New ways to Short Tesla

Posted:

Tesla (NASDAQ: TSLA) is the biggest electric automobile manufacturer in the world based on its market cap, (Source: Companies market cap) The company has surpassed some of the biggest automotive manufacturers based on company’s market cap, including Toyota, Mercedes, Daimler, Volkswagen, and General Motors. (Source: Reuters).

Even though the company has reached these heights there are various macroeconomic factors like inflation, China production hindrance, the Twitter deal, and other factors that have affected the company’s stocks. After hitting its all-time high in November 2021, the company’s share price has dragged down over 40% from its peak and approximately over 37% since the middle of September 2022. (Source: Forbes).

Moreover, the company has been Wall Street’s biggest short bet since April 2020. Recently, after September 2022 Tesla (TSLA) is the second most shorted stock after Apple. The largest Automobile maker had an open short interest of $17.4 billion based on the research by S3 Partners. Various investors have also taken advantage of the volatility in the electric auto manufacturer's shares by buying puts and short positions (Source: marketwatch.com).

So, to gain from the momentum of the market there are various options investors can opt to sell short Tesla. Let’s first understand short-selling and various options to short-sell Tesla stock.

How to short a stock?

Short selling or shorting is a bearish strategy, that allows investors to profit on a financial instrument when the price of that asset is expected to decline. For shorting investors borrows the security from their broker and sell it in an open market with an expectation that the price of the security will fall in the future and they can buy it from the market at a lower price. In this manner, the short seller earns a profit from the difference.

Let's take an example: if you short 100 Tesla stocks at $100 and the stock declines by $30 by the end of the month, in this case, you will earn a profit of $3,000 on the short position.

Short selling comes with greater market risk and limits potential rewards. If the market doesn’t move according to the investor’s expectation, they are bound to incur a loss on the trade. On the contrary, shorting stocks can help traders to hedge against any potential negative movements in markets that they have taken a long position. Going short on stock and shares or assets can also offer means to benefit from the bear market.

What are the options to short Tesla (TSLA)?

There are various strategies and financial instruments to help short stocks in the market. We have discussed some of them in the previous article ‘How to short Tesla?’. In this article, we will find different and easy ways other than the ones mentioned before to short Tesla (TSLA).

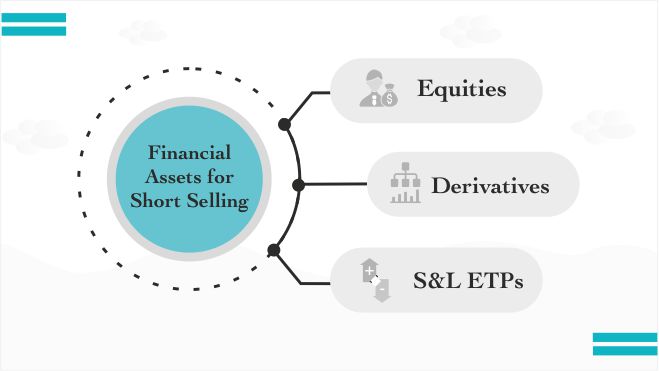

Investors can short Tesla in the market through various leverage financial instruments including

-

Short Selling through Equities:

Investors can short shares of Tesla (ticker: TSLA) directly through equity shares. This is one of the most common and traditional strategies to short a stock. It can be done by opening a broker’s account. This method of shorting stocks involves borrowing shares from someone who already owns them, like a broker or another investor (usually for a fee) and selling them at the current market price. Shorting stocks directly requires a margin. Although for the required margin, investors need to qualify for a margin account. To qualify for the margin, it needs to be approved by a broker and investors will have to deposit a certain sum of money to be able to borrow and short Tesla stock.

The problem with investing or shorting a stock directly through equities for either swing trading or intraday is costly i.e., the brokerage cost, taxes, and leverage costs are higher as compared to other instruments.

-

Derivatives:

It is a leveraged contract where two or more parties i.e., the buyer and the seller and the value is derived from the value of the performance of the underlying asset or entity. It can be equity, an asset, or an index. Derivatives include futures, options, forwards, and swaps. They are leverage instruments where the margin required for trading is comparatively less than that of the equity short selling. But there is a minimum margin requirement for the contracts.

These are leveraged products where traders can earn profits based on movement and leverage. In futures and options contracts, the loss is not necessarily limited to the initial investment. There is no embedded stop-loss mechanism to curb the loss if the price goes in the opposite direction of the expected trade. Since derivatives are leveraged, investments there is some inherent risk involved while investing. Investors must analyze the market trends as well as technical ones before trading through derivatives.

-

Short and Leveraged ETPs (S&L ETPs):

S&L ETPs or inverse ETPs are a type of leverage instrument that is listed on the exchange. They consist of either single stock or a basket of securities that are designed to track the underlying security, an index, or other financial instruments.

They can be benchmarked to indexes, sectors, industries, or themes. ETPs offer leveraged exposure to popular single-stock ETPs like Tesla ETPs, indexes, or other asset classes such as commodities.

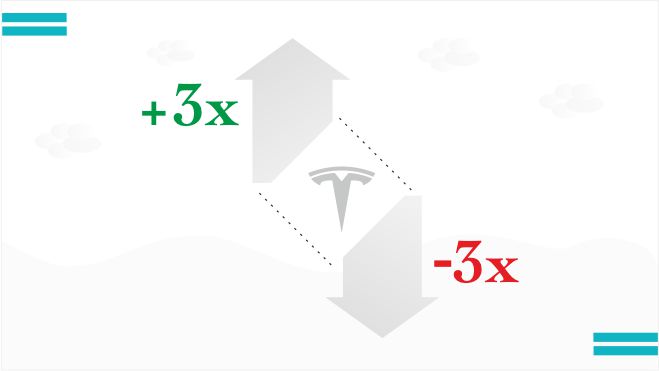

Inverse ETPs provide positive returns when the underlying single-stock or indexes declines. Like Leveraged ETPs, Inverse ETPs mark returns based on the daily performance of the underlying security or index. Inverse leveraged ETPS is one of the ways to hedge portfolios, they can be used to profit when the market declines on the broad market index.

Inverse ETPs are usually denoted as either a negative number like -2x, -3x or terms like “short” or “inverse” in the name of funds or product name. In the case of a short in the stock market for Tesla, it will denote -3x Tesla inverse ETP / 3x short Tesla ETP(3x short TSLA). Investors can short Tesla stock in the UK through this method. Inverse Tesla (3x Inverse TSLA) will offer 3x returns.

Benefits of trading through Short and Leveraged ETPs:

Sophisticated investors are not required to have a specific margin account to trade through leveraged ETPs. Also, if Tesla’s market value moves against your prediction the leveraged ETPs are embedded with a stop-loss mechanism to limit your losses.

Bottom Line:

Investors can opt for various financial instruments and strategies to short Tesla stock. But before jumping into short investments, investors must take appropriate precautions, and analyze the market to earn returns on the risk invested.

|

Product name |

Ticker(USD) |

Ticker(EUR) |

Ticker(GBX) |

|---|---|---|---|

|

GraniteShares 3x Short Tesla Daily ETP |

3STS | 3STE | 3STP |

|

GraniteShares 3x Long Tesla Daily ETP |

3LTS | 3LTE | 3LTP |

|

GraniteShares 3x Short FATANG Daily ETP |

3SFT | 3S3E | 3S3P |

|

GraniteShares 3x Long FATANG Daily ETP |

3SFT | 3S3E | 3S3P |

|

GraniteShares FATANG ETP |

FTNG | FTNE | FTNP |

|

GraniteShares 1x Short FATANG Daily ETP |

SFTG | SFTE | SFTP |

DISCLAIMER

This is a disclaimer stating that all trading and investing come with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents. GraniteShares Limited (“GraniteShares”) (FRN: 798443) is an appointed representative of Messels Limited which is authorised and regulated by the Financial Conduct Authority.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks and liquidity risks. Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.