Commodities & Precious Metals Weekly Report: May 27

Posted:

Key points

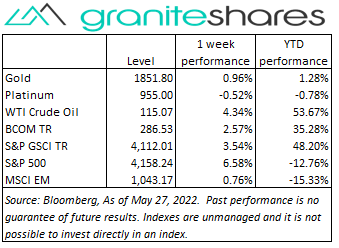

Energy prices were sharply higher. Gasoil and heating oil increased the most gaining close to 8%, followed by gasoline and natural gas prices which rose 6% and 7% respectively. WTI and Brent crude oil prices increased 4.3% and 5.0%, respectively.

Energy prices were sharply higher. Gasoil and heating oil increased the most gaining close to 8%, followed by gasoline and natural gas prices which rose 6% and 7% respectively. WTI and Brent crude oil prices increased 4.3% and 5.0%, respectively. - Grain prices were mixed. Wheat prices fell about 1% and corn prices moved slightly lower, falling 0.2%. Soybean prices rose 1.6%.

- Precious metal prices were all higher. Spot gold prices increased 0.4% and spot silver prices rose just 1.7%. Spot platinum prices were up 0.1%.

- Except for aluminum prices, base metal prices moved higher. Zinc prices gained almost 4% and nickel and copper prices rose 1%. Aluminum prices fell 3%.

- The Bloomberg Commodity Index increased 2.6%. The energy sector was primarily responsible for the gains with the precious metals sector providing smaller gains.

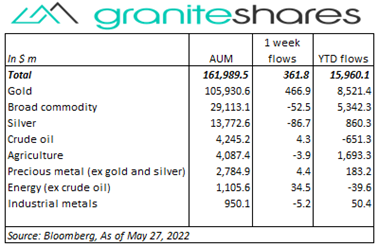

- Net inflows into commodity ETPs last week with gold ($467m) inflows comprising the lion’s share. Small outflows from broad commodity (-$53m) and silver (-$87m) ETPs.

Commentary

U.S. stock markets powered higher last week with all three major stock market indexes rising more than 6%. Stronger-than-expected retail earnings reports, a no-surprise release of Fed minutes, increased household spending and a slight decline in the Fed’s preferred inflation index all contributed to last week’s performance. The Dow Jones Industrial Average increased every day last week while the S&P 500 and Nasdaq Indexes moved higher every day but Tuesday when Snap Inc plummeted 43% on profit and revenue warnings. Stock markets moved higher despite some weaker-than-expected economic releases, namely much lower-than-expected growth in new home sales, a larger contraction in Q1 GDP than estimated last month and an over 10-year low in consumer sentiment. 10-year U.S. Treasury rates moved 5bps lower last week with the move lower coming from falling 10-year real rates (down 11bps to 9bs). 10-year inflation expectations rose 6bps to 2.65%. At week’s end, the S&P 500 Index increased 6.6% to 4,158.24, the Nasdaq Composite Index gained 6.8% to close at 12,131.13, the Dow Jones Industrial Average rose 6.2% to 33,213.55, the 10-year U.S. Treasury rate decreased 5 bps to 2.74% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 1.4%.

U.S. stock markets powered higher last week with all three major stock market indexes rising more than 6%. Stronger-than-expected retail earnings reports, a no-surprise release of Fed minutes, increased household spending and a slight decline in the Fed’s preferred inflation index all contributed to last week’s performance. The Dow Jones Industrial Average increased every day last week while the S&P 500 and Nasdaq Indexes moved higher every day but Tuesday when Snap Inc plummeted 43% on profit and revenue warnings. Stock markets moved higher despite some weaker-than-expected economic releases, namely much lower-than-expected growth in new home sales, a larger contraction in Q1 GDP than estimated last month and an over 10-year low in consumer sentiment. 10-year U.S. Treasury rates moved 5bps lower last week with the move lower coming from falling 10-year real rates (down 11bps to 9bs). 10-year inflation expectations rose 6bps to 2.65%. At week’s end, the S&P 500 Index increased 6.6% to 4,158.24, the Nasdaq Composite Index gained 6.8% to close at 12,131.13, the Dow Jones Industrial Average rose 6.2% to 33,213.55, the 10-year U.S. Treasury rate decreased 5 bps to 2.74% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 1.4%.

Oil prices moved higher last week supported by both supply and demand factors. On the demand side, expectations of a strong gasoline demand over the Memorial Day weekend in the face of already tight gasoline supplies (with refiners running at levels not seen in over 2 years), the planned relaxation/termination of Shanghai Covid-related lockdowns beginning June 1 and the possibility of an EU ban of Russia oil imports all worked to move prices higher. On the supply side, expectations of OPEC+ (which meets June 2) to maintain planned production levels along with limited increases in U.S. shale production and a decline in U.S. oil and gasoline inventories worked to support prices as well.

Spot gold prices moved higher last week supported by a weaker U.S. dollar, rising 10-year inflation expectations and falling 10-year real rates. Up over 1% through Tuesday mainly on falling longer-term real rates and a weaker U.S. dollar, gold prices fell Wednesday and Thursday following the release of the FOMC minutes. The minutes revealed no surprises, however, expressing the possibility the Fed will raise rates 50bps in the next two meetings in a desire to squelch inflation. Spot gold prices moved slightly higher Friday to the end week up 0.4%.

Copper prices moved higher Monday, buoyed by Chinese stimulus measures, including a larger-than-expected cut in short-term rates. Those gains were erased Tuesday and Wednesday as concerns of slowing economic growth globally moved prices lower. Prices rose Friday with investor sentiment turning positive on expectations of a demand boost as China winds down lockdowns in Shanghai. Aluminum prices fell last week, suffering from high energy-related production costs and weak demand. Zinc prices, up almost 4% last week, benefited from historically low inventory levels and expectations of increased demand.

Lackluster week for grain prices. The USDA crop progress report, released Monday, showed surprisingly good progress for corn plantings but smaller-than-expected progress for soybeans and, particularly wheat. Wheat prices moved almost 2% higher Monday only to see those gains and more erased Tuesday on no real news but perhaps moving in sympathy with U.S. stock markets. Similarly, grain prices moved higher Friday, again, on no real news but perhaps moving with U.S. stock prices.

Coming up this week

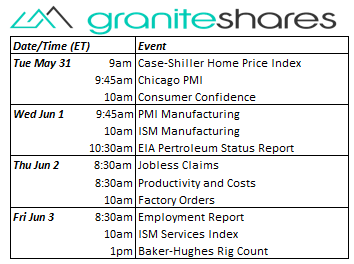

PMI and ISM Mfg Indexes, Consumer Confidence and the Employment Report feature in this week’s data releases.

PMI and ISM Mfg Indexes, Consumer Confidence and the Employment Report feature in this week’s data releases.- Case-Shiller Home Price Index, Chicago PMI and Consumer Confidence on Tuesday.

- PMI and ISM Manufacturing Indexes on Wednesday.

- Jobless Claims, Productivity and Cost and Factory Orders on Thursday.

- Employment Report and ISM Services Index on Friday..

- EIA Petroleum Status Report Wednesday and Baker-Hughes Rig Count on Friday.