ETF or ETP - what is the difference?

Posted:

Exchange-Traded Fund (ETFs) and Exchange Traded Products (ETPs) both in recent times have been exploding and gaining traction from investors. So, it seems like a good opportunity to guide the investors to make an informed decision as to which financial product suits them the best. We will be discussing some of the financial terms people are confused with if what is the differentiating factor Between ETFs and ETPs.

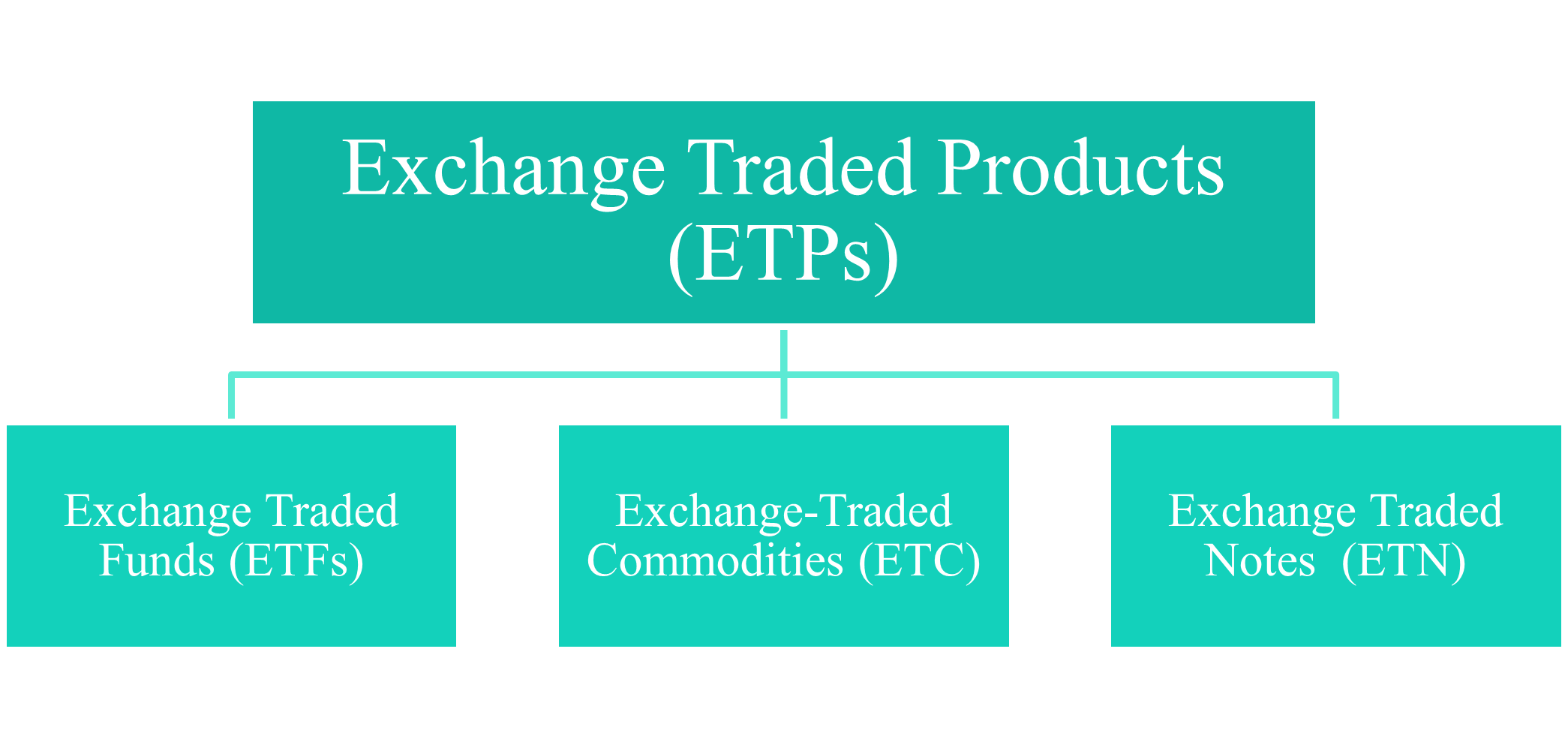

All ETFs are ETPs, however not all ETPs are ETFs. Confused? Let us dispel the confusion.

The term ETF is more frequently used. It is at times assumed that ETPs are a subset of ETFs, however, that is not exactly true. It is the opposite; ETFs are a subset of ETPs. ETPs include traditional, Exchange Trading Funds (ETFs), Exchange-Traded Commodities (ETC), and Exchange Traded Notes (ETN).

Both financial instruments, i.e., ETPs and ETFs have one thing in common, which is that they are both exchange-listed, traded intra-day, and open-ended. This means that the number of units is not fixed, and they can go up and down based on demand and supply.

Exchange-Traded Product (ETPs):

Exchange Traded Products are financial instrument that tracks underlying security, indices, or financial assets. ETPs trade on a stock exchange and offer leverage and track underlying security, index, or financial instruments. They can be benchmarked to various securities including commodities, currency, stocks, and bonds. Some ETPs gear investments intentionally gear the investment through leverage or futures which increases the risk and notional exposure. ETPs use financial engineering to magnify the returns on a different market.

Along with leveraged ETPs we also have inverse ETPs that seek to deliver the opposite performance of the index or security they track. Short and leveraged inverse ETPs aim to deliver multiple of for example 2x or 3x I.e., two times or three times the return of the opposite trend. Inverse ETPs are tagged as -2x inverse ETP or -3x inverse ETPs. They are a type of short-selling instrument for a portfolio of securities that offers leverage to increase the investment by a little of your investment if sure helps in amplifying returns of the investor.

These funds and products come with a higher level of complexity in terms of pricing and compounding as well as heightened associated levels of risk. It is important to always look for the product or fund disclosure statement to ensure that you understand how the underlying security, as well as the instrument, works.

Exchange-Traded Funds (ETFs):

ETF is a type of investment fund and exchange-traded product, i.e. they are traded on stock exchanges. Just like any stock on the exchange ETFs can also be traded at any given time when the stock exchange opens. They were launched in 1993 and expanded significantly in terms of range and variety. ETFs are usually a low-cost alternative to mutual funds and actively-managed funds.

Usually, ETF tracks an index fund or indexes, for example, S&P 500, FAANG, GAFAM, and FATANG but it can also follow or have underlying securities including commodities, markets, a particular sector, industries, and currencies. The prices of the ETFs will increase, and decrease based on the demand as well as the underlying index.

ETFs can be levered and unlevered. Unlevered ETFs are also called vanilla ETFs that offer exposure to various indices as a basket. Leveraged ETFs seek to return some multiples (e.g., 2× or 3×) on the return of the underlying asset. For example, if the Tesla stock rises 1%, a 2× leveraged Tesla ETF will return 2% (and if Tesla falls by 1%, the ETF would lose 2%).

Conclusion:

There is a difference in the working of both the instruments and as mentioned earlier ETF is a subset of ETP. ETFs usually are plain vanilla instruments where investors invest the full amount on the stock exchange for the NAV. However, investing through ETP provides investors with an option of leverage where the same amount of investment can offer a higher NAV. It also offers higher returns if the trend is captured and predicted appropriately. On the contrary, the risk for that return is subjective. Investors should be aware of the risks and the rewards as well as provide in-depth information about the fund before investing.

DISCLAIMER

Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents. Graniteshares Limited is an appointed representative of Messels Limited which is authorised and regulated by the Financial Conduct Authority.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author, and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks, and liquidity risks.