3SZN

3x Short Amazon (AMZN) ETP

3SZN Product Description

GraniteShares 3x Short Amazon Daily ETP is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x Short Amazon.com Inc Index that seeks to provide -3 times the daily performance of Amazon shares.

For example, if Amazon rises by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments. However, if Amazon falls by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments.

GraniteShares -3x Amazon is available in GBX,USD

What is Amazon (AMZN)

Amazon.com, Inc. is a multinational company engaged in e-commerce, cloud computing, digital media, and consumer electronics. It operates through three segments: North America, International, and Amazon Web Services (AWS). The company sells products directly and provides a platform for third-party sellers through its online and physical stores. It also offers subscription services, including Amazon Prime. Amazon develops and sells electronic devices such as Kindle, Fire tablets, Fire TV, Echo, Ring, Blink, and eero. Its AWS division provides cloud computing services, including computing power, storage, database management, and machine learning. Additionally, the company offers digital content and advertising services. Founded in 1994, Amazon is headquartered in Seattle, Washington.

Key Facts

3x Short Amazon (AMZN) ETP OVERVIEW

LISTING AND CODES for 3x Short Amazon (AMZN) ETP

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| London Stock Exchange | USD | 3SZN | XS2671672900 | BQ2L1M1 | |

| London Stock Exchange | EUR | 3SPE | XS2671672900 | BQ2L239 | |

| London Stock Exchange | GBX | 3SZP | XS2671672900 | BQ2L228 | |

| Borsa Italiana | EUR | 3SZN | XS2671672900 | BQ2L240 |

INDEX & PERFORMANCE of 3x Short Amazon (AMZN) ETP

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

COLLATERAL Details of 3x Short Amazon (AMZN) ETP

Understanding Collateral

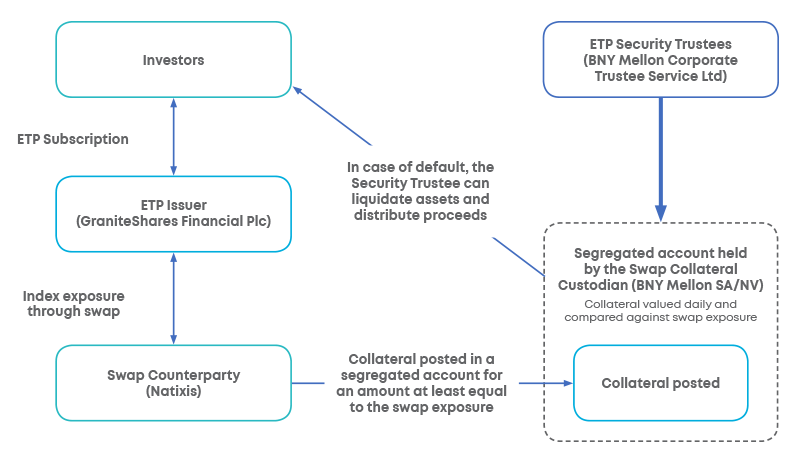

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.