Leveraging Tesla using ETPs

Posted:

The automotive giant became the first to launch and adopt an electric vehicle. The company recently announced its first-quarter earnings for 2022. The revenue increased by 81% and operating profits were up by 137% (Source: Tesla investor relations). Even with stable earnings for the company the stock had been volatile, increasing 5% when the results were announced and later it plunged.

With this increasing volatility in the stock, the best way to capitalize on the profits is to hedge the risk. Hedging for volatility in this market can be strenuous but possible. With the increase in the popularity and demand of the stock, various companies offer Exchange-Traded Products (ETP). Single stock leveraged exchange-traded products, either long or short, are practical for earning profits. It is a collateralized ETP that provides exposure for long as well as short investment trajectories. ETP of Tesla includes 3x long and 3x short Tesla Daily (3LTE, 3LTP, and 3LTS) based on different currencies and exchanges.

ETPs offer a daily compounded structure of returns. Follow the trend to expect returns. It may seem radical to trade through ETPs rather than options and futures derivatives, but it is one of the viable options.

Hedging Strategies:

There can be various strategies to adhere based on the sophisticated investor’s risk appetite and preferences.

Conservative Strategy:

This strategy is based on a four-day rule. The sophisticated investor, as the name suggests, trades strictly based on the upper and lower bound set and the price difference to trade is less. Here, rule one is first to decide whether the investor is planning to go long or short and the type of leverage they will opt for I.e. -3x or +3x. Then we analyze whether the position has breached the upper or lower bound price of 4 days prior. Here, if the upper band, then the factor decision is to buy ETP I.e., +3x. If the lower bound is breached, then the investor should buy -3x ETP I.e., short the position.

The second rule is based on the decision to hold the position or liquidate. If in four days the counter is three or greater than three, in this case, a short ETP will be liquidated and if the counter is two or less than two then the Long ETP would be liquidated. If Bothe the cases are not matched, then the position is held.

Although ETP trading is not usually helped for more than a day without any active supervision, holding the position for a longer period can be beneficial in terms of the transaction cost.

Active Strategy:

In this hedging strategy catching the trend is of utmost priority, and transaction cost risk is foregone. The trader focuses on the current-day price movement as compared to two days prior. The counter calculates and analyses the trend daily and supervises the price day to day if it is at or above the price 3 days prior (including the present day). In this case, the holding of ETP is not constrained based on the ETP purchasing date. In terms of active hedging, if the counter is less or at two the long ETP is liquidated and on the other hand, if it is at or above 2 then the short ETP is liquidated. Furthermore, if none of the above scenarios occur then the ETP can be held.

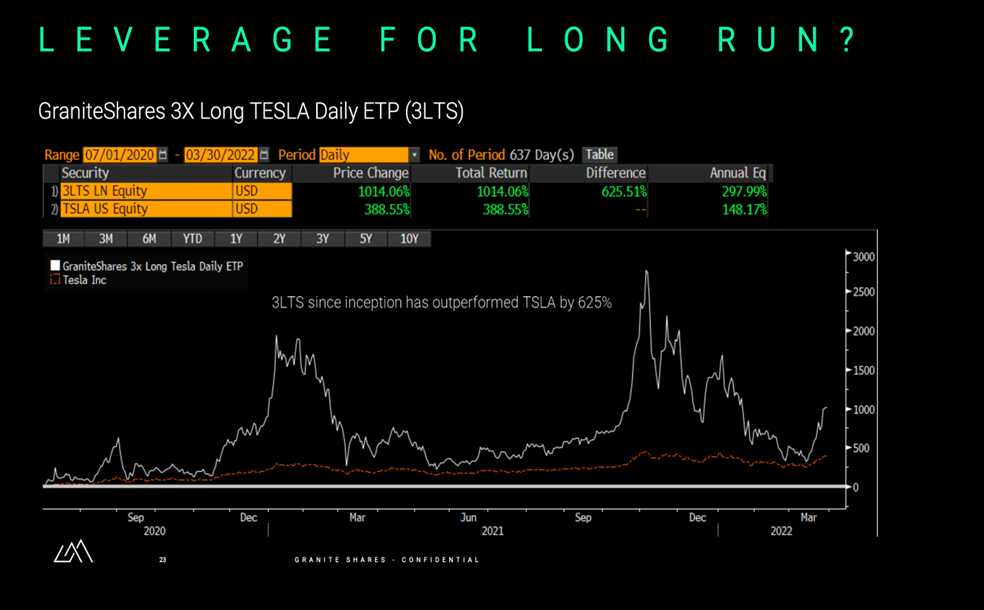

3x Long Daily ETP (3LTS):

It is a collateralized Exchange Traded Product (ETP). It tracks the performance of Solactive Daily Leveraged 3x long Tesla Inc Index that provides three times the daily performance of the company’s shares excluding fees and other adjustment.

For example: if Tesla Shares increase during the day by 1% then the ETP of the company will rise by 3% excluding fees and other adjustment. On the other hand, if the shares of the company fall by 1% during the day ETP of the same will go down by 3% excluding fees and other adjustments.

Example of Investing in 3LTS:

Source: GraniteShares ETF Stream Webinar

3x Short Tesla Daily ETP

Also called inverse Tesla ETP. It tracks the performance of Solactive Daily Leveraged -3x Short Tesla Inc Index that provides -3 times the daily performance of the company’s shares excluding fees and another adjustment. The inverse Tesla ETP provides 3x leverage the opposite of the index that it is tracked.

For example: if Tesla Shares increase during the day by 1% then the ETP of the company will fall by 3% excluding fees and another adjustment the movement of inverse Tesla ETP is the opposite of the underlying security. On the other hand, if the shares of the company fall by 1% during the day ETP of the same will rise by 3% excluding fees and other adjustments.

Both the strategies if adhered to by the rules can provide potential gain. Both these strategies are based on closing prices on ETPS on any of the days. Experienced/sophisticated investors will use both strategies based on the market trends to hedge the risk as well as take the opportunity of volume in their favor to earn returns. Leverage trading is risky, even if playing with ETPs, trading with leverage requires short term trading and with constant supervision as well as active management to hedge risk.

DISCLAIMER

Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author, and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks, and liquidity risks. Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.