prices rose 3%. Natural gas prices were up less than ½ percent.

Energy prices were higher last week. WTI and Brent crude oil and heating oil prices were up between 4% and 6%. Gasoline prices rose 3%. Natural gas prices were up less than ½ percent.- Grain prices moved markedly higher. Wheat prices increased 6.5%. Corn prices gained 9% and soybean prices climbed 12%.

- Precious metal prices were higher as well. Spot gold prices increased 2.2% and spot platinum prices rose 3.0%. Spot silver prices surged 9.5%.

- Base metal prices, too, were all higher. Nickel and copper prices rose 7% and zinc prices surged 11%. Aluminum prices increased less than 1 percent.

- The Bloomberg Commodity Index rose 4.6%. All sectors contributed with the grains, energy and base metals sectors contributing the most.

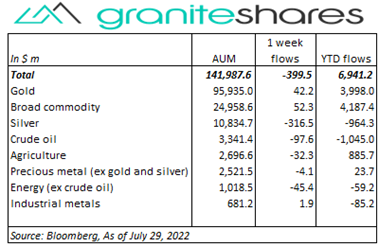

- $400 million outflows from commodity ETPs last week, predominantly from silver ETPs. Silver (-$317m) and crude oil (-$98m) outflows were partially offset by small gold and broad commodity inflows.

Commentary

Stock prices moved higher last week, struggling before Wednesday’s FOMC announcement and then rallying afterwards. Concerns of slower growth and weak earnings reports (accentuated by Walmart’s worse-than-expected report after hours Monday) in front of Wednesday’s FOMC announcement pressured prices lower through Tuesday. Wednesday’s as-expected 75bp rate hike, combined with announcement wording suggesting the Fed would be less aggressive going forward, spurred stock prices higher. This risk-on sentiment continued through Friday despite Thursday’s report showing GDP contracted 0.9% in June, the second contraction in a row. Strong earnings reports from Alphabet, Microsoft and Amazon were responsible for stock markets moving higher as well. The 10-year Treasury rate, reacting to expectations of a less aggressive Fed, decreased 10bps. Interestingly, the decline resulted from a 30bp decrease in 10-year real rates offset by a 20bp increase in 10-year inflation expectations. Similarly, the U.S. dollar weakened, also reacting to prospects of less aggressive Fed tightening vis-à-vis other central banks. At week’s end, the S&P 500 Index rose 4.3% to 4,130.29, the Nasdaq Composite Index climbed 4.7% to 12,390.69, the Dow Jones Industrial Average increased 3.0% to 32,846.45, the 10-year U.S. Treasury rate fell 10 bps to 2.65% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 0.7%.

Stock prices moved higher last week, struggling before Wednesday’s FOMC announcement and then rallying afterwards. Concerns of slower growth and weak earnings reports (accentuated by Walmart’s worse-than-expected report after hours Monday) in front of Wednesday’s FOMC announcement pressured prices lower through Tuesday. Wednesday’s as-expected 75bp rate hike, combined with announcement wording suggesting the Fed would be less aggressive going forward, spurred stock prices higher. This risk-on sentiment continued through Friday despite Thursday’s report showing GDP contracted 0.9% in June, the second contraction in a row. Strong earnings reports from Alphabet, Microsoft and Amazon were responsible for stock markets moving higher as well. The 10-year Treasury rate, reacting to expectations of a less aggressive Fed, decreased 10bps. Interestingly, the decline resulted from a 30bp decrease in 10-year real rates offset by a 20bp increase in 10-year inflation expectations. Similarly, the U.S. dollar weakened, also reacting to prospects of less aggressive Fed tightening vis-à-vis other central banks. At week’s end, the S&P 500 Index rose 4.3% to 4,130.29, the Nasdaq Composite Index climbed 4.7% to 12,390.69, the Dow Jones Industrial Average increased 3.0% to 32,846.45, the 10-year U.S. Treasury rate fell 10 bps to 2.65% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 0.7%.

A see-saw week for oil prices with supply and demand factors pushing and pulling prices throughout the week. Continued concerns of slowing global growth combined with expectations of increased Libyan oil production worked to pressure prices lower. Russia’s sharp reduction of natural gas shipments through Nord Stream 1, increased expectations OPEC will not increase production this week and sharply falling U.S. oil inventories, on the other hand, supported prices pushing WTI and Brent crude oil prices higher on the week. The Fed’s less-hawkish guidance on future rate increases (contributing to a weaker U.S. dollar) also acted to support prices even as U.S. GDP contracted for the second month in a row. Natural gas prices were volatile as well but ended the week less than ½ percent higher.

Gold prices continued their move higher last week bolstered, mainly, by Wednesday’s as-expected 75bp rate hike and seemingly less-aggressive guidance regarding future rate policy in the face of growing economic growth concerns. Thursday’s GDP release showing the U.S. economy contracted for a second month in a row added to sentiment the Fed, while still tightening, would do so at a slower pace and begin to reduce rates sooner than expected. 10-year real yields, as a result, moved over 30bps lower ending the week at 0.10% and the U.S. dollar weakened 0.7%.

Base metal prices rose again last week powered predominantly by a weaker U.S. dollar. Low inventory levels and reduced mining production targets bolstered copper prices as well. Zinc and Nickel prices, up 11% and 7% on the week, respectively, benefited from Senate legislation that slates $370 billion toward climate and clean energy investment. Base metal prices also benefited from increased optimism regarding Chinese demand going forward.

Grain prices moved significantly higher with soybean prices leading the way. Disappointing rainfall and more hot and dry weather forecasts helped push corn, soybean and wheat prices higher as crop ratings and yields estimates were lowered. Strong Chinese soybean buying supported soybean prices as well. Russia’s attack Monday on Ukraine wheat exporting facilities moved wheat prices sharply higher Tuesday. A weaker U.S. dollar also benefited grain prices.

Coming up this week

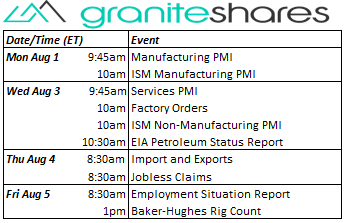

Manufacturing and Services PMIs this week along with the Employment Report Friday.

Manufacturing and Services PMIs this week along with the Employment Report Friday.- Manufacturing PMI and ISM Mfg PMI Monday.

- Services PMI, Factory Orders and ISM Non-Mfg PMI on Wednesday.

- Imports and Exports and Jobless Claims on Thursday.

- Employment Report on Friday.

- EIA Petroleum Status Report Wednesday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.