Commodities & Precious Metals Weekly Report: Aug 12

Posted:

Key points

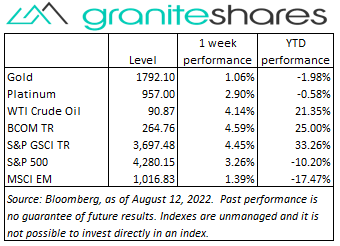

Energy prices rose last week. WTI and Brent crude oil prices increased 4%. Gasoline prices rose 6%. Natural gas and heating oil prices climbed 9%.

Energy prices rose last week. WTI and Brent crude oil prices increased 4%. Gasoline prices rose 6%. Natural gas and heating oil prices climbed 9%. - Grain prices were higher, too. Wheat prices fell increased between 3% and 4%, soybean prices rose 3% and corn prices gained 5%.

- Precious metal prices were all higher as well. Spot gold prices increased 1.5% and spot platinum prices rose 3.5%. Spot silver prices were increased 4.7%.

- Base metal prices, too, were higher. Nickel prices increased 4%, and copper and zinc prices rose 3%. Aluminum prices increased under 1%.

- The Bloomberg Commodity Index rose 4.6%. The energy sector was responsible over half the increase, followed by the grains sector which was responsible for 20% of the increase. All sectors posted positive returns.

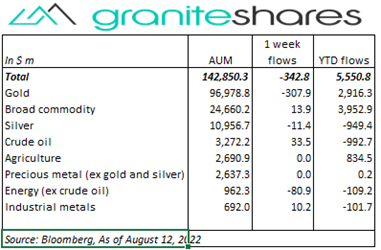

- $340 million outflows from commodity ETPs almost entirely from gold ETPs. Small inflows into broad commodity, crude oil and industrial metal ETPs. Small outflows from silver and energy (ex-crude oil).

Commentary

Stock markets moved higher last week powered by lower-than-expected CPI and PPI releases. All three major indexes rose 3% or more with the S&P 500 Index slightly outperforming the Nasdaq Composite Index and the Dow Jones Industrial Average. Stock prices were lower through Tuesday tilted by weak earnings reports from Nvidia, Palantir and Micron, the previous Friday’s much stronger-than-expected payroll report and in anticipation of Wednesday’s CPI release. The much lower-than-expected CPI release Wednesday powered stock markets higher with growing expectations of a less aggressive Fed and, consequently, diminishing recession concerns. Stock markets paused on Thursday but resumed their move higher Friday on good earnings reports and improved consumer sentiment. The 10-year Treasury rate edged slightly higher last week, increasing 2bps with 10-year real rates and 10-year inflation expectations both increasing 1bp. For the week, the S&P 500 Index increased 3.3% to 4,280.15, the Nasdaq Composite Index rose 3.1% to 13,047.19, the Dow Jones Industrial Average edged gained 2.9% to close at 33,761.11, the 10-year U.S. Treasury rate rose 2bps to 2.84% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 0.9%.

Stock markets moved higher last week powered by lower-than-expected CPI and PPI releases. All three major indexes rose 3% or more with the S&P 500 Index slightly outperforming the Nasdaq Composite Index and the Dow Jones Industrial Average. Stock prices were lower through Tuesday tilted by weak earnings reports from Nvidia, Palantir and Micron, the previous Friday’s much stronger-than-expected payroll report and in anticipation of Wednesday’s CPI release. The much lower-than-expected CPI release Wednesday powered stock markets higher with growing expectations of a less aggressive Fed and, consequently, diminishing recession concerns. Stock markets paused on Thursday but resumed their move higher Friday on good earnings reports and improved consumer sentiment. The 10-year Treasury rate edged slightly higher last week, increasing 2bps with 10-year real rates and 10-year inflation expectations both increasing 1bp. For the week, the S&P 500 Index increased 3.3% to 4,280.15, the Nasdaq Composite Index rose 3.1% to 13,047.19, the Dow Jones Industrial Average edged gained 2.9% to close at 33,761.11, the 10-year U.S. Treasury rate rose 2bps to 2.84% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 0.9%.

Oil prices recovered some of last week’s losses, gaining about 4% for the week. Supported by the previous Friday’s stronger-than-expected payroll report and by stronger-than-expected Chinese exports, oil prices moved almost 2% higher through Tuesday. Wednesday’s lower-than-expected CPI release reduced increased expectations of a less aggressive Fed and reduced concerns of a recession pushing oil prices almost another 2% higher. A larger-than-expected drop in gasoline stocks also supported oil prices despite a larger-than-expected increase in oil inventories. Thursday’s news that a damaged pipeline forced Shell to stop production on 3 of its offshore Gulf of Mexico platforms as well as the IEA increasing its demand forecasts for 2022 pushed WTI crude oil prices 2.5% higher. Prices gave back most of those gains Friday following reports the damaged pipeline would be repaired by the end of day. A weaker U.S. dollar also supported prices.

Gold prices moved higher again last week buoyed primarily by expectations of a less aggressive Fed. Spot gold prices moved over 1% higher through Tuesday, recovering all of the previous Friday’s loss caused by the much stronger-than-expected payroll report, as expectations of an aggressive Fed diminished. Wednesday’s lower-than-expected CPI release further reduced those expectations though hawkish comments by some Fed presidents seemingly prevented gold from moving higher until Friday.

Base metal price moved higher as well last week affected by both strong economic data out of China and the U.S. and by Wednesday’s much lower-than-expected CPI release. Copper and aluminum prices also were supported by falling inventory levels.

Grain prices moved higher as well supported by hot and dry weather forecasts, strong exports and lower crop ratings.

Coming up this week

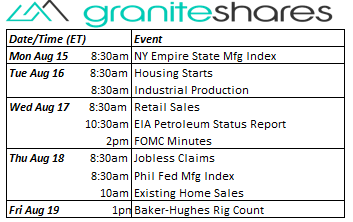

Light data week but punctuated with Housing Starts, Retail Sales, FOMC Minutes and Existing Home Sales.

Light data week but punctuated with Housing Starts, Retail Sales, FOMC Minutes and Existing Home Sales.- NY Empire State Mfg Index on Monday.

- Housing Starts and Industrial Production on Tuesday.

- Retail Sales and FOMC Minutes on Wednesday.

- Jobless Claims, Phil Fed Mfg Index and Existing Home Sales on Thursday.

- EIA Petroleum Status Report Wednesday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.